Mining Intelligence Articles & Market Analysis - Page 135

Discover news, analysis, and insights on junior mining companies and precious metals

Featured Articles

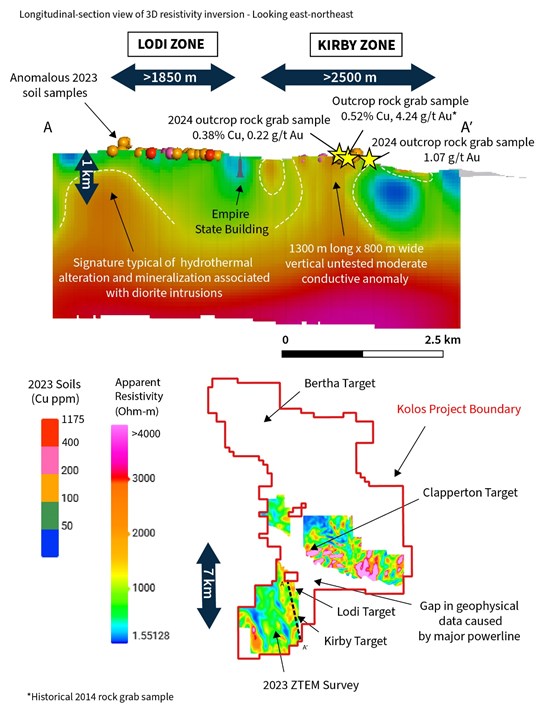

Torr Metals Inc. Secures Drill Permit for the Kirby, Lodi, and Clapperton Targets at the Kolos Copper-Gold Project

Torr Metals received a five-year drill permit for high-priority copper-gold targets at its Kolos Project in BC, enabling initial drilling at undrilled, geophysically promising zones.

Canadian Critical Minerals Announces the Passing of Founder David W. Johnston

Canadian Critical Minerals mourns founder David Johnston, a mining pioneer and entrepreneur, who significantly contributed to the company's assets and the Canadian mining industry.

Trending Now

View All

Homerun Collaborates with Igraine PLC to Launch Rapid-Deployment EV Charging and Battery Storage Solutions for UK Auto Sector

Homerun Resources partners with Igraine PLC to develop quick-deploy EV charging and battery storage solutions in the UK, targeting major automakers and accelerating EV adoption.

Dinero Completes Drilling at the New Raven Property

Dinero Ventures reports drill results at New Raven gold project, testing multiple zones, and seeks to extend warrant expiry dates by 3 years, pending TSX approval.

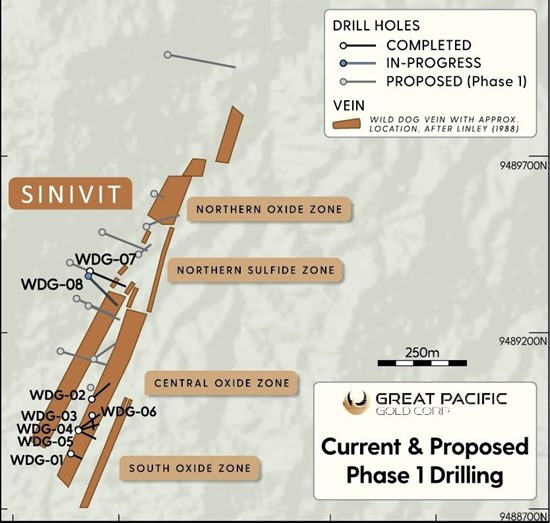

3.5m at 13.1 g/t AuEq Drilled at Great Pacific Gold's Wild Dog Project

Great Pacific Gold reports promising drill results at Wild Dog PNG, including high-grade gold and copper intercepts, advancing exploration of a 15km mineralized corridor.

All Articles

Homerun Resources Inc. NREL (U.S. Department of Energy) Enduring Energy Storage R&D Partnership Update

Homerun Resources Inc. has announced an update on the Enduring Energy Storage research being conducted in collaboration with the U.S. Department of Energy's National Renewable Energy Laboratory (NREL). The research has resulted in a breakthrough in vertically integrated silica processing techniques. NREL has performed several works including thermal cycle testing and measuring the Homerun sand particle size distributions and heat capacity. The testing has shown promising results with the Homerun silica sand achieving high purity. The research agreement has been refined and extended to May 2025.

Bear Creek Mining Reports Q3 2024 Financial and Operating Results

Bear Creek Mining Corporation has reported its Q3 2024 financial results, revealing a gross profit of $5.9 million, an increase in gold and silver production, and for the first time since acquiring Mercedes, a profit after operating expenses. The company's Mercedes gold mine in Sonora, Mexico, produced 10,751 ounces of gold and 76,939 ounces of silver during this period. CEO Eric Caba attributes the positive results to ongoing efforts to improve efficiency and reduce costs, the strength of metal prices, and operational improvements at Mercedes. He anticipates further improvements in profitability in 2025.

