Mining Intelligence Articles & Market Analysis - Page 144

Discover news, analysis, and insights on junior mining companies and precious metals

Featured Articles

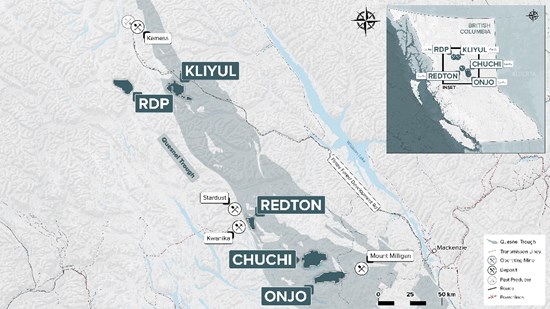

Pacific Ridge Announces Initial Mineral Resource Estimate for Kliyul Copper-Gold Project

Pacific Ridge reports a significant initial resource estimate at Kliyul, BC, with 334.1 Mt grading 0.33% CuEq, highlighting a valuable copper-gold deposit in Northcentral BC.

Homerun Collaborates with Igraine PLC to Launch Rapid-Deployment EV Charging and Battery Storage Solutions for UK Auto Sector

Homerun Resources partners with Igraine PLC to develop quick-deploy EV charging and battery storage solutions in the UK, targeting major automakers and accelerating EV adoption.

Trending Now

View All

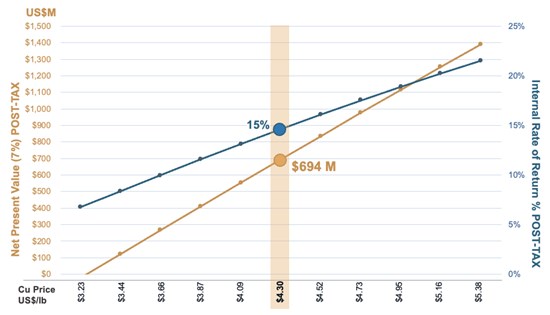

Lion Copper and Gold Announces Pre-Feasibility Study Results for Brownfield Yerington Copper Project and Maiden Mineral Reserve

Lion Copper's Yerington project shows strong US copper production potential, with a 12-year mine life, 120M lbs/year, and positive NPV and IRR at $4.30/lb copper.

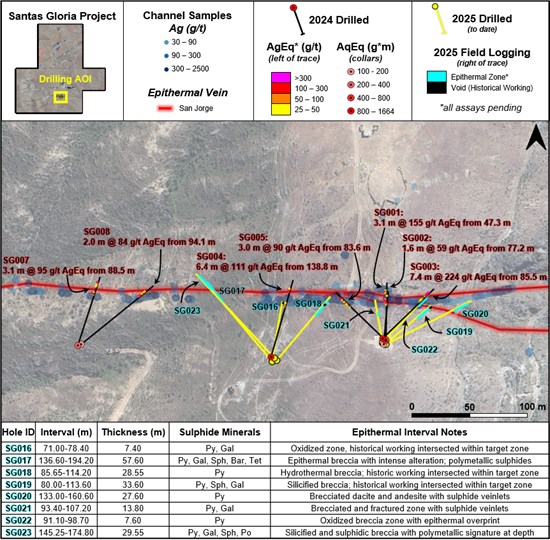

First Andes Silver Reports Additional Drilling Intersections of the San Jorge Epithermal Vein, Santas Gloria Project, Peru

First Andes reports drilling at Santa Gloria, Peru, revealing sulfide zones and mineralization, supporting a deep silver-polymetallic system with ongoing assays.

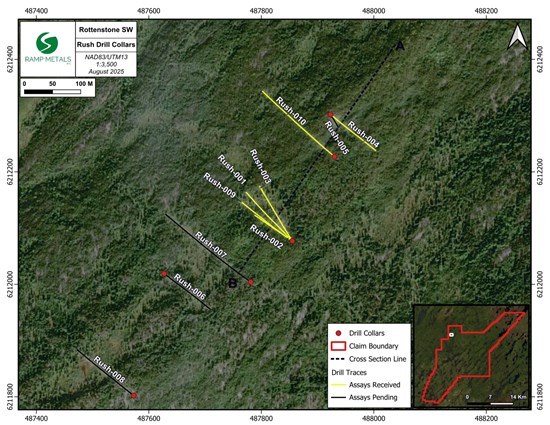

Ramp Metals Confirms VMS Discovery at Rush Target

Ramp Metals reports positive drill results indicating a significant copper-zinc VMS system at Rottenstone SW, with new targets identified via geophysics for further exploration.

