Mining Intelligence Articles & Market Analysis - Page 134

Discover news, analysis, and insights on junior mining companies and precious metals

Featured Articles

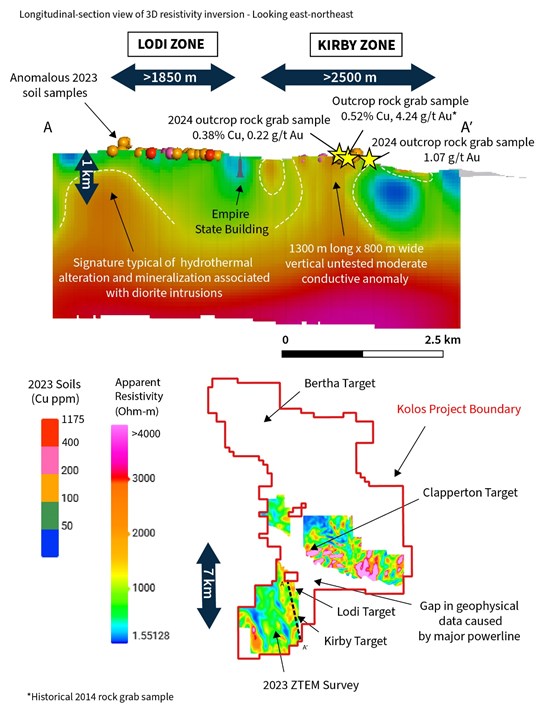

Torr Metals Inc. Secures Drill Permit for the Kirby, Lodi, and Clapperton Targets at the Kolos Copper-Gold Project

Torr Metals received a five-year drill permit for high-priority copper-gold targets at its Kolos Project in BC, enabling initial drilling at undrilled, geophysically promising zones.

Canadian Critical Minerals Announces the Passing of Founder David W. Johnston

Canadian Critical Minerals mourns founder David Johnston, a mining pioneer and entrepreneur, who significantly contributed to the company's assets and the Canadian mining industry.

Trending Now

View All

Homerun Collaborates with Igraine PLC to Launch Rapid-Deployment EV Charging and Battery Storage Solutions for UK Auto Sector

Homerun Resources partners with Igraine PLC to develop quick-deploy EV charging and battery storage solutions in the UK, targeting major automakers and accelerating EV adoption.

Dinero Completes Drilling at the New Raven Property

Dinero Ventures reports drill results at New Raven gold project, testing multiple zones, and seeks to extend warrant expiry dates by 3 years, pending TSX approval.

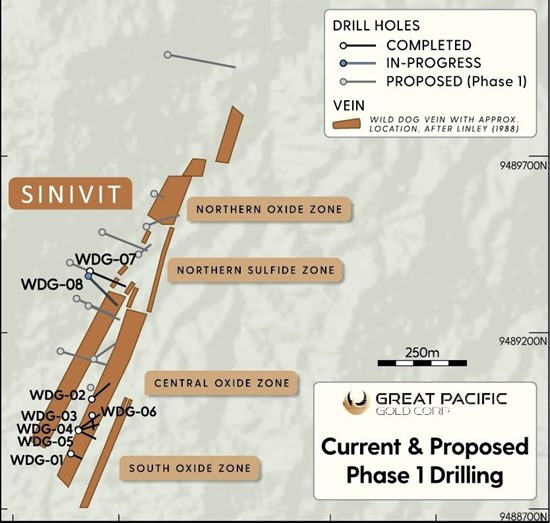

3.5m at 13.1 g/t AuEq Drilled at Great Pacific Gold's Wild Dog Project

Great Pacific Gold reports promising drill results at Wild Dog PNG, including high-grade gold and copper intercepts, advancing exploration of a 15km mineralized corridor.

All Articles

Millennial Increases Private Placement

Millennial Potash Corp., a company based in West Vancouver, has increased its private placement from 11,250,000 units to 12,643,333 units, at a price of $0.30 per unit. This will result in proceeds of $3,793,000, up from $3,375,000, which will be used to fund further exploration and development of its Banio Potash Project and for general working capital. The Company has also retained Independent Trading Group (ITG) to provide market-making services to help maintain a fair market in the Company's shares. The private placement is awaiting approval from the TSX Venture Exchange.

Myriad Uranium Concludes Maiden Drill Campaign at Copper Mountain; Program Encountered Significant High Grade, Exceeded Expectations, Provided Verification of Historical Drilling, and Encountered Mineralisation in Deeper Zones Which Opens Exciting New Potential

Myriad Uranium Corp. has completed its maiden drilling program at Copper Mountain, with positive results. The drilling exceeded expectations, with numerous intervals encountered containing significant quantities of uranium. Notably, uranium mineralisation was confirmed below the previous maximum depth of historical drilling, a discovery that could increase the project's potential. The company is now analyzing core samples and expects chemical assay results in the coming months.

