Mining Intelligence Articles & Market Analysis - Page 137

Discover news, analysis, and insights on junior mining companies and precious metals

Featured Articles

Quimbaya Gold Announces Termination of LOI with Denarius Metals

Quimbaya Gold's joint venture with Denarius Metals for artisanal mining at Tahami was terminated; Quimbaya retains full ownership and continues exploration plans.

Galloper Gold Clarification Release

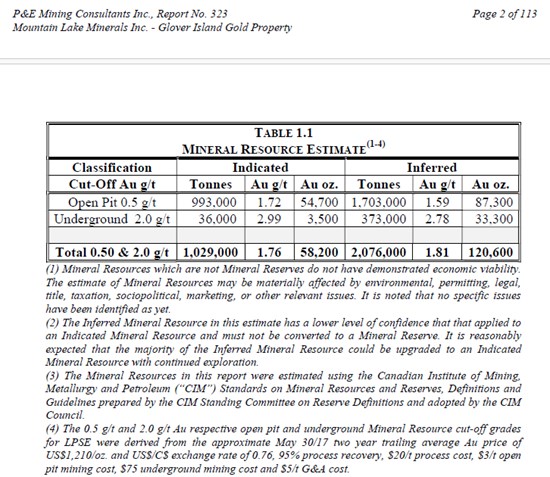

Galloper Gold clarifies its recent EML license award on Glover Island, covering the historic LPSE gold resource, with no new exploration since 2012, within a mineral-rich 11 km corridor.

Trending Now

View All

Sanatana Announces Market Making Services Agreement with Independent Trading Group

Sanatana Resources hires ITG for one-month market-making to boost share liquidity, paying $5,000 monthly, with automatic renewal and no equity compensation.

Silver47 and Summa Silver Complete Merger to Create a Premier U.S. High Grade Silver Explorer & Developer

Silver47 and Summa merged to form Silver47 Exploration Corp., a U.S.-focused high-grade silver explorer with significant resources in Alaska, Nevada, and New Mexico.

Element 29 Announces Upsized Private Placement of up to $6,400,000

Element 29 Resources increases private placement to $6.4M for exploration in Perú, issuing units with shares and warrants, pending TSX-V approval.

All Articles

Canadian Critical Minerals Generates Record Revenue from Bull River Mine

Canadian Critical Minerals Inc. (CCMI) has reported record revenues from the sale of stockpiled copper, gold, and silver mineralized material at the Bull River Mine project in BC. In October 2024, CCMI trucked 1,064 tonnes of this material to New Afton and received a payment of about $378,000. As of October 5th, 2024, the contractor finished crushing and screening all mineralized material from the original 180,000 tonne surface stockpile. To date, the company has shipped around 5,300 tonnes of mineralized material under the Ore Purchase Agreement. At the end of October, CCMI had about 73,000 tonnes of coarse material available for sorting

T2 Metals Announces Closing of $527,000 Flow Through Private Placement to Fund 2025 Drilling at Sherridon

T2 Metals Corp. has announced the closing of a non-brokered flow-through private placement financing, raising $527,000 by issuing 1,550,000 flow-through units at $0.34 per unit. The proceeds will fund an expanded Q1 2025 drilling program at the Sherridon copper-gold-zinc project in Manitoba. The company is fully permitted for drilling at Sherridon until July 2027. The project has many untested targets, and its location offers year-round road access and proximity to the mining center of Flin Flon.

Maple Gold Appoints New Chief Financial Officer to Management Team

Maple Gold Mines Ltd has appointed seasoned CFO, Nicholas (Nick) Furber, effective immediately. Furber has over 25 years of experience in financial advisory services, with a focus on the mining industry. He has previously served as CFO and Corporate Secretary of Dynasty Metals & Mining Inc. and spent a decade at PricewaterhouseCoopers. He replaces Michael Rukus, who will continue with the company in another role.

Fed Rate Cuts: A ‘Catastrophic Error’? Jim Bianco’s Warning to Powell

Jim Bianco warns against further Fed rate cuts, citing potential economic catastrophe and market impacts....

Ionic Rare Earths (ASX:IXR) - Low-Cost, High-Margin Magnet Recycling Play

Ionic Rare Earths aims to recycle magnets for critical materials, supported by strong economics and government backing....

GTI Energy (ASX:GTR) - Powering Up Lo Herma ISR Uranium Project in Wyoming

Interview with GTI Energy's Bruce Lane discusses uranium project growth and investment potential....

Greenheart Gold (TSXV:GHRT) - Proven Team Pursues New Gold Discoveries in Guyana

Interview with Greenheart Gold's CEO on their exploration efforts in the Guyana Shield for gold....