All Articles

Heliostar Announces 2024 Production Guidance for Acquired Mines

Heliostar Metals Ltd. has provided production guidance for July-December 2024, post-acquisition of the San Agustin Mine and the La Colorada Mine in Mexico. Gold sales from these mines are expected to be between 19,350 - 19,750 ounces, with cash cost per ounce between US$1,500 - US$1,600 and all-in sustaining cost (AISC) between US$1,650 - US$1,750. The company aims to expand annual production and grow resources, with five drill rigs in operation across its portfolio. The cash flow from these operations will be reinvested in the Mexican assets, and the company plans to make a production decision about Ana Paula in 2025

Metal Energy Announces Multi-Phase Exploration Program on Newly Acquired Highland Valley Project

Metal Energy Corp. has announced a multi-phase exploration program for its newly acquired Highland Valley Project, led by geologist Charlie Greig. The program will use geophysics to identify priority targets, culminating in a drilling program in 2025. Phase 1 of the program includes a Ground AMT survey of the project's most prospective areas, which is expected to be completed by the end of 2024. This new application could be highly effective in the Highland Valley district. The company will also conduct passive seismic and hyperspectral studies and leverage historical datasets to help identify new targets.

RETRANSMISSION: Group Eleven Intersects 8.7m of 23.9% Zn+Pb and 85 g/t Ag; Expands Zinc-Rich Massive Sulphide Zone at Ballywire

Group Eleven Resources Corp. has released the results from the latest five step-out holes of their 2024 drill program at their 100% owned Ballywire zinc-lead-silver discovery, part of the PG West Project in Ireland. The results showed significant intersections of zinc, lead, and silver in all holes. The data from these holes have extended the lateral extent of the recently announced zinc-rich sulphide zone at the base of the Waulsortian Limestone by 50-100m, with the zone now extending for at least 360m. The company continues its two-rig drill program.

Doubleview Gold Corp Announces Closing of Private Placement for Total of $4,027,000

Doubleview Gold Corp. has announced the closing of its non-brokered Private Placement, raising gross proceeds of $4,026,999.84, exceeding the initial amount announced earlier. The company will issue over 8.3 million flow-through shares at $0.48 per share. The proceeds will be used for exploration work on its wholly owned BC projects, the Hat Project and the Red Spring Project. The company will also pay $100,000 in finder's fees and issue over 250,000 finder's shares at $0.39 each. The offering's closing is subject to necessary regulatory approvals.

Alpha Exploration Announces New Drill Results from the Aburna Gold District Including 29 Meters Averaging 2.89 g/t Gold at Hill 52 Prospect, and 8 Meters Averaging 3.77 g/t Gold at the Northeast Prospect

Alpha Exploration Ltd. has announced initial drilling results from its Aburna orogenic gold prospect within its Kerkasha Project in Eritrea. The prospect is one of three significant discoveries by Alpha on this license, covering an area of at least 7km long and 2km wide. Assays from 20 holes completed in July 2024 have been received, showing promising results from both the Hill 52 and Northeast areas. Drill samples from the second and third quarters of 2024 are now being prepared for assay. The results indicate significant gold mineralization, extending the Northeast Prospect's strike length to over 650m.

Group Eleven Intersects 8.7m of 23.9% Zn+Pb and 85 g/t Ag; Expands Zinc-Rich Massive Sulphide Zone at Ballywire

Group Eleven Resources Corp. has announced the results from the latest five step-out holes of the 2024 drill program at their 100%-owned Ballywire zinc-lead-silver discovery in Ireland. The drillings show significant intersections of zinc, lead, and silver in all three holes. The results add at least 50-100m to the lateral extent of the recently announced flat-lying zone of zinc-rich massive sulphide lenses at the base of the Waulsortian Limestone, with the zone extending for at least 360m along strike and remaining open.

