Mining Intelligence Articles & Market Analysis - Page 111

Discover news, analysis, and insights on junior mining companies and precious metals

Featured Articles

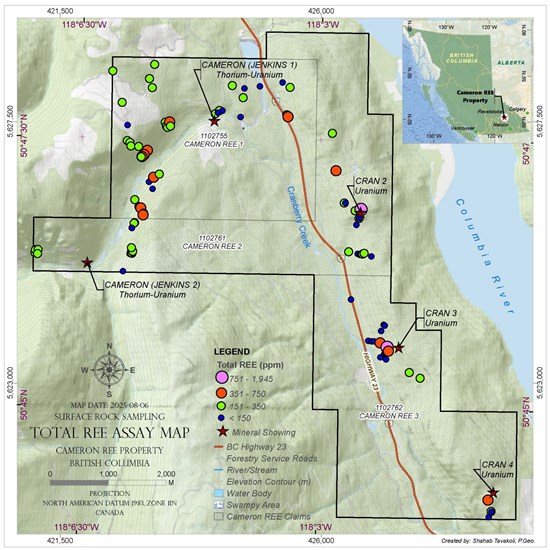

Powermax Minerals Reports Encouraging Rare Earth Element (REE) Assay Results from Phase 1 Program at Cameron Project, British Columbia

Powermax's Phase 1 exploration at the Cameron REE Project shows promising REE enrichment in surface and sediment samples, indicating potential for valuable light and heavy rare earth elements.

St. Augustine Announces the Appointment of a New Board Member

St. Augustine appoints Michael G. Regino to its board, replacing Johnny Felizardo, bringing extensive experience in mining, business, and public service.

Trending Now

View All

York Harbour Metals Announces Sale of Firetail Shares for CAD $1.71 million and Provides Strategic Update

York Harbour sold shares of Firetail, earned CAD $1.71M, retains a majority stake, and is involved in project development and potential partnerships in gold and rare earths.

Dryden Gold Corp. Announces Upsizing of Previously Announced Equity Financing with Participation from Centerra Gold

Dryden Gold increases its financing to $7.8M via flow-through and hard dollar shares, with Centerra Gold exercising its top-up right to maintain 9.9% interest.

Angel Wing Metals Reports Voting Results from Annual General and Special Meeting

Angel Wing Metals shareholders approved directors, auditors, and stock plan at the August 2025 AGM, with all nominees elected unanimously.

All Articles

Fuerte Metals Geophysical Survey Confirms Two Significant Porphyry Cu-Au Targets at its Placeton Project, Chile

Fuerte Metals Corporation announced promising results from geophysical surveys at its Placeton Project in Chile, revealing two undrilled copper-gold targets. The project, located near significant mining deposits, is now prepared for drilling to explore these targets further.

Endurance Announces Near-Surface Drilling Results from Eagle Zone - Highlights include 5.15 gpt Gold over 21.6 m and 6.51 gpt gold over 14.0 m

Endurance Gold Corporation announced positive assay results from the Eagle and Crown Zones at its Reliance Gold Project, revealing multiple gold-rich intercepts from recent drilling. Highlights include significant gold grades, demonstrating potential for further exploration.

Awalé's Transformative 2024 Sets the Stage for an Ambitious 2025

Awalé Resources highlights achievements in 2024, including significant gold targets at Charger and BBM zones, strong financial backing, enhanced leadership, and a robust 2025 exploration plan to uncover regional potential and drive growth for shareholders.

Tudor Gold Intensifies Exploration Efforts by Initiating Permitting for Construction of Underground Exploration Infrastructure to Expand and Complete Drilling of Supercell One Zone at Treaty Creek, Golden Triangle of British Columbia

Tudor Gold Corp. has begun the permitting process for 3,000 meters of underground development at its Treaty Creek Project to access the high-grade Supercell One Zone for exploration. This initiative aims to reduce drilling costs and time, enhance exploration, and support future mining operations.

Ivanhoe Electric's Typhoon(TM) Technology Quickly Proves its Power with Discovery in Saudi Arabia

Ivanhoe Electric's joint venture with Ma'aden reported successful drilling at the Umm Ad Dabah prospect, revealing copper mineralization beyond 700 meters. Utilizing advanced TyphoonTM technology, the partnership aims to explore Saudi Arabia for various metals efficiently.