Record Resources Acquires Potential Ontario Western Extension of QIMC Hydrogen Discovery and Announces LIFE Offering of Units

Record Resources Inc. has acquired a significant western geological extension in Ontario, building on Quebec Innovative Materials Corp.'s key Quebec hydrogen discovery. The acquisition strengthens Record Resources' position as a leader in renewable hydrogen exploration in Ontario. The company plans to use this extension to explore and potentially unlock new sources of clean energy and natural renewable hydrogen. The acquired Beauchamp Property, which has not been previously explored for hydrogen-bearing gas pools, consists of 300 claims and is located on a northwesterly-trending Lake Timiskaming Rift zone.

Great Atlantic to Resume Drilling at the Jaclyn Main Zone with Bulk Sample Area Utilizing Novamera's Proprietary Guidance Tool at its 100% Owned Golden Promise Gold Property - Central Newfoundland

Great Atlantic Resources Corp.'s subsidiary, Golden Promise Mines Inc., will resume the 2024 diamond drilling program at its Golden Promise Gold Property in early December. The next phase will incorporate Novamera's Guidance Tool in three extra drill holes. The program, which is fully funded, takes place in the gold-bearing Jaclyn Main Zone in central Newfoundland. So far, eight drill holes have been completed in 2024, seven of which intersected quartz veins with visible gold. High-grade gold results have been confirmed in three holes, with the highest being 34.87 grams per tonne. The final three holes will provide further data to define the vein's characteristics, and the program will be conducted in the west region of the zone.

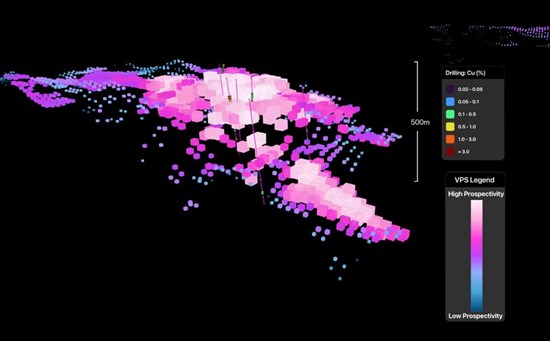

Canterra Announces High Grade Drill Results Correlate VRIFY AI Targets at the Buchans Project and the Next Phase of Exploration

Canterra Minerals Corporation has provided an update on its partnership with VRIFY Technology, utilizing their AI-assisted mineral discovery platform. The recent results from Canterra's 2024 drilling aligns with VRIFY AI's predictive model, showing a strong correlation with historic drilling. This validates the potential of other AI-generated targets on the property, including the highly prospective Nu target. Canterra's CEO, Chris Pennimpede, praised the effectiveness of the AI technology in identifying and prioritizing exploration targets, stating it is revolutionizing their process.

Pacific Bay Completes Sphinx Mountain Rare Earth Field Program, Assays Pending

Pacific Bay Minerals Ltd, a mineral exploration company, has completed its field program at its Sphinx Mountain Rare Earth Element project in British Columbia. The project involved geological mapping, prospecting, ground-based geophysics, and various sample collection. The samples collected are awaiting lab analysis and are intended to guide future exploration activities. Pacific Bay Minerals' portfolio includes properties in British Columbia, with short term focus on the newly added Sphinx Mountain Project.

Ivanhoe Mines Announces DRC President, His Excellency Félix Tshisekedi, Officially Reopens the Kipushi Zinc-Copper-Lead-Germanium Mine

The Kipushi zinc-copper-lead-germanium mine in the Democratic Republic of the Congo (DRC) has been officially reopened by President Félix Tshisekedi on November 17, 2024. The ceremony was attended by the First Lady, Denise Nyakeru Tshisekedi, and other national, provincial, and local dignitaries. Ivanhoe Mines, recognized as one of the lowest carbon emitters by the Mining Journal's ESG Company Index, and its partners have built the largest zinc mine in Africa, following their earlier achievement of constructing the largest copper mine. The project is expected to boost local economies and sustainable resource development.

Founders Metals Announces Positive Metallurgical Test Work

Founders Metals Inc. announced metallurgical test results for its Antino Gold Project in Suriname. The tests showed an average gold extraction of 94.9% for fresh rock and 95.3% for saprolite, with the best overall gold recovery at 95.0%. Results also confirmed medium hardness levels, low concentrations of harmful elements, and no significant gold theft. The company's President & CEO, Colin Padget, noted these results as a major de-risking milestone for the project. Additional drill results from various locations are expected by the end of the year. The testing was directed by Founders and Fuse Advisors Inc., and completed by Blue Coast Research Ltd. in British Columbia, Canada.