Silver Dollar Commences Exploration Drilling at the Ranger-Page Project in Idaho's Silver Valley

Silver Dollar Resources Inc. has announced the start of its inaugural diamond drilling program at the Ranger-Page Project, located in the renowned Coeur d'Alene Mining District. The initial target is the Crown Point Mine area, near the historic Bunker Hill Mine. Historical records indicate high-grade ores were first mined at Crown Point in the late 1800s. Mining ceased in the 1950s due to fluctuating metal prices and complex lease agreements. A recent survey identified a deep polarization anomaly in the area, which will be the first to be drill tested in 2024. The aim is to expand the mineralized footprint 190 meters below the lowest known level of the mine.

Québec Innovative Materials Corp Announces DTC Eligibility of Its Common Shares

Québec Innovative Materials Corp. (QIMC) has announced that its common shares are now eligible for electronic clearing and settlement through the Depository Trust Company (DTC), expected to enhance the company's market presence in the US. This will simplify the trading process, allowing investors to buy, sell, and hold QIMC shares with more ease and efficiency. The move is expected to increase the liquidity and execution speeds of QIMC's shares while reducing costs. QIMC, a mineral exploration and development company, is committed to exploring Canada's resources, focusing on white hydrogen and high-grade silica deposits.

MineHub Partners with CargoGo a Leading Chinese Visibility Platform

MineHub Technologies has partnered with Elane Technology, owner of CargoGo, to improve shipment tracking capabilities in Asian commodity markets. The partnership will integrate MineHub's cloud platform with CargoGo's advanced logistics solutions, allowing for secure data sharing between the two platforms and enhanced shipment tracking. This collaboration enables MineHub to access Asia's dynamic metals market, particularly significant as China's sector grew by 10.8% in H1 2024. Elane, with over 20 years of shipping and logistics data experience, provides a robust technology infrastructure, including global satellite data access.

Independence Gold Provides an Update on Discovery of New Veins at the 3Ts Project, BC

Independence Gold Corp. has announced the discovery of several new veins from its 100% owned 3Ts Project, located 185 kilometers southwest of Prince George, British Columbia. The project covers a low-sulphidation epithermal quartz-carbonate vein district with more than nineteen individual mineralized veins. The Ootsa target, situated 700 meters northeast of the Ted-Mint Vein System, showed promising copper and silver values. In 2024, a 100 meter-long trench was excavated in the area, yielding 79 samples that contained copper and silver mineralization. The Ootsa target has been traced for 1.2 km on surface and is still open along strike. The Cardiff Vein, located

The Recession Signal Everyone's Ignoring | George Gammon

George Gammon explains that economic crashes typically follow Fed rate cuts, not inversions....

Benton Identifies Deep Electro-Magnetic Anomaly on the Great Burnt Copper Deposit and Continues to Intersect Significant Gold in Drilling at South Pond

Benton Resources Inc. has identified a deep geophysical conductor that could significantly expand the Great Burnt Copper deposit to 1.1 km in length. Excellent gold intercepts have been found at the South Pond Area, potentially extending the zone to 2.3 km. High copper grades, along with new targets of copper, gold, nickel, and zinc have been identified for further exploration. A large nickel target has also been outlined. A further 15,000 m drill program is being planned for 2024-2025. The company aims to test the new anomaly with immediate follow-up drilling.

Enduro Metals Intercepts 10.01 g/t Gold over 12.45m at McLymont Fault

Enduro Metals Corporation has announced assay results from its 2024 drill program at the Newmont Lake property. The program consisted of four diamond drill holes in the NW Zone of the McLymont Fault, aiming to test a reinterpreted model of structural controls on gold mineralization. The results show that all drill holes intersected gold associated with mineralized structures. The findings suggest that structures have an apparent dip of 60-80 degrees to the northwest, indicating a potential to expand the gold system at the NW Zone and beyond. The new structural framework sets the basis for refined targeting in the NW Zone and along the 20km strike of the McLymont Fault.

Gladiator Announces Upsize to Private Placement

Gladiator Metals Corp. has increased the size of its earlier announced non-brokered private placement due to demand, and now aims to raise up to C$12,625,000. This will be done by issuing more Charity Flow Through Shares, but no increase in Non-Flow Through common shares. The funds raised will be used for general working capital and funding the exploration program at its Whitehorse Copper Project in Yukon. The fundraising is expected to close on or around November 29, 2024, subject to certain conditions including necessary approvals.

