Mining Intelligence Articles & Market Analysis - Page 136

Discover news, analysis, and insights on junior mining companies and precious metals

Featured Articles

Quimbaya Gold Announces Termination of LOI with Denarius Metals

Quimbaya Gold's joint venture with Denarius Metals for artisanal mining at Tahami was terminated; Quimbaya retains full ownership and continues exploration plans.

Galloper Gold Clarification Release

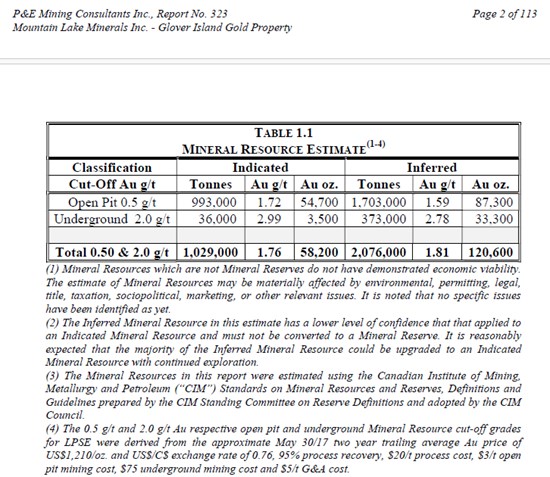

Galloper Gold clarifies its recent EML license award on Glover Island, covering the historic LPSE gold resource, with no new exploration since 2012, within a mineral-rich 11 km corridor.

Trending Now

View All

Sanatana Announces Market Making Services Agreement with Independent Trading Group

Sanatana Resources hires ITG for one-month market-making to boost share liquidity, paying $5,000 monthly, with automatic renewal and no equity compensation.

Silver47 and Summa Silver Complete Merger to Create a Premier U.S. High Grade Silver Explorer & Developer

Silver47 and Summa merged to form Silver47 Exploration Corp., a U.S.-focused high-grade silver explorer with significant resources in Alaska, Nevada, and New Mexico.

Element 29 Announces Upsized Private Placement of up to $6,400,000

Element 29 Resources increases private placement to $6.4M for exploration in Perú, issuing units with shares and warrants, pending TSX-V approval.

All Articles

Neotech Metals Corp. Samples 28.97% TREO and 2.91% Nb2O5 at the TREO Project

Neotech Metals Corp. has announced results from a 2024 field reconnaissance program at its TREO Project in British Columbia. Of the 113 rock samples collected, assay results showed peak value of 28.97% TREO with 17 samples assaying above 1.0% TREO. Furthermore, numerous assays revealed anomalous niobium values. Plans to expand on these results include off-season modelling, 3D projections to define drill targets, and additional work programs for the next season. The TREO project is situated near an active railway, powerlines, and year-round maintained roads, allowing for low-cost exploration programs.

Benz Appoints Chief Executive Officer

Mark Lynch-Staunton, who previously served as Benz Mining's Chief Development Officer, has been promoted to Chief Executive Officer. Since joining Benz more than a year ago, Lynch-Staunton has played a crucial role in shaping the company's strategy, particularly in acquiring high-grade gold assets in Western Australia. He brings over 15 years of experience in metals and mining to the role, including managing large-scale projects such as the Bulyanhulu Gold Mine. Lynch-Staunton plans to drive substantial value for Benz's shareholders by leveraging their new assets in Western Australia and existing projects in Quebec.

Element 29 Resources (TSXV:ECU) - Developing the Next Major Copper Mine in Peru

Interview with Richard Osmond on Element 29's Elida copper project, highlighting its potential and investment appeal....

Rupert Resources (TSX:RUP) - New CEO's Vision for Finland's 4M Oz Gold Project

Interview with CEO Graham Crew on Rupert Resources' Ikkari gold deposit development and potential....

