Mining Intelligence Articles & Market Analysis - Page 19

Discover news, analysis, and insights on junior mining companies and precious metals

Featured Articles

Quimbaya Gold Announces Termination of LOI with Denarius Metals

Quimbaya Gold's joint venture with Denarius Metals for artisanal mining at Tahami was terminated; Quimbaya retains full ownership and continues exploration plans.

Galloper Gold Clarification Release

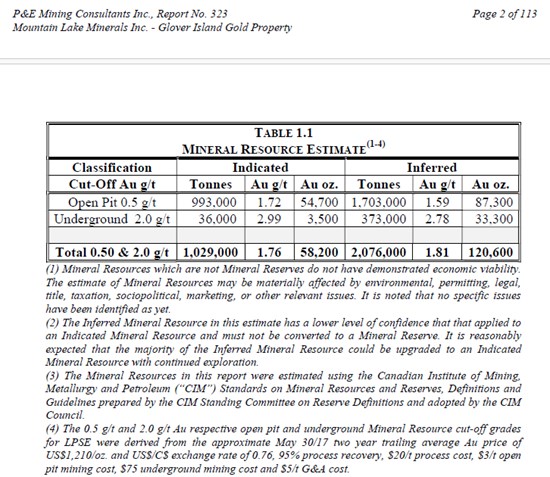

Galloper Gold clarifies its recent EML license award on Glover Island, covering the historic LPSE gold resource, with no new exploration since 2012, within a mineral-rich 11 km corridor.

Trending Now

View All

Sanatana Announces Market Making Services Agreement with Independent Trading Group

Sanatana Resources hires ITG for one-month market-making to boost share liquidity, paying $5,000 monthly, with automatic renewal and no equity compensation.

Silver47 and Summa Silver Complete Merger to Create a Premier U.S. High Grade Silver Explorer & Developer

Silver47 and Summa merged to form Silver47 Exploration Corp., a U.S.-focused high-grade silver explorer with significant resources in Alaska, Nevada, and New Mexico.

Element 29 Announces Upsized Private Placement of up to $6,400,000

Element 29 Resources increases private placement to $6.4M for exploration in Perú, issuing units with shares and warrants, pending TSX-V approval.

All Articles

Ivanhoe Mines Responds to Inaccuracies Made in a Press Release by Zijin Mining About Kamoa-Kakula's Operations

Ivanhoe Mines clarifies mine safety issues, ongoing inspections, and plans to update on operations and potential impact on production by May 27, 2025.

Dollar Destruction: Will It End in Depression, Collapse or Civil War? | Tom DiLorenzo

Economist Tom DiLorenzo warns of U.S. economic collapse risks from unchecked debt, Federal Reserve policies, inflation, and government overreach, threatening financial stability and constitutional principles.

StrikePoint Completes Sale of Porter Idaho Project to Dolly Varden Silver

StrikePoint sold its Porter Idaho Project to Dolly Varden for $1.1M in shares, focusing on Nevada's gold projects, especially the Hercules Gold project in the Walker Lane.

Homerun Resources Inc. Announces Retirement of Long Time Director Greg Pearson - Hires Integral for Market Making Services

Homerun Resources announces Greg Pearson’s retirement and retains Integral for market-making services to maintain an orderly securities market.

Omai Gold Commences Gilt Creek Drill Hole Planned to Also Explore the Blue-Sky Depth Potential of the Wenot Deposit

Omai Gold begins drilling at its Guyana project to explore deep extensions of the Gilt Creek and Wenot gold deposits, aiming to assess long-term resource potential and mine life expansion.

'Market Turmoil' Ahead Will Lead to MASSIVE Gains in These Commodities: Rick Rule

Rick Rule predicts market upheaval will shift wealth into commodities like gold, silver, and mining stocks, offering long-term opportunities amid volatility and economic uncertainty.

“Value is Now in High-Risk Junior Miners” says Pro Investor David Erfle

David Erfle sees increasing value in high-risk junior miners due to fund flow shifts from major miners and improving market sentiment, making them more attractive despite their risk.

Raise Cash Now: Market Is Repeating 2001, Gold & Credit Flashing Alarms | Larry McDonald

Expert warns of rising market risks akin to 2001, urging investors to raise cash amid signs of economic weakness, credit crunch, and potential market downturn.

Copper Project Development in Namibia | Koryx Copper CEO Interview

Koryx Copper's CEO discusses advancing Namibia’s Haib Copper Project through strategic exploration, experienced leadership, and careful funding to unlock its resource potential.

Copper-Gold Exploration in Kazakhstan | East Star Resources CEO Interview

East Star Resources' CEO discusses Kazakhstan copper-gold exploration, company finances, strategic goals, technical expertise, and project portfolio in an informational interview.

