Mining News Releases & Company Updates - Page 114

Discover news, analysis, and insights on junior mining companies and precious metals

Featured Articles

Honey Badger Silver Announces Closing of First Tranche of Non-Brokered Private Placement Raising Gross Proceeds of Approximately $2.013 Million

Honey Badger Silver raised $2.013M via private placements to fund exploration in Canada’s northern territories.

Dios Sells K2 to Azimut

Dios explores gold at its Heberto-Gold project; sells K2 property to Azimut for cash and shares, retaining a royalty. Focus on discovering a world-class gold deposit.

Trending Now

View All

Excellon Announces Appointment of Mike Hoffman to Board of Directors and Provides Corporate Update

Excellon Resources appoints mining veteran Mike Hoffman to its Board to enhance governance and support growth and production strategies.

Arya Resources Ltd. Engages CHF Capital Markets Inc.

Arya Resources partners with CHF Capital Markets for 12 months to boost investor relations, marketing, and capital markets advisory, with an option for share purchase.

Nevada Organic Phosphate Announces Stock Option Grant and Compensation Shares Issuance

Nevada Organic Phosphate granted stock options and issued shares as bonuses, including a related party transaction, to key personnel.

All Articles

Besra Gold Announces: Jugan Project: Metallurgical Test Work - Incorporating New Mining Strategy

Besra Gold Inc. has announced the start of a drilling programme involving deep diamond drill holes, in preparation for metallurgical test work set to begin in early 2025. This comes after a review of the Jugan Project, which has prompted a new mining strategy involving a smaller open pit, potentially followed by a 400 metre deep underground development. The revised strategy will result in less surface disturbance, lower tailings storage, a reduced environmental impact, and less land acquisition. The completion of the project will help showcase the company's gold mining ambitions.

Nexus Announces Non-Brokered Financing of FT Units

Nexus Uranium Corp. has announced a non-brokered private placement of up to 5,000,000 units at a price of $0.30 per unit to raise up to $1,500,000. Each unit includes one common share and one share purchase warrant, which can be used to acquire another share for 18 months at a price of $0.40. The proceeds will be used for Canadian exploration expenses and mining expenditures at the Cree East uranium project in the Athabasca Basin. The completion of the offering is subject to various approvals, including from the Canadian Securities Exchange.

Sitka Drills 119.0 Metres of 1.05 g/t Gold, Including 37.9 Metres of 2.05 g/t Gold and 11.5 Metres of 4.32 g/t Gold in Initial Diamond Drilling at the Rhosgobel Intrusion at Its Flagship RC Gold Project in Yukon

Sitka Gold Corp. has announced promising assay results from its first diamond drill at the Rhosgobel intrusion in Yukon, Canada. The drill hole returned 164.8 metres of 0.82 g/t gold starting 9 metres from the surface, with segments showing even higher gold levels. Drilling confirmed strong gold mineralization from the surface to at least 300 metres deep. The results indicate that Rhosgobel has the potential to host a significant multi-million ounce intrusion-related gold deposit. Results for six additional diamond drill holes are currently pending.

Red Metal Resources Closes First Tranche of Financing

Red Metal Resources Ltd. has completed the first stage of a non-brokered private placement, issuing 3 million flow-through units at a price of $0.10 per unit, resulting in gross proceeds of $300,000. The company also issued 915,000 non-flow-through units at $0.08 per unit, generating an additional $73,200. Each unit consists of one common share and half a common share purchase warrant, with each warrant exercisable to acquire one common share at $0.12 per share until May 2026. The company paid $30,000 in finder's fees and issued 300,000 share purchase warrants in connection with subscriptions introduced by Castlewood Capital Corporation.

Northstar Commences Diamond Drilling at Miller Copper-Gold Property

Northstar Gold Corp. has begun diamond drilling at its 100%-owned Miller Copper-Gold Property in Ontario. The company has hired Wiijiiwaagan Drilling Limited Partnership to complete a 1,500 metre drill program by the end of the year. The drilling targets copper-gold-silver sulphide mineralization along a recently defined conductor anomaly. Northstar has already intersected high-grade copper horizons at the site. This drilling was made possible by strategic investor support and a recent private placement that raised over $800,000. The company is planning to close a second tranche soon.

