Alpha Announces New Drilling Results from Ongoing 2025 Exploration Program at the Aburna Gold Project

Alpha reports promising drilling results at Eritrea's Aburna Gold Project, confirming its large, shallow, and high-grade gold system over a 7km by 2km area.

Michael Chen

Senior Mining Analyst

Calgary, Alberta--(Newsfile Corp. - November 5, 2025) - Alpha Exploration Ltd. (TSXV: ALEX) ("Alpha" or the "Company") is pleased to announce drilling results from the initial 2,105 metres in 14 reverse circulation ("RC") drillholes from its 2025 exploration program at the Aburna Gold Project, within its 100% owned, 514km² Kerkasha Project located in Eritrea. The Aburna Gold Project is a district scale gold system covering at least a 7km long and 2km wide area. Three prospects, Central, Hill 52, Northeast have been the main focus for exploration and evaluation drilling. The large Aburna area of gold mineralization is also indicated by extensive anomalous gold values in soil and shallow Rotary Air Blast ("RAB") drill sampling sometimes associated with artisanal workings. The Aburna Gold Project is one of three significant discoveries made by the Alpha team on the Kerkasha licence.

HIGHLIGHTS OF 2025 DRILLING RESULTS TO DATE

- ABR179: 21.00 metres grading 1.20 grams per tonnes ("g/t") gold from 21.00 metres drilled depth

Including: 18.00 metres grading 1.34 g/t gold

Including: 5.00 metres grading 3.32 g/t gold

- ABR178: 8.00 metres grading 1.19 g/t gold from 101.00 metres drilled depth

Including: 5.00 metres grading 1.73 g/t gold

- Only some 20% of the 7km long Aburna gold trend has been tested by drilling

- The mainly shallow drilling to date has returned 90% of the gold mineralization at depths of less than 120 metres below surface

- Other anomalous gold intercepts drilled provide targets for follow up drill testing

Based upon current data and interpretation it is estimated true widths range between 70% and 90% of the drilled intersections.

John Wilton, CEO of Alpha, stated: "These new drilling results further confirm the highly prospective scale and tenor of the Hill 52 and Central areas within the larger and extensive Aburna gold system (at least 7km by 2km size). Drillhole ABR179 illustrates the shallow nature of the gold mineralization with 21m @ 1.20 g/t gold from 21m, drilled depth, at the Hill 52 area. While ABR178 with 8m @ 1.19 g/t including 5m @ 1.73 g/t gold has extended the mineralized envelope some 60m to the southeast on this section line at the Central prospect. The team is currently working on increasing our geological understanding of the controls to the Abruna gold system, its higher-grade trends, and priority targets to extend the gold zones. Overall, some 80% of the Abruna gold trend remains untested by drilling, and to date, the largely shallow drilling completed has delivered some 90% of the gold mineralization at depths above 120m from surface."

ABURNA GOLD PROJECT: DRILLING RESULTS

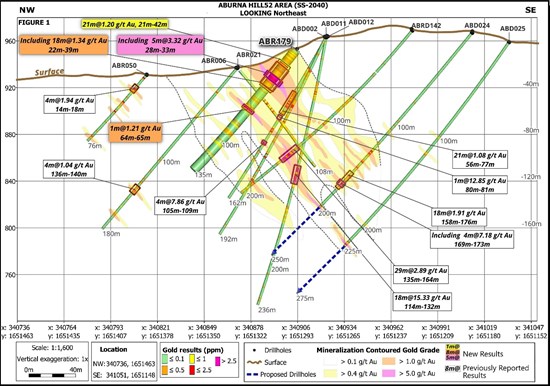

The new results from this Reverse Circulation ("RC") drillhole ABR179 emphasize the shallow broad zone of gold mineralization with 21.00 metres ("m") grading 1.20 g/t gold from only 21m drilled depth, which also contains higher grade interval of 18m @ 1.34 g/t and 5m @ 3.32 g/t gold. Figure 1 illustrates the location of ABR179 and its intercept on a cross section. This graphic provides its important context to the other previously reported intervals on this section line of ABD002: 21m @ 1.08 g/t, ABRD142: 29m @ 2.89 g/t, ABD012: 18m @ 15.33 g/t, and ABRD024: 18m @ 1.91 including 4m @7.18 g/t gold. Figure 1 additionally indicates the relationship of these intervals within a contoured larger 0.4 g/t gold envelope. Above the ABR179 intercept of 21m @ 1.20 g/t gold are two additional intervals of 7m @ 0.52 g/t and 4m @ 0.99 from 3m and 13m respectively.