BluMetric Announces LIFE Offering & Concurrent Private Placement

BluMetric Environmental Inc. has entered an agreement with Clarus Securities Inc., which will act as lead agent in a private placement to issue up to 4,375,000 common shares at $0.80 per share for gross proceeds of up to $3.5 million. This offering is applicable to purchasers in all Canadian provinces except Quebec, under the Listed Issuer Financing Exemption. The Agent will receive a 6% cash commission from the gross proceeds and broker warrants equal to 6% of the issued shares.

Metals Creeks Commences Diamond Drilling at the Tillex Copper Project

Metals Creek Resources Corp. has begun diamond drilling at the Tillex Copper Project in Currie Township, Ontario to further define the structurally complex Tillex copper mineralization. This comes after the discovery of significant copper and silver deposits in previous drilling campaigns in September and October 2024. Results from the new program will be released once compiled. The Tillex project hosts a copper deposit discovered in 1973, with an estimated near-surface resource of 1,338,000 tonnes grading 1.56% Copper calculated in 1990. However, this calculation has not been independently validated or verified by the Corporation.

Unigold Accelerates the Project Timelime for the Candelones Gold Project

Unigold Inc. has announced that the Dominican Republic government has outlined procedures for the Environmental and Social Impact Assessment (ESIA) process for the Candelones gold project. These changes to environmental regulations mean Unigold can proceed directly to the ESIA, including community consultations and finalizing design parameters. This comes after the appointment of a progressive Mines Minister in 2024, which helped to accelerate the project timeline. The ESIA process completion, before granting a 75-year Exploitation Licence, ensures mining projects are designed and executed sustainably and allows local community input. Unigold submitted an application in 2022 for the conversion of the Neita area into an Exploitation Concession, and delivered a full feasibility study for the

Heliostar Announces First Results from 2024 Drilling Program at La Colorada Mine

Heliostar Metals Ltd. is evaluating the potential to restart gold mining at the La Colorada Mine in Sonora, Mexico in 2025, following a successful 12,500m drilling program aimed at expanding mineral reserves. The company has released the first results from the program, with various grading levels of gold found. The findings suggest the opportunity to turn what was previously considered waste into ore, potentially reducing capital costs and increasing cash flow. The production decision for El Creston is expected by mid-2025. Mining operations at La Colorada ceased in 2023.

Dakota Gold Reports Further Resource Expansion at Richmond Hill with Step-Out Drilling Results

Dakota Gold Corp. has announced the results of thirteen drill holes from an ongoing program at the Richmond Hill Gold Project. This information will be incorporated into an updated S-K 1300 Initial Assessment in Q1 2025. The maiden S-K 1300 resource had an Indicated Resource of 51.83 million tonnes at 0.80 grams per tonne gold for 1.33 million ounces and an Inferred Resource of 58.06 million tonnes at 0.61 grams per tonne gold for 1.13 million ounces. The drill results show areas of mineralization where the grade and width are higher than those reported in the maiden resource. The resource shell is still open in all directions and has potential for

Purepoint Uranium and Cameco Approve 2025 Drill Program for Smart Lake Joint Venture

Purepoint Uranium Group Inc. has announced the approval of a $1.2 million drilling program at the Smart Lake Joint Venture (JV) Project, which is co-owned by Cameco Corporation (73%) and Purepoint (27%). The project is located in the southwestern Athabasca Basin, Saskatchewan, Canada. The drilling program is indicative of Purepoint's return to the highly prospective project, and their strategic approach of advancing high-potential projects through partnerships with industry leaders. The 2025 drilling program will build on the results of Purepoint's initial drill campaign at Smart Lake in 2008, during which uranium mineralization was first identified.

Forum Drilling Extends Uranium Mineralization at the Tatiggaq Deposit, Aberdeen Uranium Project, Nunavut

Forum Energy Metals Corp. has announced the first results from its summer drilling program at the Aberdeen Uranium Project. The project is located 5km west of the Kiggavik uranium project. The results from 11 holes drilled show significant mineralization in seven holes. The Main and West zones showed significant uranium mineralization, with some areas showing high percentages of U3O8. The total strike extent of uranium mineralization drilled at the Main and West zones has increased from 200m to over 310 metres.

Copper Fox Updates Sombrero Butte Copper Project

Copper Fox Metals Inc. and its subsidiary, Desert Fox Sombrero Butte Co., have updated on their exploration activities at the Sombrero Butte project in Calgary, Alberta. The 2024 program aims to obtain a comprehensive chargeability/resistivity model for the project along with an updated geology, alteration, and mineralization models to transition the project to the drilling stage. The program also includes mapping, sampling, petrographic studies, and geochemistry. Preliminary results have expanded their knowledge base and support the belief that a large Laramide age porphyry copper-molybdenum system is located within the project.

