Mining Intelligence Articles & Market Analysis - Page 140

Discover news, analysis, and insights on junior mining companies and precious metals

Featured Articles

Quimbaya Gold Announces Termination of LOI with Denarius Metals

Quimbaya Gold's joint venture with Denarius Metals for artisanal mining at Tahami was terminated; Quimbaya retains full ownership and continues exploration plans.

Galloper Gold Clarification Release

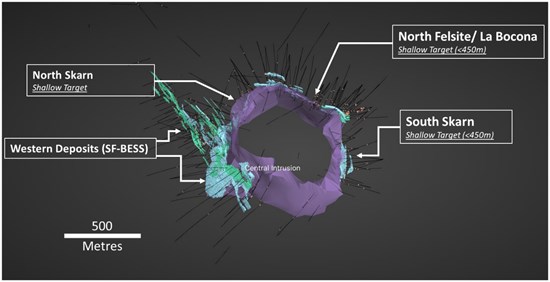

Galloper Gold clarifies its recent EML license award on Glover Island, covering the historic LPSE gold resource, with no new exploration since 2012, within a mineral-rich 11 km corridor.

Trending Now

View All

Sanatana Announces Market Making Services Agreement with Independent Trading Group

Sanatana Resources hires ITG for one-month market-making to boost share liquidity, paying $5,000 monthly, with automatic renewal and no equity compensation.

Silver47 and Summa Silver Complete Merger to Create a Premier U.S. High Grade Silver Explorer & Developer

Silver47 and Summa merged to form Silver47 Exploration Corp., a U.S.-focused high-grade silver explorer with significant resources in Alaska, Nevada, and New Mexico.

Element 29 Announces Upsized Private Placement of up to $6,400,000

Element 29 Resources increases private placement to $6.4M for exploration in Perú, issuing units with shares and warrants, pending TSX-V approval.

All Articles

Edison Lithium Arranges Sale of Interest in Argentinian Lithium Properties for US$3.5 Million

Edison Lithium Corp. has accepted a non-binding purchase offer from Mava Gasoil LLC for the sale of 100% interest in its Argentina subsidiary, Resource Ventures S.A., for $3.5 million. The sale excludes certain mining properties and royalties which will be retained by Edison. The agreement includes 30 mining concessions covering around 104,538 hectares in Catamarca Province, Argentina. The parties aim to close the transaction within 45 days of TSX Venture Exchange approval. The payment terms include an initial deposit of $100,000, with further payments totaling $3.4 million to be made on closing. As of the date of the announcement, the initial deposit has not yet been made.

Quetzal Copper Announces Brokered Private Placement Offering to Raise $3.0 Million

Quetzal Copper Corp., a North American copper exploration company, has entered into an agreement with Independent Trading Group (ITG) to conduct a private placement for aggregate gross proceeds of up to $3,000,000. The placement includes up to 6,666,666 units of the company at $0.15 per unit and up to 10,526,315 common shares at $0.19 per share. The shares will be offered as "flow-through shares" under the Canadian Income Tax Act. The units also include a half warrant for each common share, exercisable at $0.25 per common share for 24 months from the closing date. The securities will be offered under the "accredited investor" exemption and will

First Phosphate Announces OTCQB Market Listing and DTC Eligibility in the United States

First Phosphate Corp. has announced that its common shares have begun trading on the OTCQB Venture Market under the ticker symbol FRSPF. The shares are also eligible for electronic clearing and settlement in the U.S. through the Depository Trust Company (DTC), which is expected to simplify trading and enhance share liquidity. The OTCQB is a market for early-stage and developing companies, providing benefits such as efficient trading and transparent pricing. First Phosphate Corp. is a mineral development company focused on extracting phosphate for the lithium iron phosphate battery industry.

