Mining Intelligence Articles & Market Analysis - Page 138

Discover news, analysis, and insights on junior mining companies and precious metals

Featured Articles

Quimbaya Gold Announces Termination of LOI with Denarius Metals

Quimbaya Gold's joint venture with Denarius Metals for artisanal mining at Tahami was terminated; Quimbaya retains full ownership and continues exploration plans.

Galloper Gold Clarification Release

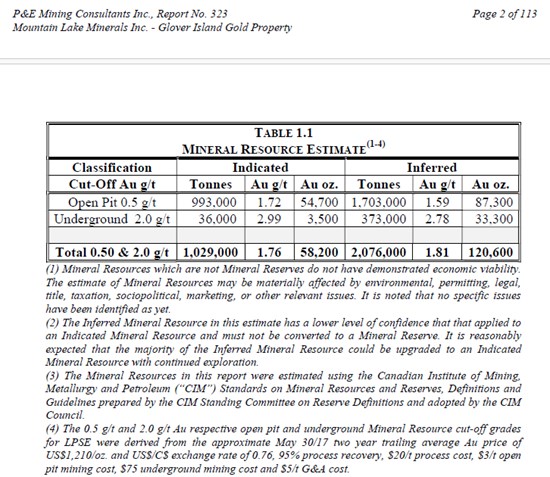

Galloper Gold clarifies its recent EML license award on Glover Island, covering the historic LPSE gold resource, with no new exploration since 2012, within a mineral-rich 11 km corridor.

Trending Now

View All

Sanatana Announces Market Making Services Agreement with Independent Trading Group

Sanatana Resources hires ITG for one-month market-making to boost share liquidity, paying $5,000 monthly, with automatic renewal and no equity compensation.

Silver47 and Summa Silver Complete Merger to Create a Premier U.S. High Grade Silver Explorer & Developer

Silver47 and Summa merged to form Silver47 Exploration Corp., a U.S.-focused high-grade silver explorer with significant resources in Alaska, Nevada, and New Mexico.

Element 29 Announces Upsized Private Placement of up to $6,400,000

Element 29 Resources increases private placement to $6.4M for exploration in Perú, issuing units with shares and warrants, pending TSX-V approval.

All Articles

Ximen Mining Corp Drilling Intersects 16.30 g/t Gold on McKinney Vein Extension at its 100% Owned Amelia Gold Property - Camp McKinney BC

Vancouver-based Ximen Mining Corp has shared results from its drilling program at the Amelia Gold project in Camp McKinney, southern British Columbia. The program was carried out to test the extension of the historic Cariboo-Amelia gold mine. The drilling was completed last year, and core sampling and analyses were conducted this year. Eight drill holes were completed for a total of 2,064 meters. The target vein was intersected in five holes. The best result was from hole AM23-03, which intersected 16.3 grams of gold per tonne and 79.9 grams of silver per tonne.

Bayhorse Silver Mobilizes Drill to the Bayhorse Mine VTEM Anomaly for Drilling Potential Porphyry Copper Target

Bayhorse Silver Inc announced the arrival of an underground diamond drill rig at the Bayhorse Silver Mine in Oregon, USA. The rig is set to drill a large low-resistivity anomaly beneath the company's silver/copper mine. The drilling operation will start from 73m inside the mine portal, at an elevation of 703m above sea level. The anomaly is believed to have a vertical extent of 500m and a width of up to 100m. The company expects to intersect the top of the anomaly 150m down the hole, with a planned termination depth of 257m on the east side of the anomaly. The aim is to test for a potential porphyry copper deposit.

Sonoran Desert Copper Corporation Announces Private Placement Financing and New Chief Financial Officer

The Sonoran Desert Copper Corporation has appointed Nancy Zhao as its new CFO. Zhao has over nine years of experience and has served as CFO for several publicly traded companies. She holds a CPA designation, a diploma in financial management from British Columbia Institute of Technology, and a bachelor's degree in chemical engineering from Tianjin University of Technology. The company also announced a non-brokered private placement financing for aggregate gross proceeds of up to $750,000, consisting of up to 500,000 units at $0.15 each. Each unit includes a common share and a warrant exercisable for an additional common share at $0.30 for 24 months.

