Mining Intelligence Articles & Market Analysis - Page 109

Discover news, analysis, and insights on junior mining companies and precious metals

Featured Articles

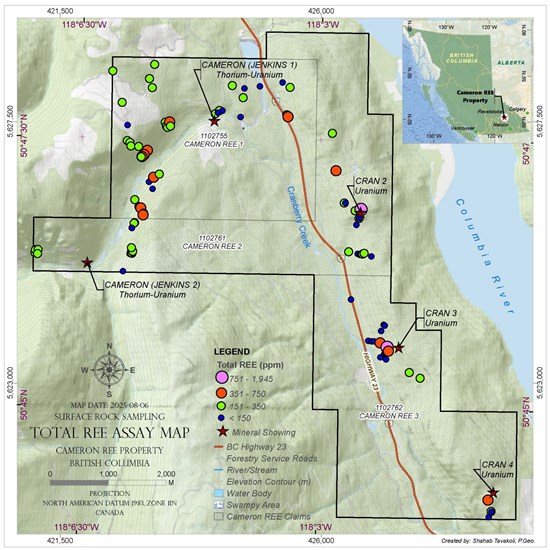

Powermax Minerals Reports Encouraging Rare Earth Element (REE) Assay Results from Phase 1 Program at Cameron Project, British Columbia

Powermax's Phase 1 exploration at the Cameron REE Project shows promising REE enrichment in surface and sediment samples, indicating potential for valuable light and heavy rare earth elements.

St. Augustine Announces the Appointment of a New Board Member

St. Augustine appoints Michael G. Regino to its board, replacing Johnny Felizardo, bringing extensive experience in mining, business, and public service.

Trending Now

View All

York Harbour Metals Announces Sale of Firetail Shares for CAD $1.71 million and Provides Strategic Update

York Harbour sold shares of Firetail, earned CAD $1.71M, retains a majority stake, and is involved in project development and potential partnerships in gold and rare earths.

Dryden Gold Corp. Announces Upsizing of Previously Announced Equity Financing with Participation from Centerra Gold

Dryden Gold increases its financing to $7.8M via flow-through and hard dollar shares, with Centerra Gold exercising its top-up right to maintain 9.9% interest.

Angel Wing Metals Reports Voting Results from Annual General and Special Meeting

Angel Wing Metals shareholders approved directors, auditors, and stock plan at the August 2025 AGM, with all nominees elected unanimously.

All Articles

Transition Metals Commences Drill Program at Its Saturday Night PGM Discovery, and Will Be in Attendance at VRIC and Roundup

Transition Metals Corp. has begun drilling at its Saturday Night PGM Project in Ontario, aiming to evaluate mineralization. The 2025 program is partially funded by a grant, and the company will also attend the Vancouver Resource Investment Conference and AME Roundup.

Andean Precious Metals Signs Exclusive Agreement to Purchase up to 100,000 Tonnes of Oxide Material from the Trapiche Concession in Bolivia

Andean Precious Metals Corp. has signed a Sale and Purchase Agreement with Empresa Minera Trapiche S.R.L. for up to 100,000 dry tonnes of oxide material from Bolivia. Initial delivery of 28,000 tonnes is due within 3 months, with compliance to quality and environmental standards.

CanAlaska Begins Three Drill Program at West McArthur Joint Venture

CanAlaska Uranium Ltd. has commenced a $12.5 million drilling program at the West McArthur project to expand the ultra high-grade Pike Zone uranium discovery. Three drills are focused on delineation, with the company aiming to increase its ownership in the joint venture with Cameco Corporation.

Big Ridge Gold Corp Provides Corporate Update and 2025 Objectives

Big Ridge Gold Corp. announced progress on the Hope Brook Gold Project, increasing its ownership to 80% and completing environmental studies and field programs. Upcoming plans include releasing exploration results and finalizing drill targets.

Imagine Lithium Intersects 11.50 m of 1.08% Li2O and 8.80 m of 0.81% Li2O at Casino Royale and Makes New Pegmatite Dike Discovery

Imagine Lithium Inc. announced successful results from its fall 2024 drill program at the Jackpot lithium project in Ontario, including the discovery of a new lithium pegmatite dike. Highlights include significant lithium grades and extensive geological mapping efforts.