Silver to $100: 46-Year Breakout Setup Could Trigger Explosive Surge | Jordan Roy-Byrne

Analyst predicts a 46-year breakout for silver and gold, with gold potentially hitting $4,500 and silver surpassing $35, driven by macroeconomic risks, inflation, and safe-haven demand.

'They're Crazy People' - EU Leaders Hell-Bent on Endless WAR: Gerald Celente

Gerald Celente criticizes Western leaders for escalating conflicts, especially in Ukraine, to serve economic interests, fueled by media propaganda that hampers peace efforts.

Are We Heading Into a Systemic Meltdown? Moody’s Downgrade, Soaring Debt: Here’s How Gold Performs

Global financial instability boosts gold demand, with increased central bank and retail purchases, highlighting gold's role as a safe haven amid systemic risks and market turmoil.

I Went to Kazakhstan to Investigate a Copper-Gold Junior

A report on Arras Minerals' copper-gold exploration in Kazakhstan, highlighting regional advantages, team expertise, geological features, and potential, with some conflict of interest disclosures.

URANIUM Will 'Really Be on Fire' as Governments & Big Tech Dive In

Uranium market poised for growth due to government support, tech investments in nuclear energy, and increased sector funding, potentially boosting prices and mining stocks.

Pro Insights on Several Mining Stocks by Analyst Joe Mazumdar

Mining analyst Joe Mazumdar discusses recent sector trends, financing, M&A activity, valuation shifts, and increased investor interest in critical metals and gold sector consolidation.

Lavras Gold Corp. Issues Stock Options and Deferred Share Units

Lavras Gold issued stock options and deferred share units to officers, directors, and employees, vesting over three years, as part of its incentive plan.

Thunder Gold Announces Phase One Drill Results and Start of Phase Two Drill Program at the Tower Mountain Gold Property

Thunder Gold's Phase One drill at Tower Mountain suggests high-grade gold plunges southeast; 8 of 9 holes found low-grade gold, with more drilling planned.

Slow Supply, Fast Demand: Uranium’s New Investment Reality

Global uranium market shifts due to rising nuclear demand from energy transition, geopolitical factors, and new reactor technologies, making uranium a strategic investment.

Iris Metals (ASX:IR1) - Brownfield Lithium Restart in US

Iris Metals aims to quickly restart permitted US lithium assets, targeting production by 2026, leveraging existing infrastructure to reduce development time and risk.

Forge Resources Announces Resignation of Non-Executive Director and Flow-Through Private Placement

Forge Resources announces a private placement raising up to $1M and the resignation of director Greg Bronson. The funds support exploration at the Alotta Project, Yukon.

Argyle Announces Renewal with Euro Digital Media

Argyle Resources extends a marketing agreement with Euro Digital Media for one month, paying $200,000, to promote its business via online campaigns.

Elemental Altus Royalties to Release Q1 2025 Results on May 20, 2025

Elemental Altus to release Q1 2025 results on May 20, 2025, with a webcast and Q&A, focusing on their gold royalty investments and future growth prospects.

Spark Energy Announces Upsize of Previously Announced Private Placement and Amended and Restated Offering Document

Spark Energy upsizes its private placement to 32.65 million units, plans a final tranche, and will use proceeds for exploration at its Arapaima Lithium Project in Brazil.

Hertz Energy Announces Change of Chief Financial Officer

Hertz Energy replaces CFO Jatin Bakshi with Natasha Tsai, a seasoned finance professional, as it continues lithium and uranium exploration in Canada and the USA.

Sage Potash Announces Shares for Debt Transactions

Sage Potash plans to issue 1,222,222 shares to settle debts, including to an officer, pending TSXV approval; related party transaction with exemptions.

Pacific Ridge Increases Private Placement

Pacific Ridge increases private placement to $2.9M for RDP drill program and working capital, focusing on copper-gold exploration in British Columbia.

Affinity Metals Corp. Completes $180,000 Non-Brokered Private Placement

Affinity Metals closed a private placement raising $180,000, with insiders purchasing $93,000 worth, subject to securities law hold periods. The company focuses on North American metal deposits.

New Break Resources Ltd Presentation Update - 2025-05-16 - Minimal Update with...

Recent update to New Break Resources' documentation involves minor edits with no material changes to financial data, resource estimates, or strategic outlook.

Vizsla Royalties Corp Presentation Update - 2025-05-16 - Minimal Updates to...

The report shows only minor, non-material updates with no significant changes to financial data, resource estimates, or strategic information, indicating stability in the company's outlook.

Unlock Premium

Get access to exclusive analysis and trading signals

- Access to all premium articles

- PDF change detection

- Advanced charting