TNR Gold NSR Royalty Update - Ganfeng Reaffirmed Its Plans to Start Production at Mariana Lithium by the End of 2024

TNR Gold Corp. has announced that Ganfeng Lithium is advancing the construction of the Mariana Lithium Project in Argentina. TNR Gold holds a 1.5% NSR Royalty on the project. Ganfeng plans to start production by the end of 2024. Kirill Klip, Executive Chairman of TNR Gold, stated that their business model provides an entry point in the creation of supply chains for energy metals and gold. Their portfolio offers a unique mix of assets with exposure to various aspects of the mining cycle, including partnerships with industry leaders like Ganfeng Lithium, McEwen Mining, and Lundin Mining. TNR Gold has no debt and believes its shares are undervalued in the market

Kobrea Receives Approval to Conduct Mineral Exploration at El Perdido and Elena Projects - Western Malargüe Mining District - Argentina

Kobrea Exploration Corp., based in Vancouver, has received approval from the Argentine Province of Mendoza to carry out mineral exploration activities, including drilling, at its El Perdido and Elena projects. This is part of a wider approval of Environmental Impact Statements for 34 projects in the Western Malargüe Mining District. This is the first time Kobrea has received approval for drilling at any of its sites, and the company's CEO, James Hedalen, expressed excitement about commencing field work. The approval process involved public hearings, citizen participation, and technical analysis. More projects, including five more held by Kobrea, will go through the same approval process over the next few months.

T2 Metals Announces Flow Through Private Placement to Raise $527,000

T2 Metals Corp. has arranged a non-brokered private placement financing to raise up to $527,000. The financing involves the sale of up to 1,550,000 flow-through units at $0.34 each. Each unit includes one flow-through common share and half a non-flow-through common share purchase warrant. The warrants allow the holder to buy a non-flow-through common share at $0.50 within two years from closing. The raised funds will be used for exploring the Company's projects in Manitoba. All issued securities are subject to a four-month hold period and necessary regulatory approvals. The shares have not been registered under the U.S. Securities Act and cannot be sold in the U.S. without registration or exemption.

Premium Resources Ltd. Announces Name Change

Premium Resources Ltd. (previously Premium Nickel Resources Ltd.) has changed its name to better reflect its focus on a broader range of critical metals beyond nickel. The change was approved by shareholders and the company's common shares will begin trading under the new name and ticker symbol "PREM" from November 20, 2024. The company, which owns mines in Botswana, focuses on redeveloping previously producing nickel, copper, and cobalt resource mines. The name and ticker symbol change will not affect existing share and warrant certificates.

Abaxx to Increase Strategic Ownership in MineHub to 19.99%

MineHub Technologies Inc. and Abaxx Technologies Inc. have announced their intent to increase Abaxx's strategic ownership in MineHub from 10.83% to 19.99%. Abaxx will acquire over 8 million MineHub common shares at $0.35 per share, in exchange for over $3 million in cash or the issuance of over 237,000 Abaxx common shares. The two companies aim to explore commercial and product collaboration opportunities, focusing on data integration, entry into commodities markets, secure communication tools, sustainability requirements, efficient hedging, and regulatory compliance. The deal will close on or before December 31, 2024, subject to conditions, including TSX Venture Exchange approval.

Bold Ventures Stakes Claims Near Joutel, Québec and Completes Second Phase of Fall Exploration at the Company's Properties in Northwestern Ontario

Bold Ventures Inc. has staked 26 claims near Joutel, Québec, covering geophysical anomalies identified in a 2012 survey. Anomalous nickel, silver, copper, zinc, and gold have been found in this area. Furthermore, Bold and Emerald Geological Services have completed a second phase of fieldwork in Atikokan, Ontario, with the goal to define 2025 trenching and drilling targets. This includes areas of interest on the Wilcorp, Traxxin, and Burchell Lake Properties. Additionally, Goldshore Resources Inc.'s Moss Gold Project, adjacent to the Burchell Lake Property, has recently raised $13.9 million for exploration.