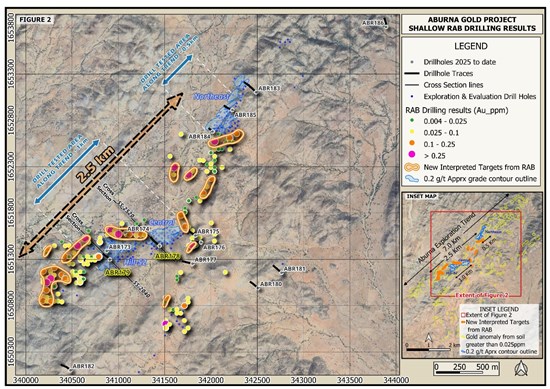

Figure 2 shows the location of ABR179 with the other completed drillholes, the approximate 0.2 g/t gold contour outline of the drilled prospects to date, and the newly identified shallow RAB targets. The Figure 2 map also shows that only some 20%, or collectively 1.5km, of the overall 7km long Aburna Project Gold trend has been tested by drilling. The Company anticipates based upon the team's experience at Aburna that further prospects will develop with future exploration and drilling along this trend.

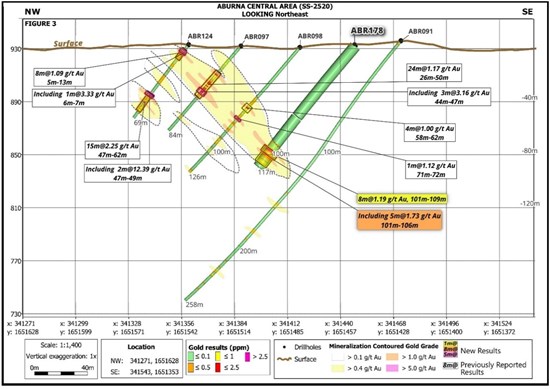

Drillhole ABR178 returned an intersection of 8m @ 1.19 g/t gold from 101m drilled depth that includes a zone of 5m @ 1.73 g/t gold. This interval extends the mineralized envelope some 60m to the southeast on this section line at the Central prospect. Figure 3 illustrates this interval along with the other intercepts on this cross section including previously reported ABR097: 24m @ 1.17 g/t, ABR124: 8m @ 1.09 g/t, and 15m @ 2.25 g/t, ABR098: 4m @ 1.00 g/t gold. Importantly it is noted this interval is developed at only some 80m below surface. Figure 2 shows the drillhole location and indicates it could be located towards the currently interpreted southeast margin of the Central prospect shoot further drilling be required to test this understanding.

Figure 1: Cross Section (SS-2040) Showing ABR179

Figure 1 notes: Previously reported results in Alpha Exploration news releases; Alpha exploration announces new drill results from the Aburna gold district including 29 meters averaging 2.89 g/t gold at hill 52 prospect, and 8 meters averaging 3.77 g/t gold at the Northeast prospect, November 14, 2024, Alpha exploration announces 18m @ 15.33 g/t gold & 49m @ 2.75 g/t gold from Hill 52 Aburna, March 1, 2024, Aburna gold prospect delivers positive drill results in four areas including:16m @ 14.07 g/t gold, November 23, 2022 and Alpha exploration announces new gold discovery at Aburna with drill intercepts 15 m of 5.85 g/t gold & 10m of 5.24 g/t gold, May 3, 2022.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8361/273265_figure_1_aburna_x_section_ss-2040_final.jpeg

Figure 2: Location of Recently Completed Drillholes, Position of Central, Hill 52, Northeast Prospects and Newly Identified RAB Targets. Inset Map: Showing Aburna Gold Trend with Prospects, RAB and Soil Gold Targets

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8361/273265_figure_2_aburna_map_final.jpeg

Figure 3: Cross Section (SS-2520) Showing ABR178

Figure 3 notes: Previously reported results in Alpha Exploration news releases; Alpha exploration announces more positive drilling results from Aburna, Jan 30, 2024, Alpha exploration provides exploration progress update, June 7, 2024, and Alpha exploration reports drill results from Aburna gold prospect: includes 9m @ 10 g/t gold, November 14, 2023.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8361/273265_figure_3_aburna_x_section_ss-2520_final.jpeg

ABR182 is an exploration hole located at the Saddle Area, a target related to some artisanal workings of quartz tourmaline veins and a surface geochemistry anomaly. The area is characterized by strong NE - SW shearing and the presence of mylonites (an indicator of a significant structure which potentially controls mineralization). Some of the mylonites and small artisanal workings have returned anomalous gold assays from surface sampling. This drillhole returned 1m @ 3.99 g/t from 4m and 3m @ 0.33 g/t from 15m drilled depth.

