Mining News Releases & Company Updates - Page 132

Discover news, analysis, and insights on junior mining companies and precious metals

Featured Articles

Honey Badger Silver Announces Closing of First Tranche of Non-Brokered Private Placement Raising Gross Proceeds of Approximately $2.013 Million

Honey Badger Silver raised $2.013M via private placements to fund exploration in Canada’s northern territories.

Dios Sells K2 to Azimut

Dios explores gold at its Heberto-Gold project; sells K2 property to Azimut for cash and shares, retaining a royalty. Focus on discovering a world-class gold deposit.

Trending Now

View All

Excellon Announces Appointment of Mike Hoffman to Board of Directors and Provides Corporate Update

Excellon Resources appoints mining veteran Mike Hoffman to its Board to enhance governance and support growth and production strategies.

Arya Resources Ltd. Engages CHF Capital Markets Inc.

Arya Resources partners with CHF Capital Markets for 12 months to boost investor relations, marketing, and capital markets advisory, with an option for share purchase.

Nevada Organic Phosphate Announces Stock Option Grant and Compensation Shares Issuance

Nevada Organic Phosphate granted stock options and issued shares as bonuses, including a related party transaction, to key personnel.

All Articles

Canstar Receives $410,000 from Early Warrant Exercises & Provides Corporate Updates

Canstar Resources Inc. has issued 8.2 million common shares to investors following the early exercise of warrants from its January 2024 financing, resulting in total proceeds of $410,000. The company plans to use this for general working capital. Furthermore, 400,000 stock options have been granted to selected employees, which are exercisable until August 2029. Some employees have cancelled a total of 450,000 previously issued options. Canstar Resources Inc. is an exploration company focusing on critical minerals and gold.

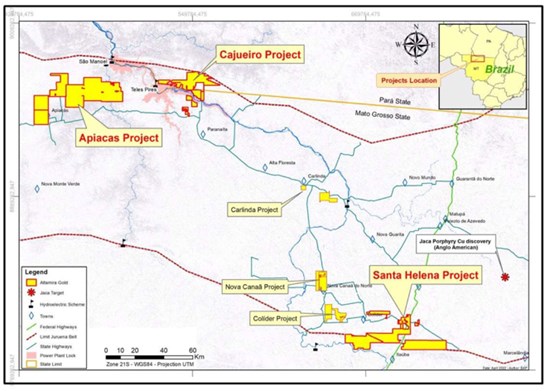

Altamira Gold Identifies Third Centre of Hydrothermally Altered and Veined Porphyry Rocks at the New Espirro Target, Within the Cajueiro Gold District

Altamira Gold Corp. has made further progress in its evaluation of porphyry-related gold mineralization within the Cajueiro project area. Fieldwork at the Espirro target identified veined and altered porphyry intrusive rocks within an area of historic placer workings. Large blocks of float up to 50cm in size indicate a short transport distance from source. A magnetic low anomaly was identified, correlating well with the area of historic placer workings. The rock samples suggest that further porphyry subcrops may be concealed beneath the historic workings. CEO Mike Bennett noted the potential for additional mineralized porphyry intrusives in a prospective east-west corridor. Espirro is the third intrusive porphyry target identified within the Caj

Canter Completes Amendments to Columbus Project Agreements

Canter Resources Corp. has announced amendments to the underlying agreements for its Columbus Lithium-Boron Project. These amendments, agreed upon with the company's property partner, defer all cash payment obligations with a focus on deeper discovery drilling at Columbus. This move is expected to create significant value for stakeholders. Additionally, the company will issue 500,000 additional shares to the underlying option partners as consideration for the amendments. The final cash payment required to purchase 100% of the water rights has also been deferred by 18 months to May 26, 2027.