Inomin Appoints Morten Stahl as Hydrogen Advisor

Inomin Mines Inc. has appointed Morten Stahl, an entrepreneur, climate tech investor, and founder of Natural Hydrogen Ventures, as an Advisor to support the company's hydrogen exploration initiatives. Stahl's fund invests globally in early-stage private companies focused on exploration and related technologies in the natural hydrogen sector. Based in Denmark, Stahl's work is driven by achieving "profitable impact" and he sees great potential in Inomin's projects and their plans to combine traditional mining and natural hydrogen exploration.

Southern Silver Initiates Drilling and Baseline Data Collection and Related Studies at its Cerro Las Minitas Project in Mexico

Southern Silver Exploration Corp. has begun drilling on its fully-owned Cerro Las Minitas, Ag-Pb-Zn property in Durango, Mexico. The initial stage plans for up to 6,000m of core drilling to test further extensions of shallow, high-grade mineralization. The aim of the drilling is to demonstrate continued shallow resource growth potential and enhance the project's economics. The company will also carry out baseline data collection, hydrology, geotechnical, archaeological, and land surveys and studies to reduce risk and advance the project.

Kingsmen Resources Announces Closing of $1 Million Private Placement

Kingsmen Resources Ltd. has successfully closed its non-brokered private placement financing, raising $1,000,000 by issuing 4,000,000 units at $0.25 each. Each unit includes one common share and one warrant, which allows the holder to buy another share at $0.40 within two years. The funds will be used to develop the Las Coloradas Silver/Gold project in Mexico and for working capital. The securities issued are subject to a four-month hold period and necessary regulatory approvals. An insider of the company purchased 60,000 units, which is considered a "related party transaction" but did not require special approval since it didn't exceed 25% of the company's market capitalization.

Kenorland Announces Termination of Joint Venture Exploration Agreement at the Chicobi Project, Quebec

Kenorland Minerals Ltd. announces that Sumitomo Metal Mining Canada Ltd. has decided to withdraw from their joint venture exploration agreement for the Chicobi Project in Quebec, effective December 6, 2024. Sumitomo will transfer its interest in the project to Kenorland, resulting in Kenorland having full ownership. The Chicobi Project, which spans over 48,109 hectares, has the potential to host significant orogenic gold and VMS mineralisation. The company has completed a phase of sonic overburden drilling, a continuation of the 55 sonic drillholes finished in 2023.

Canstar Adds U.S. National Security Strategist and Defense Tech Expert Dr. David Kilcullen to Advisory Board and Provides Corporate Update

Canstar Resources Inc. has added Dr. David Kilcullen, a global expert in national security, geopolitics, and defence technology, to its advisory board. This move is a significant step in the company's critical minerals strategy. Dr. Kilcullen's appointment, along with Canstar's previous association with the Nevada Tech Hub, is aimed at seizing opportunities associated with the West's focus on securing the supply chain for critical materials. The company believes the metals and mining industry is on the verge of a commodity supercycle, driven by economic, energy transition, and national security imperatives.

Borealis Engages ICP Securities Inc. for Automated Market Making Services

Borealis Mining Company has announced an agreement to employ the services of ICP Securities Inc. for automated market making, using ICP's proprietary algorithm. The services comply with the TSX Venture Exchange policies and other relevant legislation. ICP will be paid a monthly fee of $7,500 for an initial period of four months, with no performance-based factors. ICP's role is primarily to correct temporary imbalances in the supply and demand of Borealis's shares. ICP is a Toronto-based firm specializing in automated market making and liquidity provision. Borealis is a gold mining and exploration company focused on the Borealis Mine in Nevada.