Atomic Minerals Corp. Clarifies the Proposed Drilling Schedule for The Bleasdell Lake Uranium Project

Atomic Minerals Corp. is working to clarify the exploration schedule for the Bleasdale Lake Project. Permits are currently being processed, and the company aims to begin drilling in December. The project, located 95 kilometers southwest of Lynn Lake, Manitoba, will focus on three new uranium target zones as well as two historically drilled zones. Historic trenching returned significant amounts of triuranium octoxide. The previous estimate, made in 1957, is still considered relevant, although a qualified person has not yet verified it as a current mineral resource.

Seabridge Gold Files Third Quarter 2024 Report to Shareholders and its Financial Statements and MD&A

Seabridge Gold has reported a net loss of $27.6 million for the three months ending September 30, 2024, a significant increase from the $5.3 million loss of the same period last year. The loss is attributed to a non-cash loss of $42.0 million from the quarterly remeasurement of the company's secured notes, impacted by a decrease in discount rates, higher metal prices, and a change in the valuation date. The company has also invested $28.0 million in mineral interests, property, and equipment during the quarter. Despite the financial loss, Seabridge Gold has seen promising drill results at the Iskut's Snip North target, and gold trades are at an all-time

Québec Nickel Announces Closing of Existing Shareholder Financing

Québec Nickel Corp. has announced the closure of a private placement offering where it issued 2,000,000 units of the company at a price of $0.125 per unit, generating $250,000. Each unit consists of one common share and half of a share purchase warrant, which can be exercised for two years into one share at a price of $0.225 per share. The units were offered to existing shareholders under specific exemption laws and will be subject to a hold period of four months and a day from issuance. The net proceeds from this offering will be used for general working capital purposes. The securities have not been registered under the US Securities Act of 1933 and cannot be offered or sold within the US except under specific

Benz Announces Closing of A$4M Financing

Benz Mining Corp. has completed its private placement of 18,181,820 CHESS Depository Interests (CDIs) at A$0.22 per CDI, raising approximately A$4 million. The funds raised will be used to acquire 100% of the Glenburgh Gold Project and Mt Egerton Gold Project in Western Australia, to scale up gold exploration activities, and for general working capital. If the acquisition is not completed, the funds will be used for drilling activities on the Company's Eastmain Project. The placement is still subject to the final approval of the TSX Venture Exchange.

Chesapeake Announces San Vicente 3 Legal Update

Chesapeake Gold Corp. has initiated legal proceedings against the Dirección General de Minas of Mexico (DGM) after the DGM cancelled the company's San Vicente 3 mineral concession, part of the Metates project. The company's lawsuit was dismissed by the Federal Court of Administrative Justice, but Chesapeake plans to appeal and pursue all available legal remedies. If the company cannot reinstate San Vicente 3, its current resource estimate for Metates and the potential development of the project could be significantly impacted. Despite ongoing legal proceedings, Chesapeake remains committed to the Metates project and will continue developing its proprietary oxidative leach technology.

Goldmoney Inc. Responds to Property Purchase Media Reports

Goldmoney Inc. is in exclusive talks regarding a potential property purchase in the United Kingdom, following its usual acquisition strategy. The transaction details are still under discussion and it's not guaranteed that the deal will be completed. The company will only make further comments once an agreement has been reached. Goldmoney Inc., a company that specializes in the investment and custody of real assets, offers precious metals trading services to clients, secure custody and storage solutions, and also has diverse interests in property investment and jewelry manufacturing.

Torex Gold Reports Results From The Ongoing 2024 EPO Exploration Program

Torex Gold Resources Inc. has announced positive results from its ongoing drilling program at EPO, indicating a strong potential to upgrade Inferred Resources to Indicated Resources and expand resources north of the deposit. The first half of 2024's exploration and drilling program has confirmed mineralization extending beyond defined resources to the north and a high potential for converting Inferred Resources to Indicated Resources in the south and northeast of the deposit. The second half of the program is expected to further support the company's goal of sustaining annual gold equivalent production of 450,000 to 500,000 ounces beyond 2030.

The Fed's Dangerous Path: Ron Paul Reveals the Truth Behind U.S. Monetary Collapse

Ron Paul criticizes the Federal Reserve's power and calls for reforms, advocating for gold-backed currency....