Red Metal Resources Engages German Investor Awareness and Digital Marketing Consultants

Red Metal Resources Ltd. has engaged Investment-Zirkel-München (IZM) and Free Market Media Ltd. to boost its investor awareness and online marketing efforts. IZM, which offers services for German language investor awareness, has been contracted for two years at a cost of CAD$25,000. Free Market Media will provide digital media, advertising, and awareness campaigns for a fee of up to US$50,000 for a 90-day term, which may be extended.

Military Metals Provides Overview on Tienensgrund Antimony Project, Europe

Military Metals Corp. has provided details about its Tienesgrund antimony-gold project in eastern Slovakia. The project, part of three brownfield properties acquired by the company, covers 13.40 square kilometers and traces a likely fault or shear-controlled antimony-gold system. The area, which has a mining history dating back to the Middle Ages, has over two dozen adits and small underground operations. Despite historical resource estimates and antimony-focused reports, no current resources are on the property and the company has not yet verified these historical figures. The presence of tungsten has also been noted in historical Slovak resource estimate studies.

Golden Share Announced Property Purchase Agreement with Delta Resources Limited and Extension of Share Agreement with Lipari Diamond

Golden Share Resources Corporation has announced a Property Purchase Agreement with Delta Resources Limited. This agreement allows Delta to earn a 100% interest in Golden Share's Elwood property located west of Thunder Bay, Ontario. The property covers approximately 16.85 hectares and includes one patented mining claim. Furthermore, Golden Share has extended the Share Exchange Agreement with Lipari Diamond Ltd. to December 31, 2024, with the final step being securing the required third-party capitalization to close the RTO. More updates will be provided as they become available.

GKN Hoeganaes to Support First Phosphate in LFP Cathode Active Material Development

GKN Hoeganaes, a division of GKN Powder Metallurgy, is partnering with First Phosphate to establish a North American supply chain for lithium iron phosphate (LFP) batteries, which are critical for the electric vehicle and energy storage industries. The collaboration follows the successful integration of First Phosphate's magnetite into GKN Hoeganaes's melting process, leading to high-purity iron powder, a necessary component for LFP batteries production. The partnership aims to reduce dependence on international supply chains and promote local production of LFP battery components. First Phosphate plans to integrate the high-purity Ancorsteel into its production facility in Quebec, aiming to reach 400,000 tonnes per annum by 2032. GKN

Cabral Gold Inc. Announces Amended Terms of $3,000,000 Private Placement

Cabral Gold Inc. has announced an amendment to the pricing of its non-brokered private placement of units, with a proposal to issue up to 12.5 million units at $0.24 each, aiming for gross proceeds of up to $3 million. Each unit will comprise one common share and half a common share purchase warrant, with each full warrant allowing the holder to buy one common share at $0.36 for two years after the closing of the private placement. The funds raised will be used for general corporate purposes and to complete drilling and detailed engineering after a prefeasibility study on a starter operation in the Cuiú Cuiú gold district. The securities issued will be subject to a four-month hold period from the closing

World Copper Initiates Strategic Review Process and Engages Advisor

World Copper Ltd. has initiated a strategic review process to evaluate potential growth and value maximization strategies for the company. Origin Merchant Partners has been engaged to assist in the review. The decision comes after several corporate entities expressed interest in World Copper. No specific strategic plan or financial transaction is guaranteed from this process, and no timeline for completion has been set. World Copper Ltd. is a Canadian resource company focused on copper exploration and development projects in Arizona and Chile.