Kodiak Copper (TSX-V: KDK) - Unlocking a Premier Copper-Gold Porphyry Project in British Columbia

Interview highlights Kodiak Copper's advances in copper-gold projects amid rising global demand....

SILVER in Deficit for 'Foreseeable Future' – What Happens Next?

Dr. Hennigh discusses silver supply deficits and Barksdale's promising Sunnyside copper-silver project....

Thor Explorations Announces Exercise of Share Options and Director Dealings

On November 24, 2024, Thor Explorations Ltd. announced that Company Director Mr. Folorunso Adeoye has exercised share options for a total of 1,000,000 common shares at 20 Canadian Dollar cents per common share, for a total consideration of C$200,000. These new shares will be admitted to trading on AIM and the TSX Venture Exchange on November 28, 2024. Following this, Mr. Adeoye will have a beneficial holding of 22,349,721 common shares, which is 3.4% of the total issued share capital in the Company. Thor Explorations is a mineral exploration company with interests in Nigeria, Senegal, and Burkina

Asking People on the Street if They Invest in Gold or NOT (You'll be Surprised)

Exploring Swiss residents' views on investing in gold and silver in Zurich....

Bitcoin, Gold, or Copper? Lobo Tiggre Reveals the Best Asset to Beat Inflation in 2025

Lobo Tiggre highlights copper as the top investment for 2025 due to demand, supply constraints, and inflation....

Aranjin Resources Announces Corporate Update and Change in Chief Financial Officer

Aranjin Resources Ltd. has put its proposed ASX listing on hold indefinitely. The Company also announced the resignation of Joe Graziano as CFO and corporate secretary, who will be replaced by Robert Payment. Payment is an experienced CPA, CA with expertise in equity financings, financial reporting, and public company administration. He has worked as CFO and consultant for multiple companies across various sectors.

Argyle Announces Marketing Renewal

Argyle Resources Corp. has extended its strategic marketing agreement with Euro Digital Media Ltd. for an additional month. The agreement can be extended or shortened at management's discretion. Euro Digital will continue to manage marketing campaigns, perform keyword research, manage remarketing campaigns, and more. The promotional activity will be done on a specific landing page and through Google ads. Argyle will pay Euro Digital a fee of $150,000 for this extension but will not issue any securities as compensation.

Rise Gold Announces Change of Officers

Rise Gold Corp. has announced the appointment of Mihai Draguleasa as Chief Financial Officer, replacing Vince Boon, and Catherine Cox as Corporate Secretary, replacing Eileen Au. Draguleasa is a Chartered Professional Accountant with over 15 years of accounting experience, including in the mining and resource sector. Cox has over 20 years of experience as a Corporate Secretary in the resource sector. The company, incorporated in Nevada, USA, is an exploration-stage mining company with a principal asset being the historic past-producing Idaho-Maryland Gold Mine in California.

Volta Announces Closing of Oversubscribed Private Placement, Commences Exploration and Agrees to Acquire Claims to Expand its Footprint in the Seymour Lithium Camp, Ontario

Volta Metals Ltd. has closed an oversubscribed non-brokered private placement, issuing 4,820,000 company units at $0.05 each, generating gross proceeds of $241,000. The funds will be used for initial screening of the newly acquired ZigZag Project, an option payment on the Falcon West property, and general corporate expenses. Crews are being mobilized for exploration at the ZigZag Project. Company insiders, including directors and officers, have increased their holdings, purchasing a total of 2,520,000 units in this offering.

GOLD & SILVER Stocks: Ronnie Stoeferle, Willem Middelkoop, Peter Krauth, Luc ten Have

Interview on junior mining stocks, company insights, and investment risks; includes featured firms....

Millennial Announces Private Placement of 11,250,000 Units for Proceeds of $3,375,000

Millennial Potash Corp. is launching a private placement of 11.25 million units at $0.30 each to fund further exploration and development of its Banio Potash Project and for general capital purposes. Each unit consists of one common share and one-half of a share purchase warrant, exercisable at $0.40 per share for two years from issuance. An insider of the company is participating in the placement for 10 million units, which is considered a "related party transaction". The insider's purchase will result in them holding over 20% of the company's shares, requiring shareholder approval.