Two New Reduced Intrusive (RIRGS) Targets, Totalling Four, Identified at Tombstone Belt, Yukon - Gold Orogen, New Spin Co of Lode Gold

Toronto-based Lode Gold Resources Inc. has announced the identification of two additional RIRGS targets, "Stingray" and "Camp," on the Golden Culvert property. The discovery was made through the interpretation of data from the 2024 QMAGT survey, and these new targets add to the four previously identified targets on the property. Field verification is scheduled for the next season to confirm the presence of targeted geological features. The Golden Culvert property has a significant 15 km long geochemical anomaly, of which only an 800 m section has been drilled. The identification of these new targets enhances the overall potential of the Golden Culvert property.

Strikepoint Announces Extension of Private Placement

StrikePoint Gold Inc. has been granted an extension by the TSX Venture Exchange to complete its non-brokered private placement of company units, initially announced in October 2024, by November 27, 2024. Each unit, priced at CAD $0.20, consists of one common share and a warrant exercisable into one common share at an exercise price of $0.30 for a 24-month period. The financing could generate up to $3 million in gross proceeds, which StrikePoint plans to use for exploration at its two Nevada-based projects and for general working capital. Completion of the financing's second tranche is subject to TSXV approval.

Sailfish Reports Q3 2024 Results

Sailfish Royalty Corp. has released its Q3 2024 financial results. The company saw an increase in gold ounces earned, with 215 and 671 ounces for the three and nine months respectively, compared to 207 and 835 in 2023. The company's royalty revenue also increased to $211,942 and $541,773 for the three and nine months respectively, a significant increase from $14,661 in 2023. Total revenues were $730,024 and $2,114,221 for the three and nine months respectively, compared to $413,978 and $1,620,104 in 2023. The company reported a gross profit of $454,040 and $1,267,

Nickel 28 Responds to Meritless Litigation by Former Executive

Nickel 28 Capital Corp., a nickel-cobalt producer, is facing a legal action filed by its former president, Justin Cochrane. The lawsuit includes allegations of wrongful termination, breach of contract, and unjust enrichment. Cochrane was dismissed on May 3, 2024, due to claims of serious misconduct and non-compliance with company policies. The company denies the allegations and plans to defend itself vigorously, asserting that it may seek to recover losses and gains related to Cochrane's alleged misconduct. Nickel 28 holds an 8.56% interest in the Ramu Nickel-Cobalt Operation in Papua New Guinea and manages a portfolio of 10 nickel and cobalt royalties on projects in Canada, Australia, and Papua

Canadian Critical Minerals Closes $950,000 Flow-Through Financing

Canadian Critical Minerals Inc. (CCMI) has secured $950,000 through a flow-through financing initiative, issuing 19 million shares at $0.05 each. The funds will be utilized for exploration and development activities at the Bull River Mine project near Cranbrook, B.C. In relation to the financing, CCMI paid $66,500 in cash commissions and issued 1.33 million non-transferable broker warrants. Each warrant allows the holder to acquire a common share of the company at $0.05 per share for a 24-month period.

Platinum Group Files Final Base Shelf Prospectus

Platinum Group Metals Ltd. has filed a final short form base shelf prospectus with the securities regulatory authorities in Canada and a corresponding registration statement with the United States Securities and Exchange Commission. This will allow the company to make offerings of up to US$250 million of common shares, debt securities, warrants, subscription receipts or a combination thereof. The proceeds from any sale of securities will be used for business advancement and general corporate purposes. This replaces the company's previous registration statement filed in 2022, which expired in July 2024, to enhance financial flexibility. Future offering specifics will be established in a prospectus supplement.

Confronting Mining CEOs: What Are They Doing With YOUR Money?

Interviewing 10 Mining CEOs at the Precious Metals Summit in Zurich about their financial strategies....

Road to $23,000 GOLD, 'It Will Get There' Says James Rickards

James Rickards predicts gold could reach $23,000 an ounce, discusses silver, Trump, and his book....

Mina Guanaca Drilling Returns 0.91% Cu Over 56 Metres Including 20 Metres Grading 1.88% Cu

Cascada Silver Corp. has announced the successful completion of its Phase I drill program at the Mina Guanaca Copper Project, with significant copper mineralization found in 3 out of 4 holes. The drill hole GAS-04 revealed a 56m interval grading 0.91% Cu, including a 20m interval grading 1.88% Cu. Two drill holes indicated a new zone of copper oxide mineralization extending to depths of 80 to 100m below the surface, which is still open along strike and depth. The findings suggest that the copper mineralization is related to breccias extending from a depth of 75m to the surface.