Homerun Resources Inc. Announces CEO Update to Shareholders

Homerun Resources Inc. has announced the successful conclusion of its Phase 2 Logistics Plan. In the Phase 1 Resource Plan, the company secured a significant supply of HPQ Silica in Belmonte, Bahia, Brazil. They have also progressed towards producing their first 43-101 compliant maiden resource estimate in partnership with Companhia Baiana de Pesquisa Mineral (CBPM). The company has achieved its objective to facilitate bulk sales and internal supply within their own energy transition verticals through logistics partnerships. Future developments will focus on improving the economics of their silica sand supply chain through scaling of extraction and basic processing and optimization of port facilities. The company aims to scale bulk sales and reduce logistics costs to benefit customers and their internal supply chain

Zodiac Gold Terminates Exclusivity Agreement with Mable and Fable Limited to Pursue Multiple Strategic Opportunities and Announces Up To C$500,000 Shareholder-Led Private Placement

Zodiac Gold Inc., a West-African gold exploration company, has ended its exclusivity agreement with Mable and Fable Limited due to the latter's failure to meet funding obligations. This allows Zodiac Gold to explore various strategic opportunities such as partnerships and financing, following its recent iron ore discovery. The company aims to leverage these opportunities to maximize shareholder value. Despite the termination of the agreement, and loss of funding from Mable and Fable Limited, Zodiac Gold plans to continue its exploration projects.

Canadian Gold Corp. Announces Non-Brokered Financing to Advance Phase 4 Exploration at Tartan

Canadian Gold Corp. has announced a non-brokered private placement offering of up to $750,000, through the issuance of flow-through common shares priced at $0.19 each. The proceeds will be used to fund eligible Canadian exploration expenditures at the Tartan Mine in Flin Flon, Manitoba, to advance the company's Phase 4 exploration program. The program aims to expand upon previous exploration phases by focusing on specific areas to increase the number of ounces per vertical metre and expand the inferred resource to the west.

Standard Uranium Announces Financing for up to $1.6 Million

Standard Uranium Ltd. plans to conduct a non-brokered private placement to raise up to $1.6 million. The offering will be composed of any combination of units of the company, each valued at $0.085 or $0.10, depending on the type. The funds raised will be used for the exploration of the company's Saskatchewan uranium projects and for working capital. Proceeds from the sale of certain shares will be used to cover Canadian exploration expenses and will be renounced to the purchasers with an effective date no later than December 31, 2024.

Val-d'Or Mining Announces Option Transaction on the Powell Property in Matachewan, Ontario

Val-d'Or Mining Corporation has entered into a mining option agreement with Jacques Robert, David Lefort, and Andrew McLellan, giving it the option to acquire a 100% interest in the 32 mineral claims comprising the Powell property in Matachewan, Ontario. The company then assigned all rights and obligations under this agreement to Eldorado Gold. If Eldorado exercises the option and acquires the property, it will grant Val-d'Or a royalty of 1.5% of the net smelter returns from the property. Eldorado can reduce this royalty to 1% by paying Val-d'Or $500,000. To exercise the option, Eldorado must pay the original prospectors $305,000 and spend $2

Assays up to 18.1 g/t Au, 2,380 g/t Ag, 16.55% Cu, 15.25% Pb, and 7.44% Zn in Rocks at K2 Gold's Cerro Gordo Target

K2 Gold Corporation announced the final results from its Fall 2024 rock sampling program at the Mojave Project in Inyo County, California. The results from 105 samples showed a trend of gold, silver, copper, and base metal mineralization over a 750m wide x 3km long area in the Cerro Gordo target area. High-grade gold, silver, copper, lead, and zinc were found across the entire mineralized trend. The Company is focusing on permitting a Phase II drill program at the east gold zones, while also exploring the potential for lower grade gold mineralization.

Queen's Road Capital Announces Continuation of the NCIB

Queen's Road Capital Investment Ltd. (QRC) has announced that its Board of Directors has approved the continuation of its normal course issuer bid (NCIB) for a further 12 months, ending on November 21, 2025. The company intends to purchase up to 17.6 million common shares, representing approximately 4% of its issued shares. These shares will be cancelled and returned to treasury. The decision to make purchases will depend on future market conditions and regulatory requirements.