TriStar Announces a $1.5 Million Non-Brokered Private Placement and a Change in Officers

TriStar Gold Inc. announces a non-brokered private placement to raise up to C$1.5 million at C$0.13 per share for its Castelo de Sonhos project. The offering closes around January 27, 2025, pending regulatory approvals. Additionally, Mr. Scott Brunsdon becomes Corporate Secretary following Mr. Brian Irwin's retirement.

Forum Announces Final Assay Results from Tatiggaq; Drill Intercept Identifies Potential New Zone 300 Metres North of the Tatiggaq Deposit

Forum Energy Metals Corp. announces positive assay results from eight drill holes at the Tatiggaq anomaly in Nunavut, indicating potential new uranium zones and expanding the project's footprint. CEO Rick Mazur highlights the area's significant exploration potential.

Radisson Provides 2025 Outlook and Exploration & Development Plans for the O'Brien Gold Project

Radisson Mining Resources Inc. outlines its 2025 exploration and development plan for the O'Brien Gold Project in Quebec, with a focus on drilling to extend gold mineralization, completing metallurgical studies, and increasing environmental studies, backed by a C$6.8M budget.

Dryden Gold Corp. Reports Surface Rock Samples Grading up to 34.80 g/t Gold at Hyndman Property

Dryden Gold Corp. reports positive results from its 2024 summer exploration at the Hyndman Property, revealing five gold samples over 1 g/t, including one at 34.8 g/t. The campaign validated previous findings and identified additional exploration targets based on geophysical studies.

Silicon Metals Corp. Announces 100% Acquisition of the Longworth Silica Project

Silicon Metals Corp. has exercised its option to acquire 100% interest in the Longworth Silica Project in British Columbia, which features high-purity silica deposits. The company aims to build on prior exploration efforts and historical findings of significant silica content.

Auric Minerals Announces Hardline Exploration for Geological and Exploration Consulting

Auric Minerals Corp. has signed a consulting agreement with Hardline Exploration Corp. and Jeremy Hanson for geological and exploration services as it prepares for field programs in Labrador's Central Mineral Belt on its uranium properties.

RETRANSMISSION: Cruz Battery Metals Acquires the Central Clayton Valley Lithium Brine Project in Nevada Completely Surrounded by SLB's Property

Cruz Battery Metals Corp. plans to acquire the 580-acre Central Clayton Valley Lithium Brine Project in Nevada, expanding its total footprint to 820 acres. The acquisition aims to capitalize on the project's potential amid rising domestic lithium production demands.

Thor Explorations Announces Strong Q4 2024 Gold Production, 2025 Operating Guidance and Details of Investor Webinar

Thor Explorations Ltd. announced its Q4 and FY 2024 operational update for the Segilola Gold mine, reporting 85,057 oz of gold produced in 2024, with Q4 gold sales generating $62 million. The company has cleared its senior debt and projects 85,000-95,000 oz production for FY 2025.

Newpath Resources Reports Voting Results from Annual General Meeting

Newpath Resources Inc. announced the results of its Annual General Meeting on January 10, 2025, where 21.11% of shares were represented. All submitted matters, including the re-election of directors and auditor appointment, were approved.

Indico Resources Announces Proposed Share Consolidation

Indico Resources Ltd. plans to consolidate its shares at a rate of 10:1, reducing outstanding shares from 11.3 million to approximately 1.1 million, to improve capital raising efforts. The consolidation requires TSX Venture Exchange approval.

Enertopia Announces Consolidation of Share Capital

Enertopia Corporation is implementing a 20-for-1 share consolidation effective January 15, 2025, to enhance its capital structure for better financing opportunities. Post-consolidation, shares will total approximately 7.76 million, trading under ticker ENRT.

Centurion Minerals Ltd. Provides Status Report of Annual Financial Statements and MD&A

Centurion Minerals Ltd. reports a bi-weekly default status due to delays in filing its annual financial statements, leading to a management cease trade order for its CEO and CFO. The company aims to complete the filings by January 27, 2025.