Phenom Reports Dobbin Gold Footprint Update, Nevada

Phenom Resources Corp. has provided an update on the developments of the Dobbin gold soil anomaly. The company has identified a 600 metre long by 200 metre wide trend with similar alteration, which is interpreted as an extension of the gold anomaly. Preliminary soil results from this new segment are promising, though they only partially define the extension. Crews have been dispatched to expand the soil grid to cover a suspected remaining part of the anomaly. The gold soil anomaly is at least 1.3 kilometres in length and has the potential to be extended. The anomaly is believed to be controlled by northeast-trending structures. Phenom owns the Carlin Gold-Vanadium Project, located in Nevada, and also has options on three other gold projects

Valkea Resources to Commence Drilling at the Paana Project, Central Lapland, Finland

Valkea Resources Corp. has announced it will begin exploration at its 100% owned Paana project in Central Lapland, Finland. The Phase 1 exploration program will aim to discover high-grade gold mineralization at the Aarnivalkea West discovery. The program involves a 2,000 metre drill program and systematic core re-logging efforts. The Aarnivalkea West target, defined by S2 Resources, is located approximately 24 km northwest of Agnico's Kittilä mine and was initially identified through geochemical surveys and drilling from 2018 to 2019. The discovery was further investigated with deeper diamond drilling in 2020 and 2021.

Sonoran Desert Copper Corporation Announces New Brazilian Subsidiary and Application for New Copper Concessions in Pernambuco Brazil

Sonoran Desert Copper Corporation has begun its Brazilian asset strategy by incorporating a new Brazilian subsidiary and applying for new copper exploration concessions in Pernambuco, Brazil. The application includes seven new concessions in Afrânio/Pernambuco and Casa Nova/Bahia, covering over 10,000 hectares. The company's technical team in Brazil is preparing a preliminary report on the area as part of an initial mineral prospecting program for copper.

QC Copper: Thierry Drill Core Resampling Program on Bulk Tonnage K1 Deposit Now Completed

QC Copper has completed a core sampling program at Cuprum's Thierry Copper Project to further understand the K1 bulk-tonnage resource. The program, which was highly cost-effective, involved resampling previously unsampled areas from existing drilled cores. Around 1,100 metres of historical core, or 690 samples across 34 drill holes, were identified for this. The resampling could help identify more mineralization around K1, potentially increasing resources and improving the geological model. A business merger between Cuprum and QC Copper is expected in December.

Bullion Prepares $1M Financing and Presents Summary of Its Gold and Polymetallic Projects

Bullion Gold Resources Corp. plans to conduct a non-brokered private placement to raise a minimum of $1 million for its Bodo Project and other corporate needs. They will issue units of the company and flow-through (FT) units to raise this capital. Each unit will consist of a common share and a common share purchase warrant, while each FT unit will consist of a flow-through common share and a warrant. The Bodo project, located near Lake Mistassini, is a potential polymetallic system with indications of gold, silver, copper, lead, zinc, and molybdenum.

Premium Nickel Intersects Significant Lengths of Mineralization at Selebi North: 28.70 Metres of 3.45% CuEq or 1.67% NiEq

Premium Nickel Resources Ltd. has announced high-grade assay results for ten additional holes at its Selebi North underground mine in Botswana. These results, part of a series of in-fill drilling results at the Selebi North deposit, continue to demonstrate favorable grades and widths. The results are pending for around 14,000 meters of in-fill and expansion drilling. The details of the assay results for specific holes and their locations relative to the Mineral Resource Estimate and underground infrastructure can be found on the company's website.

T2 Metals Receives Drill Permit Valid Until July 2027 for the Sherridon Copper-Gold-Zinc Project, Manitoba

T2 Metals Corp., a mining company, has obtained a new drill permit for the Sherridon copper-gold-zinc project in Manitoba. The permit, granted by the Manitoba Permit Office, allows for drilling over a larger area than the previous permit issued in 2023, and will be valid until July 2027. The Sherridon project is situated in a well-known volcanogenic massive sulphide camp in Manitoba, with a notable history of mining and exploration. The new permit will allow for the exploration of many targets at Sherridon, including areas not previously drilled.

Unlock Premium

Get access to exclusive analysis and trading signals

- Access to all premium articles

- PDF change detection

- Advanced charting