Mining Intelligence Articles & Market Analysis - Page 116

Discover news, analysis, and insights on junior mining companies and precious metals

Featured Articles

IAMGOLD Reports Second Quarter 2025 Results

IAMGOLD reports strong Q2 2025 results, with increased production, improved operations, and plans for growth, while revising cost guidance upward due to market and operational factors.

First Majestic Second Quarter 2025 Results Conference Call Details

First Majestic will hold a webcast and conference call on August 14, 2025, to discuss Q2 results and 2025 guidance; results published before market open.

Trending Now

View All

Sego Resources Closes $206,000 First Tranche of Financing

Sego Resources receives TSX-V conditional approval for a $206K first tranche of financing, issuing units with warrants, aiming for total proceeds of up to $700K.

Japan Gold Announces US$1 Million Private Placement

Japan Gold raises US$1M via private placement, issuing 17.2M shares to Equinox, a major shareholder; proceeds support admin expenses; Equinox will hold 30.45%.

Sanatana Commences Yukon Exploration Program

Sanatana Resources started exploration on the Gold Strike Two Project in Yukon, discovering sheeted quartz veins indicating potential mineralization in an underexplored district.

All Articles

Newpath Announces Closing of Flow-Through Financing

Newpath Resources Inc. completed a non-brokered private placement, issuing 1,538,461 flow-through shares for $50,000 to fund exploration activities. CEO Alexander McAulay participated in the offering, which is considered a related-party transaction under Canadian securities laws.

Sanatana Announces Secured Promissory Note and Provides Notice of Exercise to Acquire a 60% Undivided Interest in the Oweegee Dome Porphyry Copper-Gold Project, Located in BC's Golden Triangle

Sanatana Resources Inc. has secured a $200,000 loan from an arm's length lender at 10% interest, due monthly, to finalize a 60% interest acquisition in the Oweegee Dome Project from ArcWest Exploration. The loan matures on December 31, 2025.

Radio Fuels Files Management Information Circular for Meeting of Shareholders to Approve Business Combination with Palisades

Radio Fuels Energy Corp. has filed materials for its January 30, 2025, shareholder meeting to approve a business combination with Palisades Goldcorp Ltd., where Palisades will acquire Radio Fuels. The merger aims to create a resource-focused investment company.

Caprock Announces Closing of Private Placement and Completes Issuance of First Tranche of Shares Pursuant to Destiny Gold Project Option Agreement

Caprock Mining Corp. has raised $292,125 from hard dollar units and $115,000 from flow-through units. The company issued 8 million shares to Big Ridge Gold under an option agreement for the Destiny gold project, with plans for a resource estimate update in Q1 2025.

Andean Precious Metals Provides Update on Master Services Agreement Dispute with Silver Elephant

Andean Precious Metals Corp. disputes allegations of default by Silver Elephant Mining Corp. regarding a Master Services Agreement, claiming wrongful termination and unmet obligations by Silver Elephant. Andean is seeking legal counsel and sourcing alternative suppliers.

Snow Lake Secures Funding to Drive Exploration, Strategic Acquisitions, and Investments in Clean Energy and Next Gen Minerals

Snow Lake Resources Ltd. announces it has raised over $20M to fund aggressive exploration and acquisitions in clean energy minerals. Key projects include uranium exploration at Engo Valley and Black Lake, along with updates on the Snow Lake Lithium™ Project.

Snow Lake Announces Closing of Public Offering for Gross Proceeds of US$15 Million

Snow Lake Resources Ltd. closed a public offering of 18.75 million shares at $0.80 each, raising approximately $15 million for working capital and corporate purposes. The offering was facilitated by ThinkEquity and complies with SEC regulations.

Vision Lithium Announces Closing of Flow-Through Private Placement

Vision Lithium Inc. announced a non-brokered private placement of 16.67 million flow-through shares at $0.03 each, raising $500,000 for Canadian exploration expenses. A Finder received a $30,000 commission and warrants. The offering awaits TSXV approval.