Maple Gold Announces Final Closing of Brokered Private Placement for Total Proceeds of $5.6 Million

Maple Gold Mines Ltd. has closed its previously announced concurrent private placement offering, issuing an additional 9,773,154 non-flow-through units at a price of $0.065 per unit, raising around $635,255. The total gross proceeds from the offering and the concurrent private placement are approximately $5,635,255. The offering was led by Beacon Securities Limited on behalf of a syndicate of agents. The funds will support resource expansion and de-risking of Maple Gold's Douay gold project, testing of the Joutel gold project, and potential new discoveries on their Québec property.

Volt Carbon Technologies Announces Private Placement for Gross Proceeds of up to C$600K

Volt Carbon Technologies Inc. plans to complete a non-brokered private placement, aiming to raise up to C$600,000. This will involve issuing up to 16,666,667 flow-through units at C$0.03 each for gross proceeds of up to C$500,000, and up to 4,000,000 company units at C$0.025 each for potential proceeds of C$100,000. Red Cloud Securities Inc. has been engaged to find investors for the offering. Additionally, Red Cloud will receive a cash finder's fee and an amount of non-transferable finder's warrants, each amounting to 7% of the gross proceeds raised from identified parties.

Intrepid Metals Announces Availability of Annual General and Special Meeting Materials

Intrepid Metals Corp. has announced that due to the Canada postal strike, materials for its upcoming Annual General and Special Meeting on December 19, 2024, are available online. Emails with a proxy, voting control number and voting instructions will be sent by the Company's transfer agent, TSX Trust Company, to registered shareholders. Shareholders who do not receive an email can contact TSX Trust. The company's financial statements will be delivered once the postal strike ends. Intrepid Metals is a Canadian company focused on exploring for copper, silver, and zinc mineral projects in southeastern Arizona, USA.

STLLR Gold Files Final Short Form Prospectus In Connection with Bought Deal Financing

STLLR Gold Inc. has filed for a final short form prospectus for a C$25 million public offering. The offering includes 4,793,000 units issued on a charitable flow-through basis, 3,788,000 units issued on a flow-through basis, and 11,364,000 units of the Company, all at different prices. An amended underwriting agreement has been established with Paradigm Capital Inc. and other underwriters. The company has also granted the underwriters an over-allotment option to purchase additional offered securities, up to 15% of the initial number, within 30 days of the offering's closing.

AJN Resources Inc. Closes $741,700 Private Placement Financing

AJN Resources Inc. has closed a non-brokered private placement of units to raise a total of $741,700 due to increased investor interest. This includes the issuance of 6,180,833 units, each comprising one common share and one share purchase warrant, priced at $0.12 per unit. The warrants can be exercised for an additional common share at a price of $0.15 each within a two-year period. A cash finder's fee of $5,400 and 45,000 warrants were paid to Canaccord Genuity Corp. for their services. The company's board has approved this private placement participation.

E-Power Resources Inc. Announces Closing of a Third and Final Tranche of Oversubscribed Private Placement

E-Power Resources Inc. has closed a third and final tranche of an oversubscribed private placement, raising a total of $526,264, surpassing the original goal of $420,000. In this tranche, 3,150,000 units were issued at $0.05 per unit, generating $157,500. Each unit includes one common share and half a common share purchase warrant, which allows the holder to acquire an additional share at $0.10 for 60 months from the closing date. The net proceeds will be used for general working capital. The securities offered are not registered under the U.S. Securities Act or any state securities laws, thus they cannot be sold in the U.S. without registration or

Emperor Metals Reports Positive Metallurgical Results from Initial Testing on the Duquesne West Gold Deposit

Emperor Metals Inc. has reported positive initial results from metallurgical testing of drill core samples taken from the Duquesne West Project in Quebec, Canada during its 2023 drilling program. The testing, which began in 2024, focused on replacement style mineralization and low-grade bulk tonnage style mineralization within the Quartz-Feldspar Porphyry (QFP). The average gold extraction from the samples tested was 90%, with the range being 90 to 100%. CEO John Florek expressed optimism about the project's future extraction potential and an upcoming mineral resource estimate expected in Q1 of 2025. The results were obtained using a patented cyanide leach process by SGS Laboratory.