Avalon Announces $3.5M Financing from JV Partner and Major Shareholder Sibelco

Avalon Advanced Materials Inc. has secured CAD $3.5 million in convertible debenture financing from its major shareholder, SCR-Sibelco NV. The funds will be used to advance Avalon's Lake Superior Lithium Project in Thunder Bay, the Nechalacho REE and Zirconium Project in the Northwest Territories, as well as for working capital and administrative expenses. This new financing replaces Avalon's existing CAD $3.0 million convertible secured debenture, resulting in a principal amount of CAD $6.5 million. The debenture carries a 7.5% annual interest rate, with the principal and accrued interest payable by November 18, 2026. Avalon has also applied for provincial and federal

CopperCorp Intersects Broad Zones of Visible Copper Mineralization in Drilling at Jukes

CopperCorp Resources Inc. announced that significant areas of visible copper mineralization have been intercepted at its Razorback Copper-Gold-REE property in Tasmania, Australia. The drill hole, JDD002W1, at Jukes prospect showed broad zones of K-feldspar-magnetite, chlorite-magnetite alteration, and sulphide mineralization. Multiple zones of visible copper sulphide mineralization were found, including two significant zones at varying depths. Laboratory assays are awaited to confirm the actual copper content. CopperCorp underlined that visual observations should not replace laboratory analysis.

Minera Alamos Provides Sabre Gold Acquisition and Operations Update

Minera Alamos Inc. is preparing for the expansion of the Santana Phase 2 Pad, following its recent acquisition of Sabre Gold and its Copperstone gold project in Arizona. The transaction is expected to finalize after a Sabre shareholder meeting set for January 14th, 2025. In addition, Sabre announced the repurchase of a 1.5% existing net smelter royalty on the Copperstone project. The company is also preparing updated process models for the new Copperstone processing facility and is reworking underground development plans. The company's grinding and flotation equipment is being prepped for shipment to Copperstone in early 2025. Over the coming months, the company will quantify the positive impact of these initiatives on the Copperstone

Gladiator Intersects 14m @ 7.67% Within 98m @ 1.49% Cu Down Dip from 26m @ 3.31% Cu at Cowley Park

Gladiator Metals Corp announced results from its recent Cowley Park drill program, which targeted resource definition and exploration. The final hole, CPG-047, discovered significant mineralization that remains open at depth. This includes a large deposit of copper and molybdenum, with the results confirming that mineralization continues for over 220 meters down dip. The findings suggest a wide zone of high-grade mineralization within a broader mineralized skarn.

Awalé Hits 2.7 g/t Gold Eq. over 27 Metres at the BBM Zone, Odienné Project

Awalé Resources Limited has announced promising results from the final two deep holes of a follow-up drilling program at the BBM Zone within the Odienné Joint Venture in Côte d'Ivoire. The findings include a significant intercept of 27 metres at 2.7 g/t gold equivalent (AuEq.) including 12m at 3.9 g/t AuEq. in hole OEDD-98. These results confirm that the system is open at depth, with potential for increased grade and volume. The company has also started a 4000m diamond drill program, funded by Newmont, which will continue until 2025. The BBM system remains open at depth and down plunge, with mineralization defined from

Metals Creek Resources Corp. Closes First Tranche of Flow-Through Private Placement Financing - Secures Drill for Next Phase of Tillex Copper Project Drilling

Metals Creek Resources Corp. has received conditional approval from the TSX Venture Exchange for its non-brokered private placement financing and closed the first tranche, raising $303,500. The company has issued over 8.6 million flow-through units at $0.035 per unit. These units include flow-through common shares and non-flow-through common share purchase warrants. The proceeds will be used for exploration on the company's Tillex Copper Project, Yellow Fox/Careless Cove/ Clarks Brook Antimony-Gold Property, and Ogden Gold Property.

American Pacific Receives US$10 Million and 100% Interest in the Palmer VMS Project in Alaska

American Pacific Mining Corp. has announced an agreement with Constantine North Inc. and Dowa Metals & Mining Alaska Ltd. to acquire Dowa's interest in Constantine Mining LLC. Following this acquisition, American Pacific will have complete ownership and control of the Palmer VMS Project. As part of the deal, Dowa will pay $10 million to American Pacific in exchange for an option to acquire up to 50% of the zinc concentrate produced at the project. The deal is seen as transformative for American Pacific, which will receive a substantial capital injection and control of a project with significant mineral resources and exploration potential.

BOB MORIARTY'S Bold Predictions | Trump's Second Term

Bob Moriarty discusses Trump's second term, Bitcoin, and precious metals in this insightful video....

