Mining Intelligence Articles & Market Analysis - Page 148

Discover news, analysis, and insights on junior mining companies and precious metals

Featured Articles

Goldmoney Inc. Reports Results for the Quarter Ended June 30, 2025

Goldmoney reports Q1 2026 with increased tangible equity, net income, and share buybacks, reflecting growth in assets and operational performance.

Phenom Reports on Drilling and Its Plans to Resume at Crescent Valley Gold Project, Nevada

Phenom Resources' Crescent Valley drill program faced delays due to difficult ground; no significant gold found yet, but the company remains optimistic about future opportunities.

Trending Now

View All

Besra Gold Inc.'s Newly Appointed Directors Visit Bau Project Site and Commence Strategic Corporate Review

New Besra Board visited Bau Gold Project, initiating a strategic review of operations, licensing, and growth plans, with results due in December 2025.

GoGold Releases Financial Results for Q3 2025 Generating Net Income of $8.2M USD

GoGold reports strong Q2 2025 results with $17.7M revenue, $8.2M net income, and $139M cash, driven by Parral tailings project, benefiting from high silver sales and cash flow.

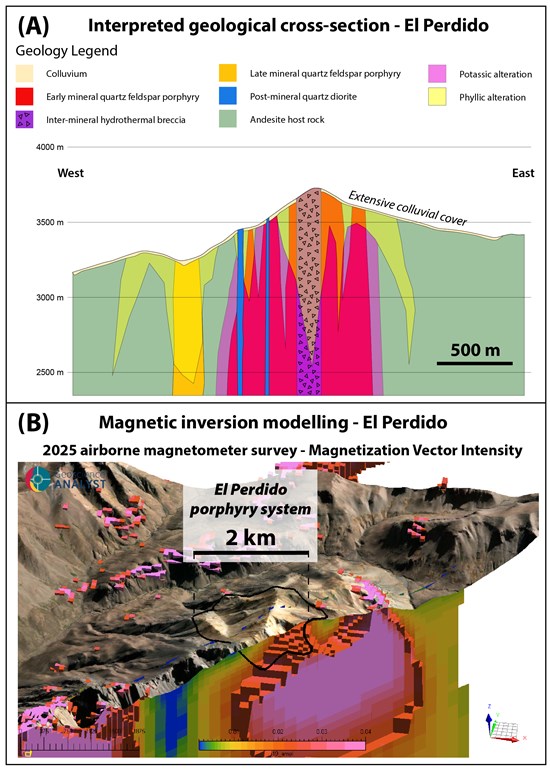

Kobrea Significantly Expands El Perdido Porphyry Target - Mendoza Province, Argentina

Kobrea explores El Perdido copper system in Argentina, expanding its size, supported by airborne magnetometry and ASTER data, with upcoming diamond drilling planned.

All Articles

Orecap Portfolio Company American Eagle Gold Announces $29M Strategic Investment by South32

South32 will invest $29M for a 19.9% stake in American Eagle Gold at a 15% premium, strengthening the company's financial position. This marks South32's role as a strategic investor alongside Teck, allowing American Eagle to enhance exploration at the NAK project.

Silver Dollar Outlines Exploration Drilling Plan for Ranger-Page Project in Idaho's Silver Valley

Silver Dollar Resources Inc. announces its initial exploration plan for the Ranger-Page Project, located in the Coeur d'Alene Mining District. The project covers six historic mines and has access to local infrastructure and a skilled workforce. Modern exploration techniques have been applied for the first time since 2022, identifying several anomalies and exploration targets. The initial drill target is the Crown Point Mine area, which is expected to restart production in 2025.

Homerun Resources Inc. Letter of Intent with Veracel Celulose for the Development of Logistic Setup and Community Relations for the High Purity Silica Sands Originating from the Belmonte Silica District

Homerun Resources Inc. has entered a non-binding Letter of Intent with Veracel Celulose S.A. to explore opportunities to use and expand Veracel's existing logistics setup for the transportation of silica sand. This partnership aims to foster cost savings and increased productivity. The companies also plan to jointly develop community relations actions to ensure local stakeholders benefit from their operations. Homerun will identify logistic partners for silica sand transportation and contribute to road maintenance, while Veracel will support Homerun in developing business relationships and allow Homerun to operate through its Belmonte Maritime terminal.

