Mining Intelligence Articles & Market Analysis - Page 147

Discover news, analysis, and insights on junior mining companies and precious metals

Featured Articles

Goldmoney Inc. Reports Results for the Quarter Ended June 30, 2025

Goldmoney reports Q1 2026 with increased tangible equity, net income, and share buybacks, reflecting growth in assets and operational performance.

Phenom Reports on Drilling and Its Plans to Resume at Crescent Valley Gold Project, Nevada

Phenom Resources' Crescent Valley drill program faced delays due to difficult ground; no significant gold found yet, but the company remains optimistic about future opportunities.

Trending Now

View All

Besra Gold Inc.'s Newly Appointed Directors Visit Bau Project Site and Commence Strategic Corporate Review

New Besra Board visited Bau Gold Project, initiating a strategic review of operations, licensing, and growth plans, with results due in December 2025.

GoGold Releases Financial Results for Q3 2025 Generating Net Income of $8.2M USD

GoGold reports strong Q2 2025 results with $17.7M revenue, $8.2M net income, and $139M cash, driven by Parral tailings project, benefiting from high silver sales and cash flow.

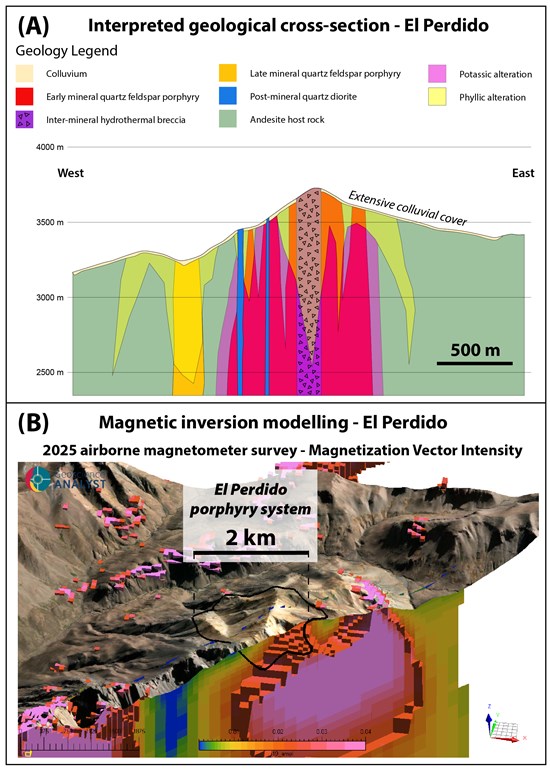

Kobrea Significantly Expands El Perdido Porphyry Target - Mendoza Province, Argentina

Kobrea explores El Perdido copper system in Argentina, expanding its size, supported by airborne magnetometry and ASTER data, with upcoming diamond drilling planned.

All Articles

Orecap Portfolio Company Awalé Resources Hits 14.7 g/t Gold Over 59 Metres

Awalé Resources reported high-grade gold results from the Charger target at the Odienné Project, highlighting 14.7 g/t Au over 59m. The findings confirm a 200m gold corridor with strong continuity. Orecap holds 8.5% of Awalé shares and is optimistic about future drilling.

AMEX Exploration Delivers Exceptional PEA on Perron Gold Project

Amex Exploration Inc. has announced the results of a Preliminary Economic Assessment (PEA) for its Perron gold project in Quebec, Canada. The PEA highlights include a pre-tax internal rate of return (IRR) of 59.5% and a net present value (NPV) of C$948 million assuming a gold price of US$2,000/ounce. The project anticipates an average annual production of 124,000 oz of gold for the first five years, with a life-of-mine (LOM) of 10 years. Initial capital expenditure is estimated at $229 million with sustaining capital expenditure of $230 million. The all-in sustaining cash costs are projected at US$807/oz of gold.

RETRANSMISSION: Spearmint to Diversify into Crypto

Spearmint Resources Inc., a mining company, has announced plans to diversify a portion of its cash on hand into the crypto market. The decision follows the Republican Party's win in the US elections, which has generated a more favorable sentiment towards crypto. The company will not allocate more than 20% of the cash on hand to this plan, and intends to invest in high quality portions of the crypto market such as Bitcoin, Ethereum, or Solana. The capital will be allocated through a public firm.

Golden Horse Minerals Results of Annual General Meeting

The Annual General and Special Meeting of Golden Horse Minerals Limited shareholders took place on November 12, 2024, at the offices of Stikeman Elliott LLP in Vancouver, BC, Canada. All resolutions presented at the meeting were approved. Detailed information on these resolutions can be found in the Company's management information circular for the meeting on SEDAR+.