Cordoba Minerals Announces the Receipt of US$10 Million Bridge Financing from JCHX

Cordoba Minerals Corp. has secured $10 million in bridge financing from JCHX Mining to advance its Alacran Copper-Gold-Silver Project in Colombia. The funding will support engineering work and general corporate needs, aiding the project's progression towards construction.

General European Strategic Investments Inc. Announces the Passing of our CEO and Board Chairman

General European Strategic Investments Inc. announces the passing of CEO Wolfgang Rauball on January 4, 2025. The Board is seeking a successor while assuring shareholders of continued commitment to projects and initiatives during this transition.

Alma Gold Provides Corporate Update

Alma Gold Inc. announces the resignation of Paul Ténière from its Board of Directors, effective January 7, 2025, while he continues as a technical consultant. The company expresses gratitude for his contributions and outlines its gold exploration projects in Guinea and New Brunswick.

DynaResource Announces Results of its 2024 Annual Meeting of Stockholders

DynaResource, Inc. announced the results of its 2024 annual stockholders' meeting, where new directors were elected, the 2024 Equity Incentive Plan was approved, and Davidson & Company LLP was ratified as auditors. CEO Rohan Hazelton expressed gratitude to stockholders.

EnGold Announces Management Changes

EnGold Mines Ltd. announces interim appointments of Dale Reimer as CFO and John K. Brown as Chairman due to vacancies. The company focuses on copper, gold, silver, and magnetite exploration in its Lac La Hache property in British Columbia.

York Harbour Announces Change of Auditor

York Harbour Metals Inc. has changed auditors from MS Partners LLP to Manning Elliott LLP effective January 10, 2025. There were no issues with the former auditor's reports, and this change has been filed as required. The company focuses on mineral exploration in Newfoundland.

East Africa Metals Announces Closing of Non-Brokered Private Placement

East Africa Metals has completed a non-brokered private placement, raising CAD$500,000 by issuing 3.33 million shares at CAD$0.15 each, backed by a strategic investor. Proceeds will fund legal, accounting, and working capital. TSX-V approval pending.

US Critical Metals Announces Non-Brokered Private Placement of Units

US Critical Metals Corp. plans a non-brokered private placement of up to 10 million units at C$0.05 each, aiming to raise up to C$500,000 by January 31, 2025. Proceeds will fund various mining projects and general working capital.

Ivanhoe Mines Launches an Offering of US$600,000,000 Senior Notes Due 2030

Ivanhoe Mines has launched a US$600 million offering of senior unsecured notes due 2030 to fund corporate purposes, including project expansion. The offering is supported by a US$120 million revolving credit facility and includes forward-looking statements about potential outcomes.

IAMGOLD Files Technical Report for the Westwood Mine Complex

IAMGOLD Corporation has filed the 2024 technical report for its Westwood Mine Complex, prepared by qualified professionals. The report complies with NI 43-101 standards and is available online. IAMGOLD is a Canadian gold producer with ongoing projects and a focus on ESG practices.

Vortex Metals Announces Non-Brokered Private Placement

Vortex Metals Inc. is launching a non-brokered private placement to raise up to $1,000,000 by selling 12,500,000 units at $0.08 each, intended for exploration at its Illapel Copper Project in Chile and general working capital, pending regulatory approval.

First Phosphate Reports University Research Reports Relating to the Geological Characterization of its Three Bégin-Lamarche Phosphate Zones

First Phosphate Corp. announces research reports from Queen's University and Université de Québec à Chicoutimi on the mineralogy and geochemistry of the Bégin-Lamarche phosphate deposit in Quebec, highlighting its potential for supplying materials for LFP batteries.

Cruz Battery Metals Acquires the Central Clayton Valley Lithium Brine Project in Nevada Completely Surrounded by SLB's Property

Cruz Battery Metals Corp. plans to acquire the 580-acre Central Clayton Valley Lithium Brine Project in Nevada, expanding its lithium footprint to 820 acres. The acquisition, aimed at capitalizing on domestic lithium production and favorable regulatory conditions, is pending approvals.

Unlock Premium

Get access to exclusive analysis and trading signals

- Access to all premium articles

- PDF change detection

- Advanced charting