Kinross Gold First Hole Drilling Update at Riley Gold's PWC Gold Project (Cortez District - Nevada)

Riley Gold Corp. has provided an update on its Pipeline West/Clipper Gold Project (PWC), which is being drilled by Kinross Gold U.S.A., Inc., targeting previously unexplored portions of the property. The first core hole drilled at PWC was designed to identify local stratigraphy and was successfully completed, revealing that known Cortez District host lithologies exist at explorable drill depths over a large, untested area close to the Pipeline complex area. All samples have been sent to ALS Labs for gold assays and trace element geochemistry, with results pending.

Cabral Gold Announces $3M Private Placement Financing

Cabral Gold Inc. has announced a non-brokered private placement of up to 10,000,000 units at $0.30 per unit for a total of up to $3,000,000. The proceeds will be used for general corporate purposes and to complete drilling and detailed engineering following a pre-feasibility study on a starter operation at the Cuiú Cuiú gold district. The securities from this placement will be subject to a four-month hold period. The completion of the placement and any finder's fees are subject to regulatory approval. Cabral Gold Inc. is a junior resource company focused on gold properties in Brazil, particularly the Cuiú Cuiú gold district in the state of Pará.

Argyle Provides Update on Pilot Plant Facility

Argyle Resources Corp has updated shareholders on its pilot processing facility in St-Lambert-de-Lauzon, which is near its silica exploration properties in Quebec as well as its research partners, the Institut National de la Recherche Scientifique (INRS). The company has begun assembling three pieces of equipment provided by the INRS to aid silica exploration and analysis. The equipment includes a ball mill for crushing and grinding quartzite into silica sand, a particle size reduction tool to create finer particles of silica for various industrial applications, and a uniformity device to ensure a consistent particle size distribution. These measures will improve the quality of the silica by controlling the grinding process.

Mundoro Announces New Targets for Drill Testing on BHP-Mundoro Project in Timok, Serbia

Mundoro Capital Inc. has announced advancement in its exploration project, Trstenik, in collaboration with BHP Exploration. Five prospective porphyry exploration targets have been advanced, with drill permit applications submitted for these areas, expected to be granted in Q4 2024. These targets include SouthWest Zone, SouthEast Zone, North-Central Zone, Central Zone, and North Zone, all in close proximity to the Majdanpek porphyry copper deposit. The targets were identified through elevated geochemistry, geophysical anomalies, and drilling. Three of these targets have been recommended for drill testing.

Sienna Closes Placement with One Strategic Investor

Sienna Resources Inc. has successfully closed its financing, generating gross proceeds of $250,000 through the sale of 5,555,555 flow-through shares. The private placement, which is subject to the final approval of the TSX Venture Exchange, does not include any warrant issues. The funds will be used for the company's existing projects in Ontario and Saskatchewan. The company's President, Jason Gigliotti, expressed optimism about the placement as a resource for commencing operations on its Canadian projects and for supporting its USA project and marketing efforts. Sienna has been expanding its projects recently, including the Stonesthrow Gold Project, the Case Lake West Cesium and Spodumene Pegmatite Project, and the Uranium Town Project

Red Metal Resources Executes Definitive Agreement to Acquire 100% Interest in Mineral Claims Package in Ville Marie, Quebec, Contiguous to Recent Hydrogen Discovery

Red Metal Resources Ltd. has completed due diligence and signed a Definitive Agreement to acquire a 100% interest in three mineral claim packages and mineral claim applications. These are directly adjacent to Quebec Innovative Materials Corp.'s recent hydrogen sample discovery, located within the Timiscaming Graben formation, 15 km north of Ville Marie, Quebec. Red Metal is planning an initial exploration program, including AI and target mapping algorithms, gas sampling, and geophysics to assess variations. This acquisition is part of their strategy to expand their clean energy portfolio while advancing their Carrizal Copper/Gold property in Chile.

Doubleview Gold Corp Announces Closing of Second Tranche of Private Placement for Total of $1,833,270

Doubleview Gold Corp. is closing its second tranche of a non-brokered private placement that was announced in September 2024. The company has so far raised a total of $1,833,270, with the second tranche bringing in $416,300. This includes 90,182 flow-through units priced at $0.55 each, and 965,000 non-flow-through units priced at $0.38 each. Each unit comprises a common share and a warrant, allowing the holder to purchase additional shares at a later date.