Beyond Lithium Completes Unit Private Placement for Gross Proceeds of $250,000

Beyond Lithium Inc. closed a non-brokered private placement of 5 million units, raising $250,000. Each unit includes a share and a half warrant. Proceeds will support corporate purposes. Finders received cash commissions and broker warrants. Securities are subject to a hold period and are not registered in the U.S.

ESGold Completes First Phase in Reaching Broader U.S. Investor Market with OTCQB Listing

ESGold Corp. announced its approval from FINRA for a priced quotation on the OTCQB, enhancing market access and liquidity. This uplisting and application for DTC eligibility aim to improve trading efficiency and broaden the investor base, reflecting the company's growth strategy.

Trojan Gold Inc. Closes a Non-Brokered Unit Offering

Trojan Gold Inc. has completed a non-brokered private placement, issuing 1,454,452 units at $0.05 each, raising $72,722.62 to settle debts. Each unit includes a common share and warrant, with a 24-month exercise option at $0.10. The company focuses on mineral exploration in Ontario.

American Creek Resources Announces Amendment to Plan of Arrangement with Cunningham Mining

American Creek Resources Ltd. has amended its arrangement agreement with Cunningham Mining Ltd., extending the acquisition deadline from December 30, 2024, to January 31, 2025, and removing a termination payment obligation. The company holds a 20% interest in the Treaty Creek Project.

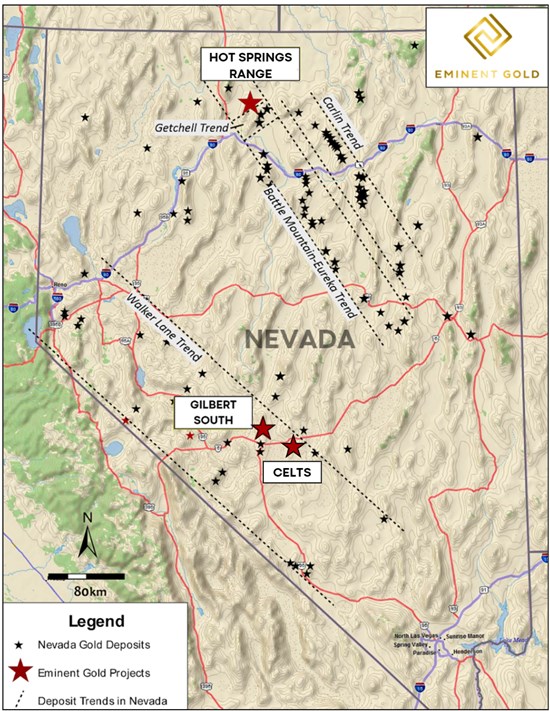

Eminent Gold Provides Drilling Update on Hot Springs Range Project

Eminent Gold Corp. reports progress on its drilling at the Hot Springs Range Project in Nevada, completing its first core hole at the Otis target. The drill program aims to explore the potential of HSRP as an analogue to the gold-rich Getchell Trend.

Elemental Altus Announces Appointment of New Director

Elemental Altus Royalties Corp. appoints Matthieu Bos as an independent non-executive director, replacing Jack Lunnon. His mining and capital markets experience is expected to enhance the Board's effectiveness. The Board remains at seven members, with six non-executives.

Sanu Gold Announces Closing of Strategic Partnership with Montage Gold & Strategic Investment by the Lundin Family

Montage Gold Corp. acquired a 19.9% stake in Sanu Gold for CAD $5.5 million, while the Lundin family gained a 10% stake. Montage's CEO now chairs Sanu's board, with plans to fund exploration activities in Guinea using the investment proceeds.

Silver Elephant Receives Notice of Cancelation of Pulacayo Mining Production Contract from Comibol

Silver Elephant Mining Corp. has received a cancellation notice for its Pulacayo Mining Production Contract from Bolivia's Comibol, citing alleged illegal mining. The company disputes this claim, maintains compliance, plans to appeal, and continues operations at its Apuradita concession.

Silver Elephant Terminates Management Services Agreement with Andean Precious Metals Corp.

Silver Elephant Mining Corp. has terminated its Mining Services Agreement and related Sale and Purchase Agreement with Andean Precious Metals due to non-payment of $1 million that was due on December 18, 2024. The company is now pursuing payment collection.