South Pacific Metals' President Cathy Fitzgerald Recognized in the 2024 "100 Global Inspirational Women in Mining (WIM100)"

South Pacific Metals Corp's President, Cathy Fitzgerald, has been recognized as one of the "100 Global Inspirational Women in Mining" for her contributions to the global mining industry. With over 20 years of experience, Fitzgerald has driven strategy and development projects across key commodities. This recognition reflects her commitment to innovation and excellence in the mining industry. The Women in Mining UK initiative awards women who advocate for positive change and demonstrate resilience. South Pacific Metals Corp is an emerging gold-copper exploration company operating in Papua New Guinea.

Battery Mineral Resources Announces up to C$7 Million in Royalty Financing

Battery Mineral Resources Corp. has signed an agreement with Electric Royalties Ltd. to sell a 0.75% Gross Revenue Royalty on its Punitaqui copper mine in Chile for C$3.5 million. The company has also received interest for an additional C$3.5 million in royalty financing, potentially bringing total proceeds to C$7 million. This additional capital will enable Battery to increase production and accelerate mining activities at the Punitaqui project. The deal is expected to close before December 31, 2024.

US Copper Corp Reports Updated Mineral Resource Estimate for Moonlight-Superior Project

US Copper Corp has announced an updated Mineral Resource Estimate for its Moonlight-Superior Copper Project in Northeast California. The indicated resources include 402 million tons with 2.5 billion pounds of copper, a 99% increase from the 2018 estimate. The company also reported an inferred resource of 64 million tons with 394 million pounds of copper. The data will be used to develop a Preliminary Economic Assessment, expected to be released in January 2025. The CEO of US Copper believes the project could become a significant part of the US's critical mineral development strategy.

Big Gold Commences Maiden Drilling on the East Divide at Tabor Property in the Shebandown Greenstone Belt in Northwestern Ontario

Big Gold Inc. has begun drilling on the East Divide at the Tabor Property in Northwestern Ontario, located on the Shebandowan Greenstone Belt. So far, over 100m have been drilled and the second drill hole is in progress. The maiden drill program is focusing on the East Divide Target Zone, which previously showed promising gold, silver, copper, and zinc samples. The Tabor Project is next to Goldshore's Moss Lake gold deposit, which has 6.73 million ounces of gold resources.

Tartisan Nickel Corp. Closes $1,500,000 Flow-Through Financing at $0.24 per Share with a Thirteen Month Escrow Period

Tartisan Nickel Corp., a Canadian mineral exploration and development company, has secured $1.5 million in flow-through financing with a 13-month escrow period. This financing resulted in the issuance of 6,250,000 shares at $0.24 each. The funding will mainly be used for the exploration, development, and advancement of Tartisan's Kenbridge Nickel Project in Ontario. A 5% commission was paid to agents involved in the deal.

Fuerte Metals Hits at Step-out Holes at the Los Ingleses Vein, Intercepts 12.1 g/t AuEq over 1.1 m, 8.9 g/t AuEq over 1.2 m and 6.0 g/t AuEq over 2.8 m at its Cristina Project in Chihuahua, Mexico

Fuerte Metals Corporation has released results from five more holes as part of a diamond drilling program at its Cristina precious metals project in Mexico. This brings the total to 25 holes, totalling 6,976.5 metres, as part of a 40-50 hole, 21,000 metre program. The latest results come from the Los Ingleses vein system. Among the highlights are 12.1 g/t AuEq over 1.1 m estimated true width in hole ACD24-245 and 8.9 g/t AuEq over 1.2 m estimated true width in hole ACD24-242.