Lions Bay Announces Corporate Update

Lions Bay Capital Inc. has filed its financial statements for Q1 ending August 31, 2024, revealing significant appreciation in two major investments. The company's investments in Fidelity Minerals Corp. and Kalina Power Ltd. have risen from $2.4 million to $4.7 million. Fidelity holds promising gold and copper assets in Peru and British Columbia. Kalina is making progress on developing three natural gas-fired power projects in Alberta, Canada. Lions Bay has also initiated legal action against GnT Mining Proprietary Limited in South Africa to recover a total outstanding amount of USD $2.175 million.

AuMEGA Completes First Pass Reconnaissance Tills Program at Intersection

The initial reconnaissance till program over AuMEGA Metals' Intersection Project has identified several priority follow-up targets. The program, the largest of its kind conducted by the company, collected 914 samples over a 15km x 7km survey area. Four areas with significant gold anomalism were identified for future targeting, including within the Windsor Point Group Sediments, the host rocks of the company's Central Zone deposits. The results also revealed clusters of till anomalies with peak gold values of 173 ppb and peak silver values of 5.82 g/t. The Intersection Project is located in Newfoundland and Labrador, Canada, along the Cape Ray Shear Zone. The company is encouraged by the findings, which support its belief in the prospectiveness of the

Flow Metals Announces Financing

Flow Metals Corp. is planning a non-brokered private placement to raise $20,000. The offering will consist of 222,222 common shares priced at $0.09 per share. The funds raised will be used for exploration and development of its projects in British Columbia and the Yukon, working capital, and general corporate purposes. No finder's fees are expected to be payable on the offering. The securities offered have not been registered under the United States Securities Act of 1933 or any state securities laws. Flow Metals is a mining exploration company with projects in Yukon and British Columbia.

Taurus Gold Corp. Announces Completion of Private Placement

Taurus Gold Corp. has successfully closed its non-brokered private placement of units, issuing 920,000 units at $0.05 per unit, raising a total of $46,000. The funds raised will be used for general working capital purposes. Each unit consists of a common share and one-half common share purchase warrant, which holders can use to buy a common share at $0.10 per share within 24 months. No finder's fees were paid and the company does not plan any additional closings. Taurus Gold Corp. is a mineral exploration company specializing in gold exploration, with a 51% ownership in the Charlotte property.

EDM Announces Closing of First Tranche of Its $1.5m Upsized Non-Brokered Private Placement

EDM Resources Inc. has announced the closure of the first tranche of a non-brokered private placement financing, raising C$777,705. The overall financing, which was increased to $1.5 million, is expected to close its second and final tranche by November 14, 2024. The first tranche involved the issuance of over 7 million units, each consisting of a common share and a purchase warrant. The proceeds will be used for environmental work at the Scotia Mine and general working capital. In relation to the offering, the Company paid C$17,094 and issued 155,400 broker warrants to eligible brokers.

Spod Lithium Appoints New Director

SPOD Lithium Corp. has announced the appointment of Richard Goldstein to its Board of Directors. Goldstein has over 31 years of experience in capital markets, including investment banking, institutional sales, and trading. He is the founder of First Republic Capital Corp. and a former Executive Vice-President at Standard Securities. Meanwhile, Gerald Kelly has resigned as a director but will continue to serve the company as a consultant for the next two years. SPOD Lithium Corp. is a leading company focused on the exploration and development of lithium resources, primarily in Quebec and Ontario, Canada.

Elemental Altus Announces Annual General and Special Meeting and Director Nominees, Adopts Advance Notice Policy for Shareholder Meetings

Elemental Altus Royalties Corp. will hold its Annual General and Special Meeting on November 28, 2024, in Vancouver. The meeting will elect the Company's board of directors, ratify the re-appointment of its auditors, and approve the Company's omnibus equity incentive plan, among other things. Nine candidates have been nominated for election to the board. The company has also adopted an advance notice policy to ensure orderly meetings, adequate notice of director nominations, and sufficient information about nominees.