Hercules Intersects 300m of 0.70% CuEq, including 138m of 1.01% CuEq, Starting 70m from Surface

Hercules Metals Corp. announces promising step-out drilling results from its Hercules Property in Idaho, revealing significant copper equivalent grades and expanding mineralization in multiple directions. Future drilling will target a large soil anomaly in the Eastern Block Zone.

C3 Metals Completes Soil Sampling over Khaleesi Copper-Gold Project, Peru - Commences Geophysical Surveys

C3 Metals Inc. has completed a soil sampling program at its Khaleesi Copper-Gold Project in Peru, with assays pending. A geophysical crew is mobilized for further data collection ahead of drilling. The project showcases potential in a mineral-rich area.

Rio Tinto and Ivanhoe Electric Acquire Land Positions on Eastern and Western Flanks of Intrepid Metals Corral Copper Property in Arizona

Intrepid Metals Corp. reports that Rio Tinto and Ivanhoe Electric have acquired mineral rights near its Corral Copper Project in Arizona, highlighting significant interest in the area. Intrepid plans further drilling in 2025, aiming to develop a major copper opportunity.

Peruvian Metals Achieves Record Throughput at Aguila Norte Processing Plant and Summarizes Major Achievements for 2024

Peruvian Metals Corp reported a record production of 33,889 tonnes at its Aguila Norte plant in 2024, marking a 12.2% increase from 2023. The company also consolidated its Palta Dorada project and acquired a 50% stake in San Maurizo Mines, enhancing its gold exploration efforts in Peru.

IsoEnergy Exercises Put Option to Strengthen Partnership with Purepoint

IsoEnergy Ltd. and Purepoint Uranium Group have established a 50/50 joint venture to explore 10 uranium projects in the eastern Athabasca Basin. IsoEnergy exercised a put option, enhancing its partnership with Purepoint and gaining access to its diverse portfolio.

IsoEnergy Exercises Put Option to Strengthen Partnership with Purepoint

IsoEnergy Ltd. and Purepoint Uranium Group Inc. have exercised a put option to establish a 50/50 joint venture for uranium exploration in the eastern Athabasca Basin, enhancing their partnership and enabling collaboration on 10 projects across 98,000 hectares.

Group Eleven Highlights Elevated Germanium Grades from Recent Drilling at Ballywire; Provides Drill Update

Group Eleven Resources Corp. has reported promising germanium assay results from its Ballywire zinc-lead-silver project in Ireland, showing strong Ge grades and ongoing drilling efforts. The company anticipates further assay results in 2025, highlighting increased exploration.

Dryden Gold Corp to Participate at the Metals Investor Forum and AME Roundup

Dryden Gold Corp. will participate in the Metals Investor Forum in Vancouver on January 17-18, 2025, featuring a presentation by President Maura Kolb. The company will also attend the AME Roundup on January 20-21, offering opportunities for investor engagement and insights.

Desert Gold Trench and Prospecting Results Showcase Opportunities for Resource Expansion

Desert Gold Ventures Inc. announced new gold resource data from 2010-2012 at Mogoyafara South and Linnguekoto West deposits, totaling 479,000 ounces of inferred resources at 1.09 g/t gold. Highlights include significant trenching and grab sample results.

Torex Gold Provides 2025 Operational Guidance and Updated Five-Year Production Outlook

Torex Gold Resources Inc. anticipates returning to positive free cash flow mid-2025 as it ramps up the Media Luna Project. The company outlines operational guidance for 2025, including production and capital expenditure forecasts, and a planned plant shutdown for upgrades.

Medaro Mining Terminates Yurchison Uranium Property Option Agreement

Medaro Mining Corp. has terminated its option agreement with Skyharbour Resources for the Yurchison uranium property, effective February 12, 2025. The company focuses on lithium exploration in Quebec and is involved in developing new lithium extraction processes.

Platinum Group Metals Ltd. Reports First Quarter 2025 Results

Platinum Group Metals Ltd. reports its financial results for Q4 2024 and updates on the Waterberg Project in South Africa, aimed at becoming a major low-cost underground PGM mine. The company is also working on battery technology initiatives using platinum and palladium.

Sabre Gold Shareholders Approve Acquisition by Minera Alamos

Sabre Gold Mines Corp. announced that shareholders approved a plan for Minera Alamos Inc. to acquire all Sabre shares at an exchange rate of 0.693 shares per common share. Additionally, they approved a debt settlement involving the issuance of shares to creditors.