Auric Minerals Announces Exploration Program on Its Uranium Project in Labrador Canada

Auric Minerals Corp. announced the start of its 2025 exploration program on the Route 500 Uranium Property in Labrador, set to begin in January. The program will include prospecting and sampling, targeting pegmatite bodies for uranium mineralization, supported by historic data.

Eureka Lithium Corp. Closes Flow Through and Non-Flow Through Private Placement

Eureka Lithium Corp. closed a non-brokered private placement of 682,000 flow-through shares at $0.22 each, raising $150,040 for exploration expenses. Additionally, a concurrent non-flow-through placement of 100,000 units at $0.15 each was completed.

Romios Announces Closing of Non-Brokered Flow-Through Offering for $50,000

Romios Gold Resources Inc. announced a non-brokered private placement of 1,666,667 flow-through units at $0.03 each, raising $50,000 for exploration expenses in British Columbia. The offering includes warrants for future share purchases and specific tax benefits.

Nubian Resources Announces Name Change to Carlton Precious Inc

Nubian Resources Ltd. is changing its name to Carlton Precious Inc., approved by shareholders on June 27, 2024. Trading under the new name and ticker "CPI" begins January 6, 2025. Existing shares remain unaffected. Shareholders can contact the company with questions.

Spod Lithium Announces the Closing of Flow-Through Units Offering

SPOD Lithium Corp. closed a non-brokered private placement, raising $272,750 by issuing 4,196,155 flow-through units at $0.065 each. The funds will be used for exploration, with warrants allowing additional shares purchase at $0.10 within 24 months.

1844 Closes Non-Brokered Private Placement of Flow Through Units

1844 RESOURCES Inc. has completed a non-brokered private placement, issuing 13,042,928 flow-through units for approximately $456,500. The funds will be used for exploration expenses as defined by Canadian tax law. Finder's fees and warrants were also issued.

Unigold Announces TSXV Approves Warrant Extensions

Unigold Inc. announced the TSX-V's approval to extend the expiry dates for 16,629,167 and 53,433,675 share purchase warrants to June 23, 2025, and December 31, 2025, respectively, maintaining the exercise price at $0.30 per share.

Record Resources Closes $437,000 Financing

Record Resources Inc. has closed a financing totaling $437,000, comprising a $330,000 LIFE Offering and a $107,000 private placement, issuing 14,566,665 Units. The company also announced it will not proceed with certain option agreements on mineral properties.

Canadian Critical Minerals Closes $100,000 Flow-Through Financing

Canadian Critical Minerals Inc. has secured $100,000 financing through the sale of flow-through units for exploration at the Bull River Mine in British Columbia. The financing involves issuing shares and warrants, with a hold period on securities.

Teako Announces Share Purchase Agreement, Closes Shares for Debt Transaction, and Provides Update on Previously Announced Private Placement

Teako Minerals Corp. announced the sale of its shares in The Coring Company for C$1.675 million and settled C$172,500 in debts by issuing shares to insiders. These transactions enhance the company's financial position and support upcoming projects in Norway.

Austral Gold and Challenger Execute Toll Processing Agmt

Austral Gold's subsidiary, Casposo, signed a Toll Processing Agreement with Challenger Gold to process material from Challenger's Hualilan project, generating new revenue. The deal includes a $3 million fixed payment, monthly fees, and operations expected to start in late 2025.

MineHub Announces Closing of Strategic Partnership with Abaxx Technologies

MineHub Technologies Inc. has completed a strategic partnership with Abaxx Technologies, increasing Abaxx's ownership in MineHub from 10.83% to 19.87% through a share exchange. The transaction involved the issuance of common shares and is classified as a related party transaction.

Benton Closes $1.026 Million Non-Brokered Flow-Through Financing

Benton Resources Inc. has closed a non-brokered private placement, issuing 9,326,571 Charity Flow-through Units for $1,025,923. The proceeds will fund Canadian exploration expenses, with tax benefits for investors. Finders' fees were also paid.

Unlock Premium

Get access to exclusive analysis and trading signals

- Access to all premium articles

- PDF change detection

- Advanced charting