Anquiro Ventures and Black Pine Provide Update Regarding Qualifying Transaction

Anquiro Ventures Ltd. and Black Pine Resources Corp. have amended their merger agreement, increasing the concurrent financing from a maximum of $1,000,000 to a minimum of $1,100,000, and revising the finder's fee to up to 10% of the gross proceeds. The other terms of the merger agreement remain the same. Black Pine, a mineral exploration company, is entitled to earn a 100% interest in the Sugarloaf Copper Project, subject to certain royalties and payments.

Cumberland Resources Announces Non-Brokered Private Placement

Cumberland Resources Nickel Corp. has announced a non-brokered private placement of 15-25 million units at $0.03 each, aiming to raise between $450,000 and $750,000. Each unit contains one common share and half of a warrant, with each full warrant granting the right to purchase an additional share at $0.05 within a year of the offering's closing. The net proceeds will be used for property development and working capital, in compliance with Canadian Securities Exchange policies. The offering may be completed in multiple closings by December 20, 2024.

World Copper Files Amended Resource Estimate and Technical Report for Updated Resource Estimate for the Zonia Project

World Copper Ltd. has announced an amended mineral resource estimate for the Zonia copper-oxide deposit in Arizona, USA, due to a calculation error in the original resource estimate. The new report, "Resource Estimate for The Zonia Project 2024 Update," presents Indicated Resources of 112.2 million short tons grading 0.297% total copper, which translates to 668 million pounds of copper, and Inferred Resources of 62.9 million short tons grading 0.255 % total copper, equating to 320 million pounds of copper. These figures show slight increases from the October 2024 report, with a 3% increase in tonnage and total contained copper, and a slight decrease in grade for the Ind

Origen Options Arlington Project to Equity Metals

Origen Resources Inc. has signed an agreement with Equity Metals Corporation to earn a 100% interest in the Arlington Property in south-central British Columbia. Under the agreement, Equity Metals would have to pay $130,000 in cash, spend $250,000 on exploration, and issue shares worth $400,000 within the first anniversary of Regulatory Approval. Origen will also retain a 2% net smelter royalty, of which Equity can buy 1% for $1,000,000. The previous option agreement with Nickelex Resources Corporation for the same property has been mutually terminated.

Denarius Metals Announces Closing of Acquisition of 100% Interest in the Toral Zn-Pb-Ag Project in Northern Spain

On November 12, 2024, Denarius Metals Corp. completed its acquisition of 100% of the shares of Europa Metals Iberia S.L. (EMI) from Europa Metals Ltd. EMI, which holds the Toral Zn-Pb-Ag Project in Northern Spain, is now a fully owned subsidiary of Denarius Metals. As part of the acquisition, Denarius issued 7,000,000 common shares to Europa and also acquired Europa's receivable for all amounts advanced to EMI, amounting to around EUR 3.7 million. Denarius Metals is a Canadian company involved in the acquisition, exploration, development, and operation of polymetallic mining projects, with interests in Spain and Colombia.

Gold Springs Resource Corp. Files Q3 2024 Financial Statements and MD&A

Gold Springs Resource Corp. has released its unaudited consolidated financial statements for the three and nine months ending September 30, 2024. General and administrative expenses decreased during both periods compared to the previous year. Exploration spending also decreased to $0.45 million from $0.53 million. The company reported a net loss of $0.52 million for the nine-month period, and $0.18 million for the three-month period. As of September 30, 2024, the company had a cash balance of $0.04 million.

Lode Gold Presents Strategic Initiatives and Exploration Plans at 121 Mining Investment Event in London, UK

Lode Gold Resources Inc. will participate in the 121 Mining Investment event in London on November 14-15, 2024, to connect with potential investors and analysts. As part of its marketing efforts, the company is also planning stakeholder meetings in several European cities. Upcoming projects include planned drilling in New Brunswick in Q1 2025, follow-up drilling on newly identified targets in Yukon, and a revised mineral resource estimate in California in Q4 2024. The company also has a brownfield project with high-grade underground potential and a projected net present value of $371M. Lode Gold is inviting interested investors to learn about these plans and more by scheduling meetings or visiting their website.

Millbank Announces Closing of Non-Brokered Private Placement

Millbank Mining Corp. has completed its previously announced private placement of over 9 million units at $0.33 per unit, raising gross proceeds of $3 million. Each unit comprises one common share and one purchase warrant, allowing the holder to acquire an additional share at $0.50 until November 8, 2026. The company has also paid a cash commission of about $82,000 and issued about 248,000 non-transferable broker warrants as compensation. The proceeds from the private placement will be used for exploration work on Millbank's properties and for working capital. Company insiders have subscribed for over 333,000 units in the private placement.