Appia is Joining MAGBRAS to Participate in the Development of Latin America's First Permanent Magnet Production Facility

Appia Rare Earths & Uranium Corp., a Toronto-based company, has joined the SENAI MAGBRAS initiative to develop Latin America's first rare earth permanent magnet facility in Lagoa Santa, Brazil. The MAGBRAS project, part of the Rota 2030/MOVER program, aims to establish a national production of rare earth permanent magnets, making Brazil a significant player in the global market. The project plans include identifying technological challenges, developing solutions, implementing a pilot plant, and eventually setting up an industrial scale facility with industry collaboration. Appia will contribute to the initiative by providing management support and a potential source of light and heavy rare earths for the Brazilian magnets' production.

Lara Raises $3.085 Million From Accelerated Exercise of 2022 Warrants

Lara Exploration Ltd. has reported that 3,085,943 warrants to purchase common shares were exercised, resulting in gross proceeds of C$3,085,943. The funds raised will be used mainly for the development of its Planalto Copper-Gold Project in Brazil and for general corporate purposes. Following this warrant exercise, the company has 49,434,772 shares outstanding, with around C$5.6 million in treasury. The company follows a Prospect and Royalty Generator business model and holds a diverse portfolio of prospects, deposits and royalties in Brazil, Peru and Chile.

Cosa Resources Executes Agreement to Form Joint Ventures with Denison Mines on Multiple Uranium Projects

Cosa Resources Corp. is set to acquire a 70% interest in three uranium exploration projects in the Eastern Athabasca Basin from Denison Mines Corp. As part of the deal, Denison will become a 19.95% shareholder in Cosa and commits to a minimum of C$1,000,000 participation in future equity financings. The projects include the Murphy Lake North Project, the Darby Project, and the Packrat Project. Cosa's senior management team will advance these projects, offering potential benefits for both Cosa and Denison.

American Pacific Reports up to 80.6 g/t Gold, 5.2% Copper and 136 g/t Silver from the 2024 Field Program at its Madison Project

American Pacific Mining Corp. has received the final assays from 88 rock samples and 141 soil samples collected during the 2024 field season. The company also completed a radiometric survey interpretation to assist future drill targeting for a 3,000-metre, Phase II program scheduled to begin in Q1 2025. The field work results extended the mineralized footprint 2.5 kilometres southeast and 2 kilometres west, and revealed 5 additional target areas that will be included in the Phase II drill program. The use of radiometric surveys, which highlight thorium, potassium and uranium, is seen as a unique approach in exploring for porphyry systems.

Maritime Trench Sampling at Hammerdown Returns 49 gpt Gold Over 0.4 Metres Width Along a Strike Length of 45 Metres

Maritime Resources Corp. has announced the results of additional surface sampling at the Hammerdown Gold Project in Newfoundland and Labrador. The project is an advanced stage, high grade gold development project with completed permitting and access to the company's existing Pine Cove mill facility. The recent sampling program exposed high-grade gold mineralization, averaging 56 grams per tonne over 0.3m. Additionally, a trenching program has confirmed the high-grade nature of the deposit and the accuracy of the mineralized vein wireframes. The company sees this as an opportunity for low cost, high margin cash flow.

GT Resources Announces BHEM Survey at the North Rock Copper-Nickel-PGE Project, Ontario, Canada

GT Resources Inc. has announced its first exploration activities on the North Rock copper – nickel – platinum project in Northwestern Ontario, Canada. The project, part of the MetalCorp Limited acquisition in 2023, includes a 13-kilometer gabbroic contact and a zone with a historic resource estimate of 1 million tons grading 1.2% Cu. The Phase I exploration program has a budget of less than $200,000 and involves a Bore Hole Electromagnetic survey, reconnaissance mapping, and prospecting/sampling. The project promises potential for both bulk tonnage and high grade sulphide deposits.

‘Fiat Is Failing’: Bitcoin’s All-Time High? It’s the Dollar’s All-Time Low | James Lavish

James Lavish discusses Bitcoin's rise amid fiat currency decline, inflation, and future potential....

Nova Pacific Drilling Confirms Significance of High-Grade Historical Trench Results

Nova Pacific Metals Corp. has announced initial results from a drilling program at its Lara Project on Vancouver Island, British Columbia. Six holes totalling 18.11m were drilled to confirm historic grades and collect geochemistry information for sulphide mineralization. Results from two boreholes have been obtained, with one hole returning an assay of 11.67 g/t Gold, 373 g/t Silver, 21.33% Zinc, 4.23% Lead, and 1.75% Copper. CEO J. Malcolm Bell described the findings as "exceptional" and a first step in revitalizing the Lara Project.