EDM Announces Further Increase to Non-Brokered Private Placement of up to C$1.8m

EDM Resources Inc. has increased its non-brokered private placement due to additional investor demand, offering up to 16,363,636 units at a price of C$0.11 per unit, aiming to raise total gross proceeds of up to C$1.8 million. Each unit comprises one common share and one share purchase warrant, which allows the holder to purchase a common share at C$0.14 within 36 months from the issue date. Proceeds will be used for environmental and permitting work at Scotia Mine and for general corporate working capital. Participation of certain directors and insiders in the offering is deemed a "related party transaction", but is exempt from specific regulatory requirements.

Nexus Provides Corporate Update

Nexus Uranium Corp. has announced plans to begin exploration at the Cree East uranium project in January 2025, following monetization of their interest in the Independence project, which raised over C$1.2 million. The company has also engaged Canaccord Genuity Corp. as a financial advisor to assist in finding strategic opportunities and improving access to capital. Canaccord will be compensated C$75,000 in shares. Nexus Uranium is also renewing a marketing program. The details of the Cree East drill program will be announced later in the month.

Silver Bullet Mines Announces Confirmatory Assay Results on Silver Concentrate from Super Champ

Silver Bullet Mines Corp. (SBMI) has received positive assay results from samples of the Super Champ concentrate, processed by an independent lab. The property, owned by a third party, is leased perpetually by SBMI. Recent results show high levels of silver, and a gold value of .52 ounces (16.16 grams/ton), indicating an increase in concentrate value. The results also confirm the accuracy of SBMI's lab data. The company is now negotiating the concentrate's sale, with timing dependent on buyer demand. SBMI continues to process and stockpile material from the Super Champ.

MineHub Launches Assay Exchange Dashboard to Revolutionize Concentrates Management

MineHub Technologies has introduced its Assay Exchange Dashboard, a tool designed to help mining companies optimize their concentrates operations through real-time, data-driven decisions. The Dashboard provides a detailed overview of concentrates deals, including shipment tracking and assay workflow status. It draws on external data from labs and other third-party sources, allowing users to manage the assay exchange process effectively. The tool is expected to streamline operations and reduce assay exchange times by up to 10 days. It also provides insights to help customers improve their concentrates business strategies.

Fathom Nickel Announces Amended Non-Brokered Unit Offering

Fathom Nickel Inc. has announced the addition of a flow-through unit component and an amendment to the pricing of their proposed private placement of hard dollar units. The new component will be offered at $0.04 per unit, with each unit consisting of a common share and half of a common share purchase warrant. The hard dollar units' price has been amended to $0.035 per unit due to limitations from the Canadian Securities Exchange. The maximum expected gross proceeds from this offering are approximated to be $750,000. The funds raised will be used for general exploration expenditures qualifying as "flow through critical mineral mining expenditures" by the end of 2025.

Los Andes Copper Announces Corporate Update

Los Andes Copper Ltd. has provided updates on its various projects and initiatives. The company carried out a UAV magnetic survey over certain areas of their property and the Vizcachitas Project, confirming previous geological work and further identifying targets. They also launched the second Female Entrepreneurs program and renewed a partnership to develop mining-related skills at local educational institutions. Two agreements were signed to investigate environmental offset potential for the Vizcachitas Project. Community engagement efforts included a door-to-door outreach program reaching 1,930 residents and a collaboration with a local water association.

Elemental Altus Royalties to Release Q3 2024 Results on November 18, 2024

Elemental Altus Royalties Corp. is set to release its Q3 2024 results on November 18, 2024, with an investor webcast to discuss the results scheduled for November 19, 2024. The company is an income-generating precious metals royalty company, focused on acquiring uncapped royalties and streams over producing or near-producing mines. The eventual goal of Elemental Altus is to build a global gold royalty company, offering investors exposure to gold with reduced risk and strong growth potential.

North Peak Intersects 85.7 g/t Au over 3.0m (10ft) within 12.0 g/t Au over 22.9m (75ft) on a New Western Trend to Wabash

North Peak Resources Ltd. has announced the assay results of its recently completed Phase 2, 15-hole surface drilling program from the Prospect Mountain North area in Nevada. The highlights include PM24-039, which intersected 22.9m with 12.0 g/t Au, including 3.0m with 85.7 g/t Au, demonstrating the potential for further expansion in the area. The second phase of the drilling program was designed to follow up on earlier successful drilling. The company's CEO, Brian Hinchcliffe, stated that the intersections demonstrate that the high-grade gold that the area is known for is still present.