Ucore Announces Private Placement Financing

Ucore Rare Metals Inc. has proposed a non-brokered private placement offering of 4,803,329 units at $0.50 per unit, aiming to raise approximately $2.4 million. Each unit includes one common share and half a common share purchase warrant, which can be exercised at $0.75 within 24 months of the closing date. The proceeds will be used for finalizing agreements, progressing engineering plans, debt servicing, and general corporate working capital for the company's planned Strategic Metals Complex. The offering's closing, expected on November 14, 2024, awaits approval from the TSX Venture Exchange.

Search Minerals Completes Option Agreement and Acquires 100% of the Two Tom Property in Labrador

Search Minerals Inc. has completed its acquisition of a 100% interest in the Critical Rare Earth Element Two Tom Property in Labrador, Canada. The transaction was completed following a final anniversary cash payment of $60,000 and the issuance of 400,000 common shares. The acquisition strengthens the company's portfolio and is expected to benefit shareholders, enhancing long-term value creation.

CopperEx Resources Corporation Announces Grant of Options

CopperEx Resources Corporation has granted 272,500 options to its directors and officers, exercisable at Cdn$0.27 per common share for a period of five years, ending on November 9, 2029. The options will be vested over 18 months starting from May 9, 2025. The grant is subject to approval from the TSX Venture Exchange. CopperEx, a copper and gold exploration company, has projects in Chile and Peru. Its flagship property is Exploradora Norte in Northern Chile, where it holds the option to earn 65% and a preferred option for an additional 35% with no attached royalty.

Solis Minerals Encounters Copper Mineralisation Encountered During Reconnaissance at Canyon Project

Solis Minerals Limited has confirmed the presence of widespread copper oxide mineralisation at the Canyon Project in Peru. Initial sampling found copper occurrences over a distance of 400m. High levels of copper and molybdenum were also found, indicating a porphyry-style mineralisation. The company plans to conduct follow-up remote sensing, mapping, and rock geochemistry to identify prospective zones within their large application area. Future drilling programs across multiple copper projects in the Coastal Belt of Peru are planned from Q1 2025.

Magnum Goldcorp Announces Share Consolidation

Magnum Goldcorp Inc. has announced that starting from November 15, 2024, its common shares will trade on a post-consolidated basis of four old shares for one new share. The consolidation, believed to be in the company's best interest, will allow greater opportunities for future financing. The company's name and symbol remain unchanged. The new CUSIP for the post-consolidated shares will be 55973N502 and the new ISIN will be CA55973N5029.

Fury Targets a New Gold Discovery Near Newmont’s Éléonore Mine explains CEO Tim Clark

Fury Gold Mines plans drilling at Éléonore South in Q1 2025 after identifying six gold targets....

Lara Exploration Ltd.: Operational Restart at The Celesta Copper Project in Brazil

On November 12, 2024, Lara Exploration Ltd. announced that mining and processing have resumed at the Celesta Copper Project in Brazil. An additional 3,545m of resource definition drilling was conducted during the reinstatement of permits and revival of the processing plant. The company expects a gradual increase in operations in the coming months. Lara holds a 5% net profit interest in the project, without the need to contribute to the re-start costs, and a 2% NSR Royalty on production. Lara Exploration follows the Prospect and Royalty Generator business model, and it has prospects, deposits, and royalties in Brazil, Peru, and Chile.

Nevada Organic Phosphate Inc.: 2025 Focus

Nevada Organic Phosphate Inc., a company based in British Columbia, has reported significant progress in its exploration for organic, sedimentary raw rock phosphate at its Murdock Property in Northeast Nevada. Financially, the company has raised $1,592,100 since January 2022 and spent $994,961 on exploration. It is now focusing on a $500,000 private placement to fund exploration activities into 2025. Geological surveys have confirmed the presence of high-quality phosphate mineralization across several new areas within the Murdock Property. Three new applications covering an additional 6,011 acres have been added, potentially bringing the total rock phosphate to 200-220 million tonnes.

Equity Metals to Acquire 100% of the Arlington Gold Property, British Columbia; Provides Silver Queen Drilling Update

Equity Metals Corporation signed an agreement with Origen Resources to acquire a 100% interest in the Arlington Property, covering 3,583.89 ha in British Columbia. The deal requires cash payments, exploration spending, and share issuance, with Origen retaining a 2% royalty.

Spearmint to Diversify into Crypto

Spearmint Resources Inc., a Vancouver-based mining company, plans to diversify a portion of its cash reserves into the cryptocurrency market. The decision follows a favorable sentiment towards crypto after the Republican Party's victory in the USA election. The company believes that high-quality crypto might offer better long-term prospects than banking rates. However, Spearmint has clarified that it will not allocate more than 20% of its cash to this plan, ensuring it remains primarily a mining company. The company's projects include four in Clayton Valley, Nevada, focused on lithium and gold.