First Majestic Announces Shareholder Approval in Connection with Gatos Silver Acquisition

First Majestic Silver Corp. has received shareholder approval to acquire Gatos Silver, Inc., exchanging up to 190 million common shares. Approximately 98.44% of First Majestic shareholders and 71.3% of Gatos Silver shareholders voted in favor. The transaction is expected to close by January 16, 2025.

Inomin Provides Project Update

Inomin Mines Inc. is conducting airborne surveys at its Beaver-Lynx project in British Columbia to identify drilling targets, with results expected in two weeks. The company is also raising capital through NFT Units and discussing potential partnerships for its La Gitana property in Mexico.

Big Red Mining Corp. Expands Antimony Soil Anomaly on Its Antimony 2.0 Property in New Brunswick

Big Red Mining Corp. updates on its Antimony 2.0 Project amid China's export ban on antimony, raising concerns over supply chain stability. Antimony prices have surged, and the project in New Brunswick aims to address North America's reliance on Chinese imports.

QIMC Strengthens Strategic Collaboration with Record Resources in the Temiskaming Hydrogen Camp

Quebec Innovative Materials Corp. announces a collaboration with Record Resources, which has secured a key property near QIMC's hydrogen discovery. This strengthens QIMC's position in the hydrogen sector, with QIMC receiving shares and a revenue royalty from Record.

Record Acquires Option on Key Temiskaming Hydrogen Property and Strengthens Strategic Collaboration with QIMC

Record Resources Inc. has entered an option agreement to acquire a key property in the Temiskaming hydrogen camp near QIMC's hydrogen discovery, enhancing its position in Ontario's renewable hydrogen sector and fostering collaboration with QIMC.

Golden Share Announces Approval of Reverse-Takeover Transaction and Voluntary Delisting from The TSX Venture Exchange

Golden Share Resources Corporation will voluntarily delist from the TSX Venture Exchange on January 23, 2025, following shareholder approval of a reverse takeover by Lipari Diamond Mines Ltd. The new entity will be named Lipari Diamond Mines Ltd., pending regulatory conditions.

CanCambria Energy Corp Announces Closing of Initial Tranche and Increase to Offering Amount

CanCambria Energy Corp has closed the first tranche of its private placement, raising $2.6 million by issuing 5,273,000 units at $0.50 each. The company plans to increase the offering by $1.225 million for its Kiskunhalas Project and general corporate needs.

Auric Minerals Announces Letter of Intent to Option Three Uranium Assets in Quebec

Auric Minerals Corp. has signed a non-binding letter of intent to acquire three uranium properties in Quebec, enhancing its portfolio in a top mining jurisdiction. The Caboose property shows promising uranium values, and the company aims to expand its regional strategy in Eastern Canada.

Great Atlantic Resources Intersects Visible Gold in Both Holes Six and Seven: 60.20 G/T Gold over 0.44 Meters in Sixth Hole; 28.02 G/T Gold over 0.80 Meters in Seventh Hole

Great Atlantic Resources Corp. announced that its subsidiary, Golden Promise Mines Inc., has completed six and seventh drill holes at the Jaclyn Main Zone of its 100% owned Golden Promise Gold Property, revealing visible gold and planning a bulk sample for 2025.

Morissette Joins Bullion Gold to Develop the Bodo Project

Bullion Gold Resources Corp. appoints Guy Morissette as President and CEO, succeeding Jonathan Hamel. Morissette emphasizes the potential of the Bodo SM project, drawing parallels to past successes in gold discovery, and highlights his extensive industry experience.

Element 29 Resources - Reviewing 2024 and a Look Ahead to 2025

Element 29 Resources Inc. provided an update to shareholders highlighting leadership changes, including Richard Osmond as President and CEO and the addition of Manuel Montoya as CTO. The company raised $3.26 million for exploration at the Elida deposit and plans further drilling and geophysical surveys in 2025.

Battery Mineral Resources Announces New Encouraging Drill Results from Its Punitaqui Copper Mine in Chile

Battery Mineral Resources Corp. announced positive drill assay results from its 2024 exploration program at the Punitaqui mine in Chile, confirming copper and silver mineralization in targeted areas. The results enhance geological models for future extraction.

Unlock Premium

Get access to exclusive analysis and trading signals

- Access to all premium articles

- PDF change detection

- Advanced charting