Sanu Gold Announces Start of Drilling at its Daina Gold Permit

Sanu Gold Corporation has announced the commencement of the Phase 1 2024 drilling campaign at its Daina gold exploration permit in Guinea, West Africa. The drilling program will test five targets at Daina, including some new, undrilled ones and follow up on previous high-grade intercepts. The Daina permit is located near areas explored by major gold miners such as AngloGold Ashanti, a strategic shareholder in Sanu Gold. The targets were selected based on strong gold results from auger-hole and promising geochemical and geophysical trends. The program includes up to 3000m of air core and RC drilling in 25 to 35 holes. Additionally, assays from all 22 holes of the first-ever drill program at the D

Appia Successfully Concludes Diamond Drilling Program Intercepting Potential Highgrade Mineralization on all three Drillholes in Goias, Brazil

Appia Rare Earths & Uranium Corp. has concluded its diamond drilling program in the SouthWest Extension Zone of Target IV at its Ionic Adsorption Clay project in Goias, Brazil. The program completed three drillholes totaling 450.7 metres, successfully intercepting the expected carbonatitic breccia and highly altered hardrock zones. The company's President, Stephen Burega, stated that the program successfully identified carbonatitic breccia beneath previously reported high-grade clay material, hinting at a continuation of similar grades in the hardrock mineralization at depth. This development presents a significant opportunity to further showcase Target IV and the entire project's potential.

Elysee Announces Results for the Nine Months Ended September 30, 2024

Elysee Development Corp. has announced its unaudited financial results for Q3 2024, showing significant financial growth compared to the same period in the previous year. The net income was $963,981, compared to a net loss of $1,400,850 in Q3 2023, and total investment income was $1,119,668, compared to a loss of $1,306,361 in the same period in 2023. Net Asset Value per share increased to $0.43, up from $0.39, and cash on hand rose to $1,961,829, up from $849,798. The increase in value was primarily due to the strong performance of the company's portfolio

K2 Gold Provides Fall Exploration Update

K2 Gold Corporation has announced updates on its exploration at the Mojave, Si2, and Wels projects in 2024. The Draft Environmental Impact Statement for the Mojave Project is complete and under review. Initial prospecting and sampling at Mojave's high-grade Gold Valley target yielded the first visible gold. The company also conducted detailed prospecting and sampling at the Soda Canyon copper trend and the Cerro Gordo target area. The Si2 Project is nearing completion of geological studies designed to better understand the gold-bearing epithermal system. The Wels Project has undertaken soil sampling over the unexplored western half of the property. The 2024 exploration strategy focused on grassroots exploration and generating new targets through sampling and mapping.

Dryden Gold Intersects 8.93 g/t Gold Over 12.45 Meters Including 32.96 g/t Gold Over 2.73 Meters at Elora

Dryden Gold Corp. has announced promising results from its Phase Five drill program at the Elora Gold System, located in the Gold Rock Camp. A notable highlight was hole KW-24-024, which intercepted a mineralized zone at approximately 190 meters from the surface, yielding 8.93 g/t gold over 12.45 meters. This is Dryden Gold's deepest and widest high-grade intercept at Elora to date. The company has already begun a follow-up drill campaign to expand the down-plunge potential and strike expansion at Elora, based on these results. The results have furthered understanding of the controls of high-grade gold mineralization and revealed a gold-bearing hanging wall structure.

Scorpio Gold Participates in 121 Mining Investment Dubai and Embarks on European Roadshows

Scorpio Gold Corporation has announced its participation in the 121 Mining Investment Dubai conference on November 19-20, 2024 and a European roadshow starting in Zurich on November 12, 2024, and Paris on November 14, 2024. The company will work with Amvest Capital in Zurich and Atlantic One Financial in Paris to connect with European investors. The CEO and Vice President of Exploration will discuss the ongoing Manhattan drill campaign in Nevada and upcoming mineral resource estimate due in Q1 2025. The company invites interested investors to request a meeting with management.

Silicon Metals Corp. Announces the Appointment of Leighton Bocking as President of the Company and Provides Corporate Update

Silicon Metals Corp. has appointed Leighton Bocking as President of the company, who will also remain on the Board of Directors. He brings over 18 years of experience in capital markets and has been instrumental in financing and structuring private and public companies, particularly in the junior mining resource sector. The company also announced updates on its operational advancements, including full rights and interest in the Ptarmigan Silica Project, as well as option agreements for the Silica Ridge and Longworth Silica Projects. Furthermore, Kyler Hardy of Cronin Exploration Inc. has been appointed to the company's Advisory Board.