ABR183 is an exploration drillhole designed to test the northeastern extension of the Northeast prospect. The collar is located 50m southeast of a shear zone on surface which hosts some shallow artisanal workings. It intersected 1m @ 0.44 g/t, 2m @ 0.73 g/t, 1m @ 0.59 g/t and 1m @ 0.45 g/t from 46m, 49m, 71m and 74m respectively. Although these intercepts are of a generally lower gold tenor the results confirm that the shear zones seen on surface are mineralized and Alpha believes there is significant scope and motivation to extend mineralization further to the northeast.

ABR184 was designed to test the southwestern extensions of a high-grade zone of mineralization at the Northeast Prospect. It is located 40m southwest of ABR041 and 80m southwest of ABR037 (16m @ 14.07 g/t Au from 14m). The drillhole was sited towards the currently interpreted southwestern margin of the Northeast prospect to test for extensions of the known mineralization.

It returned 5m @ 0.98 g/t gold from 44m, including 2m @ 2.21 g/t gold from 47m and 1m @ 4.01 g/t gold from 47m. It also had an intercept of a broad zone with anomalous gold from 11m to 29m, including 5m @ 0.25 g/t Au from 16m. The hole also intersected an 11m wide zone of sheared units with hematite (iron oxide) staining from 70m to 81m where the hole was terminated likely representing a significant fault structure. ABR184 confirms that the mineralization seen previously at the Northeast prospect continues to the southwest and further drilling in the area is warranted.

ABR185 targeted an area of potential extension to the Northeast prospect. It importantly returned multiple zones of relatively low tenor gold mineralization; 6m @ 0.28 g/t from 30m, 1m @ 1.65 g/t from 65m, 5m @ 0.27 g/t from 99m, and 2m @ 0.66 g/t gold from 132m. The Company believes these results could lead to a refined structural target for higher grade and expansion of the gold mineralization near this area of the Northeast prospect. The location of all the newly reported drillholes are also indicated on Figure 2. Table 1 provides full summary of the selected intersections and Table 2 presents details of all the drillholes completed to date with IDs, azimuth, dip, end of hole depths, collar coordinates and comments.

Table 1: Selected Drilling Results with Depth, Intervals and Gold Grade for 2025 Results to date