Great Atlantic Reports Assays First Two Drill Holes of 2024 Intersects 34.8 G/T Gold over 0.53 Meters and 12.9 G/T Gold over 0.64 Meters at Jaclyn Main Zone, 100% Owned Golden Promise Gold Property - Central Newfoundland

Great Atlantic Resources Corp. has announced that its subsidiary, Golden Promise Mines Inc., has received gold analyses for the initial two holes of the 2024 diamond drilling program at its Golden Promise Gold Property in central Newfoundland. The holes were drilled at the gold-bearing Jaclyn Main Zone. Drill hole GP-24-157 intercepted 34.87 grams per tonne gold over 0.53 meters, while GP-24-158 intersected 12.96 grams per tonne gold over 0.64 meters. These were the first two holes completed during the 2024 fully funded drill program. Eight holes, totaling 716.5 meters, have been drilled to date.

Lion Copper and Gold Corp. Receives Additional Nuton Funding of US$5,000,000 at the Yerington Copper Project

Lion Copper and Gold Corp. and Nuton LLC, a subsidiary of Rio Tinto, have agreed to a Stage 2c Program of Work Amendment, extending the term of Stage 2 to June 30, 2025. The program includes advanced studies at Yerington and completion of the pre-feasibility study using Nuton's technologies. These studies aim to unlock value by producing domestic copper with significant environmental, social, and economic benefits. The project is also being de-risked with additional exploration and geotechnical drilling, pending required permits from the Nevada Department of Environmental Protection. The results will inform Nuton's decision on whether to proceed with a Feasibility Study.

Enertopia Announces Patent Issuance from USPTO

Enertopia Corporation, a company operating in the green technology space, has announced that the United States Patent Trademark Office has issued patent number 12149091 for its Energy Management System. The patent includes features like AI predictive comparative analysis, multi-platform interface solar/energy storage system, and adaptable organic architecture. The company believes this patent will contribute to the growth of not only the solar industry but also the battery management sector, which is projected to grow from $4.43 billion in 2023 to $48.14 billion by 2034.

Lion One Intensifies Roscoelite Focus and Enhances Fiji Gold Team with Addition of Two Ex-newmont Geologists

Lion One Metals Limited has intensified its roscoelite-targeting efforts at Tuvatu and welcomed back Sergio Cattalani to lead the technical team. New additions to the team include Ivan Maldonado and Alexander Valencia as Mine Geology Manager and Senior Mine Geologist respectively. A new mineralized structure associated with roscoelite has returned high-grade gold from a bulk sample. This structure has been continuously mapped for over 100 meters and is expected to extend further.

“Silver Is Ready to Respond to Gold” plus Stock Picks with Analyst Brien Lundin

Brien Lundin discusses gold, silver, mining stocks, and the upcoming New Orleans Investment Conference....

Teako Minerals Concludes Regional Summer Program and Provides Private Placement Update

Teako Minerals Corp. has completed its summer exploration program in Norway, covering 18 projects and involving soil and rock sampling. The company also extended its previous private placement of up to 11,111,111 common shares for up to $1,000,000. The results of the exploration program included soil samples, rock chip samples, and water samples for copper isotope studies. Site visits have been conducted on the Løkken property for the upcoming 2024/2025 drill program. The exploration also identified multiple targets on the Fe-Ti-P-REE projects and potential base-metal targets in the Eiker program.

QIMC Commences Winter Real-Time Monitoring of Dynamic Hydrogen Gas Flow at Identified Hot Spots

Quebec Innovative Materials Corp. (QIMC) has announced the launch of its winter monitoring activities for measuring natural hydrogen gas flow rates in the St-Bruno-de-Guigues area. The company will use probes to monitor zones with high commercial hydrogen flow rates, guided by previous soil sampling results and geophysical analysis. These probes, placed in shallow drilling holes, will provide continuous, real-time flow measurements. Additional probes will be deployed as the company continues to understand the subsurface systems. The generated data will offer insights into flow variability over time, helping QIMC to better understand and predict hydrogen dynamics in the subsurface.

Unlock Premium

Get access to exclusive analysis and trading signals

- Access to all premium articles

- PDF change detection

- Advanced charting