Dinero Announces Closing of Non-Brokered Private Placement

Dinero Ventures Ltd. has completed a non-brokered private placement, issuing 3.3 million flow-through units at 10 cents per unit, thereby raising $330,000. The flow-through units consist of one flow-through common share and one non-flow-through share purchase warrant. The shares and warrants are subject to a hold period, preventing trading in Canada until March 1, 2025. Directors of the company acquired 1.2 million units for $120,000 in related party transactions. The funds raised will be used on the company's New Raven property in British Columbia.

Vendetta Announces Upsize and Closes Private Placement

Vendetta Mining Corp. has closed its non-brokered private placement, issuing 39.5 million units at $0.01 each, raising a total of $395,000. The TSX Venture Exchange approved an increase in the offering size from the initially planned $350,000. Each unit includes a common share and a warrant, which allows the holder to purchase a common share at $0.05 within a 36-month period. The proceeds will be used for working capital and project fees. Michael Williams, a company director, bought 5 million units, which is considered a "related party transaction" but exempt from valuation and minority shareholder approval requirements.

Elemental Altus Announces Completion of AlphaStream Transaction and La Mancha Private Placement, Appointment of Director

Elemental Altus Royalties Corp. has completed the acquisition of an additional 50% ownership of entities holding 24 existing royalties from AlphaStream Limited for US$28 million. The payment was made in 34,444,580 newly issued shares of Elemental Altus at C$1.10/share. The company also completed a private placement by La Mancha Investments following their exercise of Anti-Dilution Rights for 16,141,940 common shares. After these transactions, Elemental Altus has 245,762,591 common shares outstanding. The acquisition increases Elemental Altus' royalties on several gold projects and expands their royalty portfolio.

Military Metals Receives Approval to Post Securities to OTCQB

Military Metals Corp.'s common shares have been approved to trade on the OTCQB Venture Market starting from October 30, 2024, under the ticker symbol 'MILIF'. The company, which currently also trades on the Canadian Securities Exchange and Frankfurt Stock Exchange, expects this move to provide easier access for US investors, increase liquidity, and expand its shareholder base. Additionally, former CEO Adam Giddens is rejoining the company as an Advisor. Military Metals is a mineral exploration company focused on acquiring, exploring, and developing mineral properties, particularly copper, antimony, and gold.

Silver Dollar Closes Financing Led by Strategic Investor and Largest Shareholder Eric Sprott

Silver Dollar Resources Inc. has completed a non-brokered private placement financing, raising $1.5 million through the sale of 6 million units priced at $0.25 each. Investor Eric Sprott purchased half of these units, increasing his stake in the company to approximately 19.8%. The company will use the net proceeds to fund drilling activities at the recently acquired Ranger-Page Silver-Lead-Zinc Project in Idaho and for general working capital purposes. All securities issued will have a hold period expiring on March 2, 2025.

Weekapaug Lithium Announces Proposed Name Change to Protium Clean Energy Corp. and Provides Corporate Update

Weekapaug Lithium Ltd. plans to change its name to Protium Clean Energy Corp, to better reflect its mission of clean energy exploration. The company's shares will continue to trade on the Canadian Securities Exchange under the symbol GRUV. The company is implementing a regional remote sensing gas survey over a 12,000 sq. km area of Ontario and Quebec to explore for hydrogen and other gases. The company is also examining a 3,500 sq. km area for critical minerals/metals and kimberlites using spectral and hyperspectral techniques. On October 16, 2023, the company completed a successful project related to lithium.

Goldshore Announces Closing of Private Placement Offering Raising $13.9 Million

Goldshore Resources Inc. has closed a brokered private placement offering that raised $13.9 million in gross proceeds, including a partial exercise of the over-allotment option. The offering was led by Eight Capital, Clarus Securities Inc., and Paradigm Capital Inc. As part of the offering, the company issued around 15.8 million flow-through common shares and 12.1 million charity flow-through common shares. Proceeds will be used for eligible Canadian exploration expenses and flow-through mining expenditures. The agents received a cash commission of $813,220.20 and were granted 1.62 million non-transferable compensation warrants.