Dollar Devaluation Exposed: Why Only Gold, Bitcoin Hit 'Real' New All-Time Highs During Last 10+ Yrs

Gold has risen 818% in 24 years, outperforming indices; Checkan discusses dollar devaluation and trends....

West High Yield (W.H.Y.) Resources Ltd. Announces Proceeds from Exercise of Options

West High Yield Resources Ltd., a publicly traded junior mining exploration and development company, has announced the receipt of proceeds from the exercise of 100,000 stock options by an option holder. These options were part of an option grant in November 2019. The company focuses on acquiring, exploring, and developing mineral resource properties in Canada, with a primary goal of developing its Record Ridge critical mineral deposit using green processing techniques. The Record Ridge deposit, located near Rossland, British Columbia, contains approximately 10.6 million tonnes of magnesium.

Canadian Critical Minerals Engages Third Party Investor Relations Services

Canadian Critical Minerals Inc. (CCMI) has hired ImpactDeck, an investor relations firm, to increase its visibility within the investment community. Under the agreement, CCMI will pay ImpactDeck up to $4,000 per month starting from December 1, 2024, for a minimum term of three months. CCMI, a mining company focusing on copper production assets in Canada, believes that its status as a revenue-generating company in the Canadian junior mining space is not currently reflected in its share price.

Middle Class is 'Going Down' as War Hawks Push for Total Destruction: Gerald Celente

Gerald Celente warns of war's impact on the economy and the middle class as political elites prioritize conflict....

Coloured Ties Capital Inc. Provides Update on Canada Postal Strike and Voting at the Company's 2024 Annual General Meeting

Coloured Ties Capital Inc. has advised shareholders to vote online or by phone for the company's annual general meeting scheduled for December 6, 2024, due to an ongoing postal strike in Canada. Voting instructions are provided on the company's website and on SEDAR+. The company is a publicly traded venture capital firm in Canada, investing in early-stage junior resources and disruptive technologies.

Silver Bullet Mines Corp. Advances Mining Activity at Washington Mine in Idaho

Silver Bullet Mines Corp. has started contract mining at the Idaho Washington Mine, with a miner experienced in high grade vein operations. The miner will perform underground development and bulk sampling at the Washington Mine, which was historically a high grade gold mine. The company aims to initially target an area last tested in the 1980s which previously showed significant quantities of silver and gold. The miner has begun work to access this target zone, which is believed to be 80 feet from the portal opening.

Search Minerals Files Fiscal 2023 Audited Financial Statements, Management's Discussion and Analysis and Provides Management Update

Search Minerals Inc. has announced the filing of its audited Financial Statements and MD&A for the year ended November 30, 2023. The company also revealed changes in its executive team with Greg Andrews resigning as Interim CFO and Corporate Secretary, to be replaced by Joseph Lanzon and Diane Poole respectively. The company is working towards meeting all regulatory requirements to lift the cease trade order on its shares and is planning to resume its exploration program in St. Lewis. The company aims to return to public trading of its shares in early 2025.

First Phosphate Announces Investor Outreach Engagements

First Phosphate Corp. has hired Capital Analytica to provide investor relations and communications services, including social media consulting, reporting, and investor relations services for a six-month period beginning November 20, 2024, for a fee of CAD $120,000. In addition, First Phosphate has entered into a six-month marketing agreement with OGIB Corporate Bulletin Ltd., also starting November 20, 2024, for a total cost of CAD $40,000. Both companies are independent and do not own any securities, warrants, or options of First Phosphate Corp.