Kuya Silver Confirms New Mineralized Discovery on Hammerstrom Fault, Frontier NW Zone, Silver Kings Project, Ontario

Kuya Silver Corporation has reported significant drilling results from the Silver Kings Project in the Frontier NW area, Silver Centre. The drilling intersected two mineralized veins, including the Hammerstrom fault vein, which yielded high-grade cobalt-nickel veins associated with silver mineralization. The discovery, located about 20 km from the Campbell-Crawford discovery area, represents a new area for potential silver-cobalt mineralization, expanding the scope for developing a silver-cobalt district beyond the original Kerr Lake project area.

Bonterra Extends Marketing Agreement with Westlake Capital

Bonterra Resources Inc., a Canadian gold exploration company, has extended its agreement with Westlake Capital, a marketing firm based in Zurich. Westlake will provide marketing and investor relations services, including contacting investors, organizing meetings, forwarding news releases, preparing marketing campaigns, obtaining coverage, and providing market intelligence. In return, Westlake will receive a monthly fee of GBP 4,500 from Bonterra's working capital for six months. The cost of the services is expected to be under CAN$49,000. The agreement can be terminated by either party with 30 days' notice. Westlake does not own any Bonterra securities nor does it have the right to acquire any.

Blackrock Silver Announces Additional High-Grade Silver & Gold Assay Results from Its M&I Conversion Drilling Program at Tonopah West

Blackrock Silver Corp. has reported multiple zones of high-grade mineralization in its Tonopah West project in Nevada, USA. The most significant findings include 5.0 metres grading 744 g/t silver equivalent (AgEq) (462 g/t silver and 3.48 g/t gold), and multiple intercepts of over 1k g/t AgEq. The company's M&I Conversion Drilling Program is aimed at confirming the high-grade continuity of gold and silver in the region.

Gold Hunter Resources Announces Frankfurt Stock Exchange Listing

Canadian junior exploration company, Gold Hunter Resources Inc., has started trading its common shares on the Frankfurt Stock Exchange under the symbol "6RH" from November 20th, 2024. The listing is expected to improve the company's visibility and liquidity by connecting it with investors from European financial hubs. The company also plans to present at the Deutsche Goldmesse, Europe's top gold conference, to showcase Newfoundland's potential for discovery and highlight its focus on the Great Northern Project.

Transition Metals Corp. Announces a $300,000 Private Placement

Transition Metals Corp. plans to raise $300,000 through a non-brokered private placement of 4,000,000 Critical Flow Through Shares at $0.075 each. Proceeds will fund mineral exploration in Ontario and Yukon, with a finder's fee involved, subject to regulatory approval.

Copper Standard and Pucara Gold Complete Previously Announced Merger

Copper Standard Resources Inc. has successfully completed its acquisition of all issued and outstanding common shares of Pucara Gold Ltd. through a court-approved arrangement. Former Pucara shareholders received 0.10 of a Copper Standard common share for each Pucara share held, with a total of 7,659,195 Copper Shares issued. The new shares are expected to be listed for trading on the Canadian Securities Exchange. Options and warrants of Pucara shares have been exchanged for similar securities to purchase Copper Shares. The Pucara shares are expected to be de-listed from the TSX Venture Exchange, and Pucara will cease to be a reporting issuer.

Rise Gold Announces Results from Annual General Meeting

At the annual general meeting of Rise Gold Corp., all proposed resolutions were passed. Joseph E. Mullin III, Thomas I. Vehrs, Lawrence W. Lepard, Daniel Oliver Jr., and Clynton R. Nauman were elected as directors for the upcoming year. Davidson & Company LLP was re-appointed as the company's auditors. Shareholders approved the continuation of the company's stock option plan and, on a non-binding advisory basis, approved the compensation of the company's executive officers and annual advisory votes on executive compensation. Rise Gold Corp. is a mining company with its primary asset being the historic Idaho-Maryland Gold Mine in Nevada County, California.

Copper Standard and Pucara Gold Complete Previously Announced Merger

Copper Standard Resources Inc. has successfully completed its acquisition of all issued and outstanding common shares of Pucara Gold Ltd., according to a court-approved plan. As part of the deal, former Pucara shareholders received 0.10 of a Copper Standard common share for each Pucara share held, with Copper Standard issuing over 7.6 million shares. These shares are expected to be listed on the Canadian Securities Exchange. Meanwhile, Pucara shares are expected to be de-listed from the TSX Venture Exchange. Copper Standard is primarily involved in the acquisition and development of copper and gold projects.