Seabridge's KSM Project Substantially Started Determination Challenged by Tsetsaut Skii km Lax Ha

Seabridge Gold Inc. announced that the Tsetsaut Skii km Lax Ha (TSKLH), an Indigenous group, has filed a petition against the British Columbia province and relevant ministries. The petition seeks a judicial review of the decision by the British Columbia Environmental Assessment Office that Seabridge's KSM Project has been "substantially started". The TSKLH contests the rights of the Nisga'a Nation and Tahltan Nation over the area of the project. They seek a declaration that the province failed in its duty to consult TSKLH regarding the project's commencement and request an order quashing the project's "substantially started" status due to the province's failure to consult and procedural fairness.

Atlas Lithium Outlines Regional Growth Strategy

Atlas Lithium Corporation, the owner of the Neves Project, is set to become the next lithium concentrate producer in Brazil's Lithium Valley. The company's medium to long-term growth strategy includes holding three key projects in major lithium-mineralized zones in the valley. The Neves Project is advancing towards production while exploration activities at the Salinas and Clear Projects have shown significant progress. Atlas Lithium has assembled Brazil's largest portfolio of lithium mineral rights among publicly listed companies.

Ongold Announces Agreement to Acquire the Monument Bay and Domain Projects in Manitoba

ONGold Resources Ltd. has announced its agreement to buy 100% stakes in both the Monument Bay Gold Project and the Domain Project, which are located in Manitoba, Canada, from Agnico Eagle Mines Limited and Capella Minerals Ltd. After the deal closes, Agnico Eagle will hold a 15% stake in ONGold. The acquisition of Monument Bay, which has significant gold and tungsten mineralization, will enhance ONGold's portfolio and complement its exploration activities in Northern Ontario.

Benton Resources Inc. to Seek Shareholders Approval to Spin-out Shares of Vinland Lithium Inc.

Benton Resources Inc. has announced plans for a special shareholder meeting, likely to be held January 8, 2025, to approve a reorganization of the company's share capital. The plan includes a spin-out of approximately 2 million of Benton's 4 million shares of Vinland Lithium Inc. to shareholders. The TSX Venture Exchange has conditionally agreed to list the issued shares of Vinland following the spin-out. The exact ratio of Vinland shares per Benton shares will be determined prior to completion, with accounts holding less than 5,000 Benton shares not receiving Vinland shares due to high administrative and compliance costs.

Pacific Empire Presents Final Results of Drill Target Generation at Trident

Pacific Empire Minerals Corp., a British Columbia-based copper-gold explorer, has announced the finalization of its drilling targets and diamond drilling strategy for its flagship Trident property, 50 km west of Centerra Golds Mt. Milligan Mine. The updated drilling program proposes an initial fence of 3-5 drill holes across the target area and a hole testing a potential high grade breccia pipe. The company's analysis of regional stratigraphy suggests that the main porphyry target should dip 70 degrees to the north. This information will be used to guide the orientation of drill holes in the upcoming program to maximize exploration success.

Thunder Gold Reports 9.12 g/t Au Over 12.66 Metres and Announces Diamond Drilling Program, Tower Mountain Gold Property, Ontario

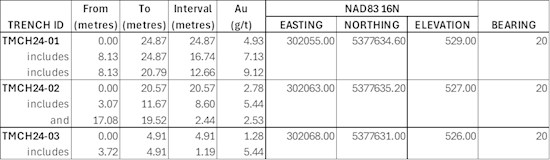

Thunder Gold Corp has announced results from its channel samples at the P-Target within its Tower Mountain Gold Property in Thunder Bay, Ontario. TMCH24-01 averaged 4.93 g/t Au over 24.87 meters, marking the longest mineralized intercept above a cut-off grade of 1.0 g/t Au in the property's history. TMCH24-02 averaged 2.78 g/t Au over 20.57 meters, while TMCH24-03 averaged 1.28 g/t Au over 4.91 meters. More than 82% of channel sample intervals were above 0.30 g/t Au, three times higher than the frequency rate of the 40,000 drill hole core samples collected

Quetzal Copper Announces Changes to the Board of Directors

Quetzal Copper Corp., a company engaged in the acquisition, exploration, and development of mineral properties, has announced changes to its Board of Directors. Lisa Thompson, a veteran corporate/securities paralegal with over 20 years of experience, will be joining the company's board. Thompson has worked with both large and small public companies listed on US and Canadian stock exchanges and co-founded Meraki Corporate Services in Vancouver. John Fraser, a founding director, will be departing the board. Fraser provided valuable guidance and contributions to the company's corporate strategy during his tenure.