Core Nickel Identifies Multiple High Priority Targets at its Halfway Lake Property from Airborne Electromagnetic Survey

Core Nickel Corp. has announced that an airborne electromagnetic survey has discovered 14 high-priority targets at its 100% owned Halfway Lake Project, located near the Bucko Mill in the Thompson Nickel Belt, Manitoba. One of the targets identified confirms the extension of the conductive trend thought to host the Halfway Lake nickel deposit. Other targets include areas north of the W62 Zone and on under-explored conductor trends. CEO Misty Urbatsch believes these findings could lead to the discovery of high-grade massive sulphide deposits on their claims.

District Applies to List on the Nasdaq First North Growth Market in Sweden

District Metals Corp. is planning to apply for a secondary listing of its shares on the Nasdaq First North Growth Market in Sweden by the end of 2024. This decision comes after an increase in the number of Swedish shareholders in the company. The move is expected to increase trading liquidity and provide greater exposure to analysts and investors. The company attributes the interest from Sweden to the potential lifting of the country's uranium mining moratorium, District's extensive Swedish uranium project portfolio, and its collaboration with Boliden Minerals AB on properties in Sweden.

Revalue Gold or Adopt Bitcoin Standard? US to Take ‘Drastic’ Action to Keep Dollar Strong: Mark Moss

Mark Moss discusses U.S. debt, Bitcoin's rise, and its potential as an inflation hedge....

Military Metals Completes Acquisition of Brownfield Antimony Projects in Europe

Military Metals Corp. has completed a transaction in which it acquired 100% of the shares of the amalgamated entity formed by its subsidiary, 1509149 B.C. Ltd., and 1458205 B.C. Ltd. As part of the deal, Military Metals Corp. issued 10 million of its shares to shareholders of the acquired company. The deal also results in Military Metals Corp. acquiring three mineral exploration projects in Slovakia, including the Trojarová antimony-gold project, the Tiennesgrund antimony-gold project, and the Medvedi tin project.

Argyle Announces Private Placement Offerings

Argyle Resources Corp., a Calgary-based company, plans to complete a non-brokered private placement financing, aiming to raise up to $1,000,000 through the sale of units at $0.85 each. Each unit will consist of one common share and one common share purchase warrant. The latter will allow the holder to purchase a common share at an exercise price of $1.05 within 24 months from issuance. The proceeds from the placement will be used to finance the company's exploration activities and increase shareholder value. The closing date is expected to be on or about November 22, 2024, and is subject to all necessary regulatory approvals.

Carlyle Commodities Announces Filing of NI 43-101 Technical Report for the Quesnel Gold 1 Property

Carlyle Commodities Corp. has filed a NI 43-101 Technical Report for its Quesnel Gold Project in Central British Columbia. The report was prepared in line with the National Instrument 43-101 Standards of Disclosure for Mineral Projects. It comes following an option agreement to acquire the Quesnel Gold Project. The report is available on the company's profile at www.sedarplus.ca. Carlyle is a mineral exploration company that also owns the Newton Project in B.C., and is listed on the Canadian Securities Exchange, the OTC Market, and the Frankfurt Exchange.

Canadian Manganese Provides Update on Royalty Financing and Annnounces Results of Annual and Special Meeting of Shareholders and Appointment of New Board Chair

Canadian Manganese Company Inc. (CDMN) has provided an update on its gross revenue royalty agreement with Leventis Capital Pte Ltd. Initially, Leventis was to buy a 3% royalty in two tranches for a total of US$15,000,000. The agreement was later adjusted to a single transaction of a 2% royalty for US$10,000,000. CDMN has the option to repurchase the 2% royalty at any time for US$15,000,000, with additional payments required if the option isn't exercised by certain dates. The company also announced the voting results of its annual general and special meeting held on June 25, 2024.

Unlock Premium

Get access to exclusive analysis and trading signals

- Access to all premium articles

- PDF change detection

- Advanced charting