| RC Hole ID | Depth From (m) | Depth To (m) | Width (m) | Gold (Au) ppm (g/t) |

| ABR179 | 3.00 | 10.00 | 7.00 | 0.52 |

| 13.00 | 17.00 | 4.00 | 0.99 | |

| 21.00 | 42.00 | 21.00 | 1.20 | |

| Including | 21.00 | 39.00 | 18.00 | 1.34 |

| Including | 28.00 | 33.00 | 5.00 | 3.32 |

| 64.00 | 65.00 | 1.00 | 1.21 | |

| 81.00 | 83.00 | 2.00 | 0.51 | |

| 103.00 | 105.00 | 2.00 | 0.71 | |

| ABR178 | 101.00 | 109.00 | 8.00 | 1.19 |

| Including | 101.00 | 106.00 | 5.00 | 1.73 |

| 112.00 | 113.00 | 1.00 | 0.55 | |

| ABR182 | 4.00 | 5.00 | 1.00 | 3.99 |

| 15.00 | 18.00 | 3.00* | 0.33 | |

| ABR183 | 46.00 | 47.00 | 1.00 | 0.44 |

| 49.00 | 51.00 | 2.00* | 0.73 | |

| 71.00 | 72.00 | 1.00 | 0.59 | |

| 74.00 | 75.00 | 1.00 | 0.45 | |

| ABR184 | ||||

| 16.00 | 21.00 | 5.00* | 0.25 | |

| 44.00 | 49.00 | 5.00* | 0.98 | |

| Including | 47.00 | 49.00 | 2.00* | 2.21 |

| Including | 47.00 | 48.00 | 1.00 | 4.01 |

| ABR185 | 30.00 | 36.00 | 6.00* | 0.28 |

| 65.00 | 66.00 | 1.00 | 1.65 | |

| 99.00 | 104.00 | 5.00* | 0.27 | |

| 132.00 | 134.00 | 2.00* | 0.66 |

Table 1 Notes: Intertek completed the analytical work with analytical procedures conducted in an Intertek laboratory in Tarkwa, Ghana. Sample preparation was undertaken by an independent laboratory NABRO in Asmara, Eritrea and the pulps shipped to Intertek, Ghana. Based upon current data and interpretation it is estimated true widths range between 70% and 90% of the drilled intersections. A nominal cut-off grade of 0.40 g/t Au has been used to determine the boundaries of these intersections with no more than 3 metres of internal dilution of the intercepts. *A nominal cut-off grade of 0.20 g/t Au has been used to determine the boundaries of these intersections with no more than 2 metres of internal dilution of the intercept.

QUALITY ASSURANCE AND QUALITY CONTROL

The results reported here for the Reverse Circulation ("RC") drilling were analysed by Intertek Minerals Ltd., an independent and accredited laboratory located in Tarkwa, Ghana. The RC drilling was managed by Alpha Exploration's field team with the field operations conducted in-line with the standard operating procedures implemented at this project. Alpha uses an independent laboratory in Asmara (NABRO) to prepare drill samples for assaying. Representative one-metre samples from the RC drilling were crushed (to >90% passing 2.0 mm) and pulverised (to >85% passing 75 micron). A scoop sample of approximately 60g for laboratory analysis was taken. The coarse and pulp rejects were stored at Alpha's warehouse in Asmara. The Company inserted certified reference material from OREAS (www.ore.com.au) into the sample stream, while NABRO sample preparation facility inserted barren granodiorite material into the sample stream as a blank. The 60g sub-samples with inserted QA/QC samples of blanks and certified reference material every 20th field sample were shipped to Intertek Minerals, Tarkwa, Ghana. The gold results at the laboratory were determined by using a 30g sub-sample for Fire Assay ("FA") and Atomic Absorption Spectroscopy ("AAS") finish (Intertek Code: FA30/AA).

Table 2: 2025 Drilling Program to Date: Drillhole ID, Azimuth, Dip, End of Hole Depth, Collar Coordinates and Comments

| Drillhole ID | Azimuth Degree | Hole Dip Degree | End of hole Depth (m) | X_UTM_37N | Y_UTM_37N | Elevation (Z) (m) | Comments |

| ABR173 | 285 | -50 | 74.00 | 340873.00 | 1651390.00 | 934.00 | Did not reach target zone being re-drilled |

| ABR173A | 285 | -50 | In Progress | 340874.00 | 1651396.00 | 948.00 | In Progress |

| ABR174 | 315 | -50 | 123.00 | 341072.00 | 1651586.00 | 933.00 | No significant intervals |

| ABR175 | 305 | -50 | 147.00 | 341831.00 | 1651557.00 | 949.00 | No significant intervals |

| ABR176 | 285 | -60 | 150.00 | 341892.00 | 1651483.00 | 943.00 | No significant intervals |

| ABR177 | 285 | -50 | 174.00 | 341800.00 | 1651253.00 | 935.00 | No significant intervals |

| ABR178 | 315 | -50 | 201.00 | 341445.00 | 1651446.00 | 932.00 | 8m @ 1.19 g/t Au including 5m @ 1.73 g/t Au |

| ABR179 | 315 | -50 | 135.00 | 340908.00 | 1651298.00 | 952.00 | 21m @ 1.20 g/t Au including 5m @ 3.32 g/t Au |

| ABR180 | 315 | -50 | 153.00 | 342506.00 | 1650990.00 | 961.00 | No significant intervals |

| ABR181 | 315 | -50 | 177.00 | 342762.00 | 1651155.00 | 934.00 | No significant intervals |

| ABR182 | 315 | -50 | 171.00 | 340482.00 | 1650102.00 | 1008.00 | 1m @ 3.99 g/t gold & 3m @ 0.33 g/t Au |

| ABR183 | 315 | -50 | 213.00 | 342487.00 | 1653104.00 | 996.00 | 2m @ 0.73 g/t Au & 1m @ 0.59 g/t Au |

| ABR184 | 315 | -50 | 81.00 | 342018.00 | 1652680.00 | 959.00 | 2m @ 2.21 g/t including 1m @ 4.01 g/t Au |

| ABR185 | 285 | -50 | 153.00 | 342230.00 | 1652914.00 | 985.00 | 6m @ 0.28 g/t and 5m @ 0.27 g/t Au |

| ABR186 | 360 | -50 | 153.00 | 343892.00 | 1653810.00 | 972.00 | No significant intervals |