Rua Gold Completes the Acquisition of Siren Gold's Reefton Assets and Becomes the Dominant Reefton Goldfield Explorer

Rua Gold Inc. has announced the successful acquisition of Reefton Resources Pty Limited, a subsidiary of Siren Gold Ltd. This transaction expands Rua Gold's tenement package to cover over 95% of the Reefton Goldfield. CEO Robert Eckford sees this as a significant milestone in the company's growth, creating the chance to develop a world-class mining operation in the underexplored area. The company is also advancing the Auld Creek gold project and has mobilized a third drilling rig on the site while continuing operations at Murray Creek. Further targets are being assessed using the VRIFY AI targeting methodology.

Goldshore Awards Contracts for Resource Expansion & Discovery Focused Winter Exploration Programs

Goldshore Resources Inc. has awarded contracts for its diamond drilling program and geophysical and geochemical program to Laframboise Drilling Inc., Forages Technic-Eau Inc., and Abitibi Geophysics, respectively. The drilling program aims to expand the mineral resource estimate within the top 200 meters from surface, aiming to extend known mineralization and reduce strip ratio at the Moss Gold Project. The geophysical and geochemical program targets unexplored structural corridors, with the goal of defining drill targets. The company expects these initiatives to improve the economic performance of the deposit and lead to additional discoveries.

Military Metals Issues Invitation to Tender for Resource Estimation at Its Trojarova Antimony-Gold Property in Slovakia

Military Metals Corp. has invited three companies to submit tenders for conducting a mineral resource estimation of its Trojarová antimony-gold property in Slovakia. The property, previously developed for antimony production, has historical resource estimates from Soviet-era work. Bids are expected by December 20, 2024, with the selected company tasked to digitize all historical data, make recommendations for drilling protocols, and prepare a new mineral resource estimate based on the new drill data. The company aims to upgrade the non-compliant historical resource to current industry standards.

Aurania Announces Amended Terms for Private Placement and Debt Settlement; Agreement Complete for Payment of Mineral Properties in Ecuador

Aurania Resources Ltd. has revised the pricing for its previously announced non-brokered private placement financing. Under the new terms, the company plans to issue up to 8,888,888 units at C$0.45 per unit, which could generate up to C$4 million. Each unit will include one common share and one purchase warrant, which allows the holder to buy one common share at C$0.75 for 24 months following the closing of the offering. The company may increase the size of the offering by up to 25%, which could raise an extra C$1 million. The proceeds will be used for exploration in France, exploration programs in Ecuador, and for working capital. The company may also pay finders

Sailfish Royalty Declares Q3 2024 Dividend

Sailfish Royalty Corp. has declared its third quarterly cash dividend for 2024 of US$0.0125 per share, to be paid on January 15, 2025, to shareholders on record as of December 31, 2024. Future dividends will be subject to Board approval and the company's current financial state. The company also decided to settle US$205,000 in accrued interest through the issuance of 188,593 common shares to the holders of convertible debentures.

Pacific Ridge's Inaugural Drill Program Returns Some of the Best Drill Results Ever Recorded at the Chuchi Copper-Gold Project

Pacific Ridge Exploration Ltd. has announced the successful completion of its inaugural drill program at the Chuchi copper-gold project in British Columbia. The exploration yielded some of the best drill results ever recorded at the site, suggesting the presence of a large, untested porphyry copper-gold system. The company intersected alkalic porphyry copper-gold mineralization in all drill holes and recorded the deepest mineralization so far at 420m vertical depth. One of the drill holes returned 65.0 m of 0.42% copper equivalent while the last hole of the program returned 0.33% copper equivalent in the last 51.0 m.