Manganese X Energy Corp. Announces Private Placement Financing

Manganese X Energy Corp. has arranged a non-brokered private placement offering of up to 11,428,571 common shares at a price of $0.035 per share for proceeds of up to $400,000. The proceeds will be used for Canadian Exploration Expenses and "flow-through mining expenditures" as defined in the Income Tax Act (Canada). The offering will close in mid-December 2024, subject to necessary regulatory approvals. The securities offered will not be registered under the U.S. Securities Act or any state securities laws and may not be offered or sold within the United States.

Empress Royalty (TSXV:EMPR) - Bullish on Potential to Deliver Significant Growth

Interview with David Rhodes highlights Empress Royalty's growth potential and undervalued market position....

Geopolitics and Uranium: Scott Melbye on Russia’s Supply Ban and U.S. Response

Russia's uranium export ban stresses U.S. energy security, prompting calls for domestic uranium production....

Myriad Uranium (CSE:M) - Exceeding Expectations at Wyoming's High-Grade Copper Mountain Project

Myriad Uranium Corp targets high-grade uranium at Copper Mountain, leveraging historic data for exploration success....

Targa Discovers Anomalous Gold in Boulders Across a 7km Gold Till Trend explains CEO Cameron Tymstra

Targa Exploration reports significant gold findings in Opinaca, planning further exploration in 2025....

Transition Metals Corp. Closes Previously Announced Private Placement

Transition Metals Corp. closed a $299,999 private placement for critical minerals exploration.

Southern Silver Announces Non-Brokered Private Placement

Southern Silver Exploration Corp. intends to conduct a non-brokered private placement of 10 million units at $0.22 each, aiming to raise $2.2 million. Each unit includes one common share and a half of one share purchase warrant, which allows the holder to buy one common share at $0.32 for two years. Proceeds will be used to progress the Cerro Las Minitas project in Durango, Mexico, and for general corporate and working capital purposes. The Offering and any finders' fees are still subject to regulatory approval.

Equity Metals Announces Non-Brokered Charity/Premium Flow-through Private Placement

Equity Metals Corporation plans a non-brokered flow-through private placement of 8 million units at $0.27, raising $2.16 million for exploration at the Silver Queen and Arlington projects. Drilling continues at Silver Queen, with assays pending, while Arlington has identified three priority targets for future exploration.

Besra Gold Announces: Jugan Project: Metallurgical Test Work - Incorporating New Mining Strategy

Besra Gold Inc. has announced the start of a drilling programme involving deep diamond drill holes, in preparation for metallurgical test work set to begin in early 2025. This comes after a review of the Jugan Project, which has prompted a new mining strategy involving a smaller open pit, potentially followed by a 400 metre deep underground development. The revised strategy will result in less surface disturbance, lower tailings storage, a reduced environmental impact, and less land acquisition. The completion of the project will help showcase the company's gold mining ambitions.

Nexus Announces Non-Brokered Financing of FT Units

Nexus Uranium Corp. has announced a non-brokered private placement of up to 5,000,000 units at a price of $0.30 per unit to raise up to $1,500,000. Each unit includes one common share and one share purchase warrant, which can be used to acquire another share for 18 months at a price of $0.40. The proceeds will be used for Canadian exploration expenses and mining expenditures at the Cree East uranium project in the Athabasca Basin. The completion of the offering is subject to various approvals, including from the Canadian Securities Exchange.

Sitka Drills 119.0 Metres of 1.05 g/t Gold, Including 37.9 Metres of 2.05 g/t Gold and 11.5 Metres of 4.32 g/t Gold in Initial Diamond Drilling at the Rhosgobel Intrusion at Its Flagship RC Gold Project in Yukon

Sitka Gold Corp. has announced promising assay results from its first diamond drill at the Rhosgobel intrusion in Yukon, Canada. The drill hole returned 164.8 metres of 0.82 g/t gold starting 9 metres from the surface, with segments showing even higher gold levels. Drilling confirmed strong gold mineralization from the surface to at least 300 metres deep. The results indicate that Rhosgobel has the potential to host a significant multi-million ounce intrusion-related gold deposit. Results for six additional diamond drill holes are currently pending.

Red Metal Resources Closes First Tranche of Financing

Red Metal Resources Ltd. has completed the first stage of a non-brokered private placement, issuing 3 million flow-through units at a price of $0.10 per unit, resulting in gross proceeds of $300,000. The company also issued 915,000 non-flow-through units at $0.08 per unit, generating an additional $73,200. Each unit consists of one common share and half a common share purchase warrant, with each warrant exercisable to acquire one common share at $0.12 per share until May 2026. The company paid $30,000 in finder's fees and issued 300,000 share purchase warrants in connection with subscriptions introduced by Castlewood Capital Corporation.

Unlock Premium

Get access to exclusive analysis and trading signals

- Access to all premium articles

- PDF change detection

- Advanced charting