QUALIFIED PERSON

All scientific and technical information in this press release, including the results of the Aburna drill program and how these results relate to the ongoing exploration at the Kerkasha Project has been reviewed, verified, and approved by Chris Bargmann CGeol FGS, consultant for Alpha and a "qualified person" for the purposes of National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

ABOUT ALPHA

Alpha (TSXV: ALEX) is an exploration company that is rapidly advancing a number of important gold and base metal discoveries across its 100% owned, 514 km2 Kerkasha Project in Eritrea.

The Aburna Gold Prospect is an exciting new gold discovery where recent drilling has confirmed a high-grade mineralized system, with grades including 18m @ 15.33 g/t Au, 16 m @ 14.07 g/t Au, 9 m @ 10 g/t Au and 23 m @ 6.74 g/t Au.

The Anagulu Gold-Copper Prospect includes recent drilling intersections of 108 m @ 1.24 g/t Au and 0.60% Cu and 49 m @ 2.42 g/t Au and 1.10% Cu within a porphyry unit mapped over at a >2 km strike length.

The Company is managed by a group of highly experienced and successful mining and exploration professionals with long track records of establishing, building and returning value to stakeholders from a number of world class gold and base metal discoveries in Eritrea and across the wider Arabian Nubian Shield.

For further information go to the Alpha webpage at www.alpha-exploration.com or contact:

John Wilton

CEO

Alpha Exploration Ltd.

Email: [email protected]

Tel: +44 207 129 1148

Cautionary Notes

This press release is intended for distribution in Canada only and is not intended for distribution to United States newswire services or dissemination in the United States. Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Forward-Looking Statements

Certain statements and information herein, including all statements that are not historical facts, contain forward-looking statements and forward-looking information within the meaning of applicable securities laws. Such forward-looking statements or information include but are not limited to statements or information with respect to future dataset interpretations, sampling, plans for its projects (including the Anagulu prospect), surveys related to Alpha's assets, and the Company's drilling program. Often, but not always, forward-looking statements or information can be identified by the use of words such as "estimate", "project", "belief", "anticipate", "intend", "expect", "plan", "predict", "may" or "should" and the negative of these words or such variations thereon or comparable terminology are intended to identify forward-looking statements and information. With respect to forward-looking statements and information contained herein, Alpha has made numerous assumptions including among other things, assumptions about general business and economic conditions and the price of gold and other minerals. The foregoing list of assumptions is not exhaustive.

Although management of Alpha believes that the assumptions made and the expectations represented by such statements or information are reasonable, there can be no assurance that forward-looking statements or information herein will prove to be accurate. Forward-looking statements and information by their nature are based on assumptions and involve known and unknown risks, uncertainties and other factors which may cause actual results, performance or achievements, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements or information. These factors include, but are not limited to: risks relating to Alpha's financing efforts; risks associated with the business of Alpha given its limited operating history; business and economic conditions in the mining industry generally; the supply and demand for labour and other project inputs; changes in commodity prices; changes in interest and currency exchange rates; risks relating to inaccurate geological and engineering assumptions (including with respect to the tonnage, grade and recoverability of reserves and resources); risks relating to unanticipated operational difficulties (including failure of equipment or processes to operate in accordance with specifications or expectations, cost escalation, unavailability of materials and equipment, government action or delays in the receipt of government approvals, industrial disturbances or other job action, and unanticipated events related to health, safety and environmental matters); risks relating to adverse weather conditions; political risk and social unrest; changes in general economic conditions or conditions in the financial markets; changes in laws (including regulations respecting mining concessions); risks related to the direct and indirect impact of COVID-19 including, but not limited to, its impact on general economic conditions, the ability to obtain financing as required, and causing potential delays to exploration activities; those factors discussed under the heading "Risk Factors" in the Final Prospectus; and other risk factors as detailed from time to time. Alpha does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/273265

Tags

Michael Chen

Michael has over 15 years of experience covering junior mining companies, with a focus on precious metals exploration and development.

View All Articles →