Spearmint Acquires the George Lake South Antimony Project in New Brunswick, Canada

Spearmint Resources Inc. has announced the acquisition of the George Lake South Antimony Project in New Brunswick, Canada. The project, spanning 1,945 acres, is prospective for antimony, a commodity whose prices have more than doubled this year. The project is near the Lake George Antimony Mine, which was once the largest primary antimony producer in North America. Antimony is used in the electronics and semiconductor industries, battery technology, and flame-retardant materials. The acquisition is seen as a significant addition to Spearmint's project portfolio.

District Provides Corporate Update

District Metals Corp., based in Vancouver, plans to list its shares on the Nasdaq First North Growth Market in Sweden by the end of 2024. The company owns the second largest exploration land package in Sweden, including the Viken Property, known for its vast deposits of various metals. Other holdings include four prospective uranium polymetallic properties and the Tomtebo Property, noted for its potential for base metals polymetallic sulphide mineralization. An exploration partnership with Boliden Mineral AB was announced in 2023, with a drill program at the jointly-owned Stollberg Property recently initiated.

Gold Won't Save You From Historic Market Bubble Bursting: Henrik Zeberg

Henrik Zeberg predicts a major market crash, doubting gold/silver's stability but sees future gains....

ATHA Energy (TSXV:SASK) - Advanced North American Uranium Project

Interview with Atha Energy CEO Troy Boisjoli on uranium exploration and growth potential at Angilak....

Powering the Clean Energy Future and Uranium Portfolios at the New Orleans Investment Conference

Uranium is gaining attention as a key investment due to rising demand and supply constraints in nuclear energy....

Talon Metals Announces Appointment of New President

Talon Metals Corp. has announced that Mike Kicis will take over as President of the company from Sean Werger, effective January 1, 2025. Werger is stepping down to assume a senior leadership role at a Toronto-based charity but will join Talon's Board of Directors to ensure a smooth transition. Kicis has been with Talon since 2013, playing a key part in the company's major transactions and partnerships.

Platinum Group Metals Ltd. and Ajlan & Bros Company for Mining Enter Memorandum of Understanding with the Ministry of Investment of Saudi Arabia as Part of the Global Supply Chain Resilience Initiative for a Proposed PGM Smelter and Base Metal Refinery in Saudi Arabia

Platinum Group Metals Ltd., Ajlan & Bros Company for Mining, and the Ministry of Investment of Saudi Arabia (MISA) have signed a memorandum of understanding (MOU) as part of the Global Supply Chain Resilience Initiative. This MOU is for the establishment of a proposed platinum group metals smelter and base metal refinery in Saudi Arabia. MISA will provide strategic guidance and study potential financial support for the project, which aligns with Saudi Arabia's Vision 2030 initiative to expand its mining and minerals industry. The MOU builds on a cooperation agreement between Ajlan and Platinum Group from December 2023 to study the establishment of the smelter and refinery.

Great Pacific Gold Provides Corporate Update on Wild Dog, Kesar Drilling and AGM Results

Great Pacific Gold Corp. has provided updates on its Wild Dog Project, Kesar Project, and its recent Annual General Meeting. The diamond drilling program at the Kesar Project is progressing well, with around 1,000 meters drilled so far. The company plans to complete 2,500 meters and five holes by the end of the year. At the Wild Dog Project, exploration reveals high-grade gold-copper systems and potential for bulk tonnage. For 2025, the company plans infrastructure establishment, data consolidation, and diamond drilling at a 3km part of the Wild Dog structure. The company’s Annual General Meeting saw the approval of all proposed resolutions and the re-election of the five directors.

Lavras Gold Announces Filing of Amended Technical Reports

Lavras Gold Corp. has amended two technical reports on its Butiá and Cerrito Projects following a review by the Ontario Securities Commission (OSC). The amended reports, which do not change the size or scope of the resource estimates, include additional disclosure details as suggested by the OSC. Among these are the assumptions used to support the cut-off grade, constraints on mineral resources, rounding of resource estimates, and the clarification of the responsible independent qualified person. The company has also revised its website and corporate presentations, particularly regarding the use of the phrase "NI 43-101 compliant" related to estimation of mineral resources.

Doubleview Gold Corp Is Concluding the Successful Drill Season of 2024

Doubleview Gold Corp. has completed a successful drill season at its 100% owned Polymetallic Hat porphyry project in British Columbia. The objectives of the season were to confirm the Mineral Resource Estimate's block model, prove further continuity of mineralization, increase resource model integrity, and test new areas. The company drilled over 10,000 metres in 18 holes and shipped over 23 tonnes of drill core samples to an analytical laboratory. Initial assay results from three drill holes revealed significant mineralization. The drilling also confirmed mineralization in previously un-drilled areas.