ArcWest Provides Exploration Update

ArcWest Exploration Inc. has updated its 2024 porphyry copper exploration programs. Drilling at the Rip porphyry Cu-Mo project, funded by Interra Copper, has been completed. The Rip project is located near Imperial Metals' past-producing Huckleberry mine and Surge Copper's Ootsa and Berg projects. Drilling at the Oweegee Dome porphyry Cu-Au-Mo project, funded by Sanatana Resources, has also been concluded. Mapping and sampling at ArcWest's Todd Creek project, funded by Freeport-McMoRan Mineral Properties Canada Inc., have been completed successfully. The program expanded the footprint of the hydrothermal-magmatic system and discovered multiple new chalcopyrite mineral

Emperor Metals Expands Near-Surface Mineralization at Duquesne West Gold Deposit; Intersects 52.1 m of 0.8 g/t Au

Emperor Metals Inc. announced the results from the first three holes in its 19-drillhole program, representing 18% of the completed 8,166m drilling campaign for 2024. The results point towards the potential for resource expansion within the open-pit concept. The company is targeting a multi-million-ounce resource in both conceptual open pit and underground mining scenarios. The property already hosts a historical inferred mineral resource estimate of 727,000 ounces of gold. The CEO commented that additional ounces are contained within their conceptual open-pit model, which will likely enhance a new mineral resource estimate expected in Q1 of 2025.

Blue Star Extends Ataani Massive Sulphide Discovery to +300 Metres, Remains Open; Completes Strategic Expansion of Landholdings

Blue Star Gold Corp. has announced a strategic expansion of its landholdings in the High Lake Belt, Nunavut, following the Ataani discovery, the first new massive sulphide discovery in the region in nearly 20 years. The Ataani discovery highlights the untapped potential of the High Lake Belt. The expansion will cover an area known for its gold-rich VMS deposits in the High Lake Greenstone Belt. The company has also expanded the Roma Project by 1,587 hectares to include additional high potential resource growth areas. The final drill results from the Ataani 2024 drill program have been received, confirming the potential of the area.

Northstar Announces Non-Brokered Private Placement

Northstar Gold Corp. has announced a non-brokered private placement financing offering aiming at gross proceeds between $800,000 CAD and $1.2 million CAD. The offering includes a Critical Minerals flow-through component and a non-flow through component, with the first tranche of approximately $900,000 CAD set to close on or before November 8, 2024. The offering is subject to conditions including necessary approvals from the Canadian Securities Exchange. Management reserves the right to amend the allocation of both components.

Centurion Announces Private Placement Financing

Vancouver-based Centurion Minerals Ltd. has announced a non-brokered private placement financing of up to $500,000, priced at $0.025 per unit. Each unit comprises one common share and one-half share purchase warrant. Additionally, Centurion has signed a Binding Letter of Intent with a Nicaraguan corporation to acquire up to 78% interest in the San Cristobal gold project by funding all exploration and development activities. The company is also considering acquiring a 100% interest in further mineral concessions from the Nicaraguan group. The financing proceeds will be used for working capital, due diligence, geophysics surveys, and corporate communications.

Golden Spike Announces Start of Drilling, and Rock and Soil Sampling Results from Gregory River

Golden Spike Resources Corp. has announced the initiation of the first drill hole at the Steep Brook target in Newfoundland, along with analytical results from recent prospecting and rock sampling. The samples from Steep Brook returned values greater than 1.0% copper, up to 7.57% copper, and anomalous values of gold. In-fill soil samples at the Vein Zone also indicated the presence of copper. The drilling represents a significant milestone for the company, with the CEO expressing excitement over the potential mineralization associated with the strong IP anomalies.

Unlock Premium

Get access to exclusive analysis and trading signals

- Access to all premium articles

- PDF change detection

- Advanced charting