Japan Gold's Dr. Keiko Hattori Awarded with Duncan R. Derry Medal

Dr. Keiko Hattori, a Director at Japan Gold Corp., has been awarded the prestigious Duncan R. Derry Medal by the Mineral Deposits Division of the Geological Association of Canada. This award is the highest honor given annually by the MDD to an economic geologist who has made significant contributions to the field in Canada. Dr. Hattori's research spans a wide range of geoscience topics and has greatly contributed to regional exploration for uranium, porphyry copper, and epithermal gold deposits. She has also published over 170 peer-reviewed papers and has served on executive councils for more than 15 organizations and professional societies.

Ximen Mining Corp Visible Gold Intersected in Hole 7 at the West Zone, Brett Epithermal Gold Property - Vernon BC

Ximen Mining Corp. has announced the intersection of visible gold in hole 7 of its drilling program at the Brett epithermal gold project near Vernon, British Columbia. The hole was drilled to test the extent of the West Zone alteration zone. The results show that the West Zone is a major gold-bearing zone associated with clay-altered faults and significant amounts of disseminated pyrite, as well as quartz and pyrite veinlets. The discovery represents a significant advancement in the exploration of the site.

SRC Provides Ballarat 2024 Exploration Update

Stakeholder Gold Corp. has announced the results of their 2024 exploration program undertaken on their Ballarat Gold Project in the Yukon Territory, Canada. The program aimed to gather more information on gold and copper anomalies initially identified in 2016. Key findings include the identification of structural controls related to gold in soil trends in the Skye Gold Zone, and a zone of anomalous copper in soils in the Loki Copper Zone, indicating potential for mineralization. Multiple other potential target areas were also identified based on soil geochemistry and structural settings within previously unexplored parts of the property.

Kapa Gold Submits Exploration Permit for Blackhawk Project

KAPA GOLD INC. has announced its intention to conduct mineral exploration activities under a Zero New Disturbance Program at its Blackhawk Gold Project in California. The program, emphasizing environmental stewardship, will use existing roads and previously impacted areas to avoid new disturbances. It also includes environmental monitoring, innovative low-impact drilling to minimize water use and dust generation, and regulatory compliance. The company plans to drill 30 holes, each about 65 meters deep, using a low ground pressure tracked sonic drill rig. All exploration will avoid environmentally sensitive areas and a biological monitor will ensure no critical species are affected.

Canadian Copper Announces Private Placement & Lead Order by Ocean Partners

Canadian Copper Inc. has launched a non-brokered private placement of up to 10 million units at $0.15 per unit, aiming to raise up to $1.5 million. The company has already secured an initial lead order of $500,000 from Ocean Partners Holdings Limited. The funds raised will be used to complete the Preliminary Economic Assessment of the economic potential of processing the Murray Brook deposit at the Caribou Complex. The company has chosen SGS Canada Inc. to complete the metallurgical program for the Murray Brook deposit. The company has also applied for financial assistance from the Atlantic Canada Opportunities Agency.

Nova Pacific Signs Option Agreement to Acquire the Anita Property

Nova Pacific Metals Corp. has entered into an option agreement to acquire full ownership of nine mineral tenures, covering about 658 hectares, near its Lara Project on Vancouver Island, British Columbia. The property contains similar geological features to those hosting the company's Lara deposit and other polymetallic sulphide occurrences in the area. Past explorations by Falconbridge Ltd. in the 1980s outlined significant metal sulphide mineralization on the property.

Red Metal Resources Announces New Board Member

Red Metal Resources Ltd. has announced the appointment of Matt Parent to its Board of Directors. Parent, an entrepreneur with over 35 years of experience in business strategy and operations, has developed businesses in various industries, including transportation and logistics. He holds a Bachelor of Commerce Degree from the University of Windsor, an accounting degree from Athabasca University, and has completed several finance-related courses. Caitlin Jeffs, CEO of Red Metal, expressed enthusiasm about Parent's appointment and his potential to contribute to the company's growth. Red Metal Resources is a mineral exploration company, primarily focused on clean energy and strategic minerals projects.

Lion One Commences Development of High-Grade Roscoelite Zone at Tuvatu Gold Mine in Fiji

Lion One Metals Limited has begun the development of a new high-grade roscoelite zone at its Tuvatu high-grade alkaline gold mine in Fiji. The initial bulk sample of the near-surface roscoelite zone has yielded 11.6 g/t gold from 861 tonnes of material. The company is now integrating this gold-rich roscoelite material into its mine plan. The roscoelite veining is directly linked to high-grade mineralization at other gold mines, including the Vatukoula and Porgera mines, which have produced millions of ounces of gold.

Unlock Premium

Get access to exclusive analysis and trading signals

- Access to all premium articles

- PDF change detection

- Advanced charting