Dark Star Announces Non-Brokered Private Placement

Dark Star Minerals Inc. is planning a non-brokered private placement financing of up to $500,000, which involves issuing 10,000,000 units at a price of $0.05 per unit. Each unit is composed of one common share and half of one common share purchase warrant. Each warrant allows the holder to buy one share at $0.075 per share for two years after closing. The funds raised will be used for exploring the company's current properties and as working capital. The securities issued will be subject to a hold period of four months and one day after the closing of the offering. These securities will not be registered under the United States Securities Act of 1933 and cannot be sold in the US without registration or

Cascada Announces $1.0 Million Private Placement

Cascada Silver Corp., based in Toronto, has announced a non-brokered private placement to raise $1,000,000. The funds will be used for exploration activities, working capital, and other corporate purposes. The offering will involve issuing up to 20 million units at $0.05 each, with each unit containing one common share and half a share purchase warrant. The offering is expected to close on December 4, 2024, subject to approval from the Canadian Securities Exchange. The securities offered haven't been registered under the United States Securities Act.

Delta Receives Exploration Permits Ahead of 2025 Drilling at the Delta-1 Expanded Property in Thunder Bay, Ontario and Grants Stock Options

Delta Resources Limited has obtained two exploration permits for early-stage mineral exploration at the Delta-1 Expanded property in the Thunder Bay District of Ontario. This permits 90% of the property for exploration, including diamond drilling. The company has also granted over 4 million stock-options to its management, board of directors, employees, and consultants. Delta Resources is a Canadian mineral exploration firm that is currently focused on two high-potential gold and base-metal projects in Canada. The Delta-1 and Delta-2 properties are located in Ontario and Quebec respectively.

EnGold Announces Management Change

Leanora Brett has stepped down as the interim Chief Financial Officer of EnGold Mines Ltd., a Vancouver-based copper, gold, silver, and magnetite exploration company. She will continue to serve as the company's Corporate Secretary, while the company seeks a new CFO. EnGold focuses solely on its Lac La Hache property in British Columbia, which hosts multiple deposits and is located in an area with world-class infrastructure.

STLLR Gold Announces Closing of the C$25.7 Million Bought Deal Financing Led by Eric Sprott

STLLR Gold Inc. has completed a public offering, raising approximately C$25.7 million. This involved issuing various units of the company at different prices. The offering was led by Paradigm Capital Inc., and included several financial institutions. Eric Sprott purchased units through his corporation, and some officers and directors of the company also bought units.

Origen Resources Samples 165 g/t Gold at New Showing on Wishbone

Origen Resources Inc. has announced results from the Wishbone Project sampling program. Highlights include 165 g/t gold sampled at the Central Glacier's eastern edge and the gold anomaly's extension by 200 meters to the south and west of the Windy showing. The newly extended gold anomaly, which has not been drilled or trenched yet, is a priority target for Origen in 2025. High-grade gold was found in boulders and outcrop at the newly exposed 'Lake' showing, with a boulder sample returning 164.7 ppm gold. A boulder with Chalcopyrite and 14.6% Copper was also found near the glacier's southern edge. Additionally, 209 soil and talus samples were collected

American Eagle Announces Closing of C$29 Million Strategic Investment by South32

American Eagle Gold Corp. has closed a non-brokered private placement with South32 Ltd.'s subsidiary, which bought 33,321,577 common shares in the company at C$0.875 per share. This resulted in gross proceeds of approximately C$29.16 million for American Eagle Gold Corp. The funds will be used to expand drilling programs in 2025 and 2026. South32 now indirectly owns around 19.9% of the issued and outstanding common shares of American Eagle Gold Corp.

Golden Spike Resources Completes Initial Drill Holes at Steep Brook and Commences Drilling at Lode 9

Golden Spike Resources Corp. has completed five diamond drill holes, totaling around 921 meters, at the Steep Brook target in the Gregory River Property in Newfoundland. The drill rig has now been moved to the next priority target, Lode 9. The initial holes have shown zones of pyrite and chalcopyrite mineralization, a positive start for the drilling program. Core samples from the initial holes have been sent to the lab and the company is awaiting results. The drilling project will proceed responsibly and efficiently, with continual updates provided to stakeholders.

What’s Really Killing Your Mining Portfolio and a $29M Copper Deal

Luc ten Have discusses stock declines and junior mining investment strategies; features American Eagle's CEO....

Bold Ventures Signs Amendment to the Burchell Gold and Copper Property Option Agreement

Bold Ventures Inc. has signed a fourth amendment to the Burchell Gold and Copper Project Option Agreement with three vendors. The amendment allows the option to be exercised by issuing 2.6 million shares of Bold, paying $100,000 in cash, and spending $700,000 on exploration. The vendors will receive $10,000 and 200,000 shares after regulatory approval of the amendment.

Unlock Premium

Get access to exclusive analysis and trading signals

- Access to all premium articles

- PDF change detection

- Advanced charting