Myriad Uranium Announces Private Placement and Appointment of Simon Clarke as Chair of the Board of Directors

Myriad Uranium Corp. is conducting a non-brokered private placement to raise up to $2.5 million. The funds will be used for exploration of the company's mineral properties, general working capital, and the expansion of the Copper Mountain Project. Each unit, priced at $0.40, will consist of one common share and one-half of one share purchase warrant. Additionally, Simon Clarke has been appointed as Chair of the Board of Directors, effective immediately.

Big Ridge Gold Corp. Confirms Availability of Annual Meeting Materials

Big Ridge Gold Corp. has announced that due to the ongoing Canadian postal strike, the materials for its Annual General Meeting on December 23, 2024, are available online on the company's profile and website. Shareholders can also request electronic copies from the company's CFO. Proxies and voting instructions will be emailed to registered shareholders. The company will mail the materials if the postal strike ends before the meeting, but cannot guarantee they will arrive in time. Non-objecting shareholders should contact Computershare to request their Voting Instruction Form, while objecting shareholders should contact their broker. The company's financial statements and related management discussion & analysis for the financial year ended June 30, 2024, are also available online.

AuMEGA Further Demonstrates Prospectivity at Bunker Hill and Announces Malachite Drill Results

AuMEGA Metals Ltd has announced significant findings from its Bunker Hill West program, including gold-in-till anomalies that are nearly 40 times the crustal abundance level. The Bunker Hill geochemical footprint surrounds historical samples that had high gold, silver, and lead grades. This anomalism correlates with structural complexity identified from recent airborne magnetic surveys. In addition, further gold and copper mineralisation was confirmed at Malachite through diamond drilling. The company is planning its largest drill program in three years for 2025, and the latest results from Bunker Hill have increased confidence in the project's potential.

Pluto Ventures Inc. Engages Fairfax Partners Inc.

Pluto Ventures Inc. has entered into a services agreement with Fairfax Partners Inc., which will provide investor relations activities for the company. The agreement, which will last for 12 months with a month-to-month option thereafter, involves a payment of $5,000 per month plus taxes from Pluto to Fairfax. Fairfax is a Vancouver-based investor relations and marketing consultancy firm that is independent of Pluto and holds no securities of the company. The press release also contains forward-looking information based on economic assumptions, which may not be updated unless required by securities legislation.

Pure Energy Minerals Announces Director Change

Pure Energy Minerals Limited has appointed Mr. Yuwei Hong, a representative of Lithium X Corp., to its board of directors. Mr. Hong has over 15 years of experience in management, investment, and consulting, and currently serves as vice president of Xizang Zhufeng Resources Co. Ltd. The company also thanked Mr. Yuankai Mao for his contributions as a previous board member. Pure Energy Minerals, a lithium resource company, has a significant land position at its Clayton Valley Project in Nevada, where it explores and develops lithium resources.

West Vault Announces Resignation and Appointment of Director

West Vault Mining Inc. has announced the resignation of Stephen Quin from its Board of Directors effective November 21, 2024, thanking him for his contributions. The company also announced the appointment of Frank R. Hallam as a director from the same date. Hallam, who co-founded the company in 2010, has previously served as a director and is currently the company's CFO and Corporate Secretary. He was also a co-founder of MAG Silver Corp., West Timmins Mining Inc., and Platinum Group Metals Ltd.

Auric Minerals Corp. Commences Exploration Work at its Goodeye Property in British Columbia, Canada

Auric Minerals Corp. has announced the start of its 2024 exploration work program on its Goodeye Property in British Columbia, Canada. The program will include prospecting, mapping, soil and rock sampling, and geophysical surveys. The focus will be on areas identified during the 2021 exploration as having higher silver and gold values, notably the contact zones between the Sheppard Intrusion and other formations, quartz veins within the Sheppard Intrusion, and target areas marked by the Wanita fault.

Unlock Premium

Get access to exclusive analysis and trading signals

- Access to all premium articles

- PDF change detection

- Advanced charting