Apex Commences Initiation of Pre-Drilling Works at Its Lithium Creek Project in Churchill County, Nevada

Apex Resources Inc. has announced the start of geophysical and geological studies on the Lithium Creek Project in Churchill County, Nevada. The studies aim to support expanded lithium brine exploration and target a planned deep drilling program. The company will use magnetotelluric and seismic survey lines to refine lithium brine reservoir targets. The selection of drill targets will be based on these surveys and the results of shallow ground water sampling. The Lithium Creek project, located near the Nevada lithium battery hub of the Tahoe-Reno Industrial Center, covers about 8240 acres and has never been systematically explored or tested for lithium brines.

Purepoint Uranium Group Inc. Closes $2,200,000 Private Placement

Purepoint Uranium Group Inc. has closed its non-brokered private placement, issuing 7,333,331 units priced at $0.30 each, raising a total of $2.2 million. Each unit is composed of a common share and a purchase warrant, which allows the holder to buy a common share at an exercise price of $0.40 per share within a 36-month period. Finders' fees were paid to Red Cloud Securities Inc. and Stephen Avenue Securities Inc., totaling $53,699.96 and 178,999 non-transferable compensation warrants. The net proceeds will be used for the company's general working capital. All issued securities are subject to a four-month hold period, expiring on March

DLP Resources intersects 303.15m of 0.49% CuEq* within a 1189.65m interval of 0.32% CuEq*, on the Aurora Project

DLP Resources Inc. has announced the receipt of complete drill results for drillhole A24-021 on the Aurora porphyry copper-molybdenum-silver project in southern Peru. The drillhole intersected copper-silver and molybdenum mineralization from 2.50m to the end of the hole at 1192.15m. The company's president and CEO, Mr. Gendall, expressed satisfaction with the results, indicating that all twenty-one drillholes have intercepted good copper-molybdenum-silver mineralization. A preliminary resource estimate is expected in the first quarter of 2025.

Neotech Metals Corp. Samples 28.97% TREO and 2.91% Nb2O5 at the TREO Project

Neotech Metals Corp. has announced results from a 2024 field reconnaissance program at its TREO Project in British Columbia. Of the 113 rock samples collected, assay results showed peak value of 28.97% TREO with 17 samples assaying above 1.0% TREO. Furthermore, numerous assays revealed anomalous niobium values. Plans to expand on these results include off-season modelling, 3D projections to define drill targets, and additional work programs for the next season. The TREO project is situated near an active railway, powerlines, and year-round maintained roads, allowing for low-cost exploration programs.

Benz Appoints Chief Executive Officer

Mark Lynch-Staunton, who previously served as Benz Mining's Chief Development Officer, has been promoted to Chief Executive Officer. Since joining Benz more than a year ago, Lynch-Staunton has played a crucial role in shaping the company's strategy, particularly in acquiring high-grade gold assets in Western Australia. He brings over 15 years of experience in metals and mining to the role, including managing large-scale projects such as the Bulyanhulu Gold Mine. Lynch-Staunton plans to drive substantial value for Benz's shareholders by leveraging their new assets in Western Australia and existing projects in Quebec.

Thor Explorations Announces Exercise of Share Options and Director Dealings

On November 24, 2024, Thor Explorations Ltd. announced that Company Director Mr. Folorunso Adeoye has exercised share options for a total of 1,000,000 common shares at 20 Canadian Dollar cents per common share, for a total consideration of C$200,000. These new shares will be admitted to trading on AIM and the TSX Venture Exchange on November 28, 2024. Following this, Mr. Adeoye will have a beneficial holding of 22,349,721 common shares, which is 3.4% of the total issued share capital in the Company. Thor Explorations is a mineral exploration company with interests in Nigeria, Senegal, and Burkina

Unlock Premium

Get access to exclusive analysis and trading signals

- Access to all premium articles

- PDF change detection

- Advanced charting