Starcore Announces Second Quarter Production Results

Starcore International Mines Ltd. has announced its production results for Q2 2024. The San Martin Mine in Mexico, owned by the company, had operations suspended following a fatal incident. After meeting all safety standards set by the labor authority, the mine returned to regular operations in October. Starcore is currently testing to optimize the recovery of gold and silver from their reserves, which are estimated to be around 1 million tons. The industrial testing is set to begin in mid-December. Despite a decrease in ore milled and gold equivalent ounces, the company saw an increase in gold grade and a significant increase in silver recovery compared to the previous year.

Oracle Commodity Holding Announces Stock Option Grant

Oracle Commodity Holding Corp. has announced that its board of directors approved the grant of incentive stock options to a consultant. This will allow the acquisition of 500,000 common shares in the company at an exercise price of $0.05. The options are part of the company's 10% rolling stock option plan and can be exercised over a five-year term expiring in November 2029. The options will vest at 12.5% per quarter for the first two years starting from February 2025.

Aftermath Silver Announces AGSM Results

Aftermath Silver Ltd. has announced that all proposals were approved at its annual general and special shareholders' meeting on November 20, 2024. The current board of directors was re-elected, and the appointment of the Company's auditor, Davidson & Company LLP, was approved. The shareholders also re-approved the long-term incentive plan and approved the creation of a new Control Person, 2176423 Ontario Ltd. and Mr. Eric Sprott. 2176423 Ontario Ltd., owned by Mr. Sprott, plans to increase its equity in the Company through a private placement of 22,222,222 units to be sold at $0.45 per unit, raising up to $10,000,000. The private placement

Forge Resources Corp Announces Portal Groundbreaking and Strategic Appointments to Strengthen Project Development Team at Fully Permitted Coal Project, Colombia

Forge Resources Corp. has announced a key development in its mining operations with the successful groundbreaking of the decline portal at Aion Mining Corp's La Estrella coal project in Colombia. This marks a significant phase in the company's strategic growth. The company also welcomed two mining professionals, Guillermo Leon as Mine Manager and Mario Alonso Alzate Ferrer as Senior Mining Engineer. The establishment of the mine portal is a critical step in the project's timeline and will enable future exploration and extraction efforts. CEO Cole McClay expressed excitement at reaching this milestone, stating it signals a productive phase for Forge's development strategy.

'We've Passed the Point of No Return' - Debt Bomb Will Ignite GOLD: Clive Thompson

Clive Thompson predicts rising gold prices due to unsustainable Western debt and shares market insights....

Valkea Resources Announces Annual General Meeting

Valkea Resources Corp. will hold its annual general meeting on December 19, 2024, in Vancouver. The meeting will include voting on the company's audited financial statements for the financial year ending June 30, 2024, setting the number of directors for the following year, electing directors, and appointing D&H Group LLP as the auditor. Due to a postal worker lockout, the company may not be able to mail the meeting materials, but they will be available online and through direct contact with the company or Odyssey Trust Company. Valkea Resources is a leading gold exploration company in Finland's Central Lapland Greenstone Belt.

Cascada Silver Announces Angie Drilling Returns Significant Near Surface Molybdenum Intersections in the Upper Level of a Chilean Porphyry Discovery

Toronto-based Cascada Silver Corp. has announced encouraging assay results from its Phase I reverse circulation drill program at the Angie Copper Molybdenum Property. The drill revealed significant intervals of molybdenum, with a notable drill hole returning 26 metres grading 713 parts per million of molybdenum, including an 8 metre section grading 1,208 parts per million. The molybdenum intersections remain open in all directions. The results are significant, even though the drill holes couldn't reach the targeted depths due to excessive water.

HIRU Corp. Shareholder Update & Forward-Looking Guidance

HIRU Corp. is working towards becoming a fully SEC-reporting company to improve transparency and market visibility. The company is in final discussions to acquire an ASX-listed public mining company, aiming to diversify its asset base and strengthen its global presence. HIRU is also pursuing potential mergers with several industrial companies to create synergies and drive long-term shareholder value. Long-term plans include vertical integration of mining operations and expansion into sectors like refining, processing, and construction.

Radio Fuels & NV King Goldlands Announce Completion of Business Combination

Radio Fuels Energy Corp. has acquired all shares of NV King Goldlands Inc. as per their previously announced plan. Post-acquisition, former NV King shareholders hold 40% of Radio Fuels shares. This has allowed Radio Fuels to become the largest junior gold explorer in Nevada and gain exposure to the Atlanta Gold Mine Project. The combined entity holds around $20 million in cash and marketable securities. The board and management remain unchanged and Radio Fuels plans to apply for NV King to cease being a reporting issuer.

Unlock Premium

Get access to exclusive analysis and trading signals

- Access to all premium articles

- PDF change detection

- Advanced charting