Andean Precious Metals Reports Third Quarter 2024 Operating and Financial Results

Andean Precious Metals Corp. reported record financial results for Q3 2024, with a record $98.1 million in cash and investments, driven by a record $17 million in free cash flow and $23.4 million in operating cash flow. The company posted consolidated revenue of $68.4 million, and a gross profit of $21.4 million which was mainly due to strong average realized gold and silver prices and lower operating costs. The company also achieved a net income of $8.2 million, and produced 29,284 gold equivalent ounces. The Golden Queen operation produced 14,025 gold equivalent ounces, compared to 16,986 ounces in Q2 2024.

Goldmoney Inc. Reports Results for the Quarter Ended September 30 2024

Goldmoney Inc. announced its financial results for Q2 of fiscal 2025. The company reported a Group Tangible Capital of $135.3 million, showing a 1.1% increase QoQ, and a Group Tangible Capital per share of $10.26. When excluding MENE, the Group Tangible Capital per share was $9.30, an increase of 7.3% QoQ. However, the company's Adjusted Net Income was $4.4 million, marking a decrease of 34.2% QoQ.

AJN Resources Inc. Intends to Close $651,700 Private Placement Financing

AJN Resources Inc. has announced plans to close a non-brokered private placement of units at a price of $0.12 per unit, intending to issue a total of 5,430,833 units for gross proceeds of $651,700. Each unit will consist of one common share and one share purchase warrant, which allows the holder to purchase an additional common share at $0.15 for a two-year period. The funds from the private placement will be used for property exploration, buying mineral properties, and working capital. The company will rely on an exemption from related party requirements for insider participation in the private placement.

Zodiac Gold Enters into Market-Making Services Agreement

Zodiac Gold Inc., a West-African gold exploration company, has signed a Market-Making Services Agreement with Velocity Trade Capital Ltd. on September 3, 2024. The purpose of the agreement is to improve the liquidity of Zodiac Gold's common shares on the TSX Venture Exchange. Velocity Trade will be compensated CDN$6,500 per month for its services and can potentially acquire an interest in the securities of Zodiac Gold in the future. The initial term of the contract is two months, with automatic renewal for one-month periods unless termination notice is given. Velocity Trade is a private investment dealer based in Toronto, Ontario.

Surge Files NI 43-101 Technical Report

Surge Battery Metals Inc., a Canadian-based mineral exploration company, has filed a technical report on SEDAR detailing the mineral resource estimate for the Nevada North Lithium Project in Elko Country, Nevada, USA. The report was required under NI 43-101 due to the mineral resource estimate disclosed in September 2024. Authors Bruce M. Davis and Jeffrey D. Phinisey, both Qualified Persons under NI 43-101, reviewed and approved the information. The Nevada North Lithium Project, owned by Surge, focuses on exploring for high-grade lithium metal, crucial for powering electric vehicles. Surge aims to contribute to the sustainable future of the electric vehicle industry through its active engagement in lithium exploration.

Lithium in Greenland, Chile's Next Gold Mine, and Investing in M&A Deals

Episode discusses M&A in mining; features RIO2's gold project & Brunswick's lithium discovery, with warnings....

Dollar Needs to Be Gold-Backed Again, This Is How It’s Possible & Why Fed Needs Reform Now | Shelton

Dr. Judy Shelton advocates for a gold-backed dollar and reforming the Federal Reserve to stabilize it....

Golden Rapture Mining High-Grade Results and $5,000,000 Equity Draw-Down Updates

Golden Rapture Mining (GLDR), which started trading in March 2024, has reported strong exploration results from its Phillips Township Gold Property in NW Ontario. The company discovered near-surface high-grade gold and confirmed the presence of shallow high-grade zones around old mine shafts, with drill results as high as 285.00 g/t Au. It has also found large piles of quartz material with sample results as high as 125.05 g/t Au. The company believes these discoveries highlight the property's potential for open-pit mining. In addition, GLDR has a $5 million equity draw-down facility with Crescita Capital LLC, providing access to capital for three years. The company has been active in exploration programs since April 202

Oil and Gas are 'Never Going Away', Prices Headed Much Higher

Max Sali discusses rising hydrocarbon demand, oil prices, and Monumental Energy's role in production....

Cumberland Resources Stakes 44 Prospective Claims in Ontario

Cumberland Resources Nickel Corp. has successfully staked 44 single-cell unpatented mining claims in Darling Township, Ontario, covering approximately 800 hectares. The area is rich in infrastructure and has documented occurrences of antimony, a critical mineral in energy storage and defense technologies, along with copper, gold, and silver. The new claims highlight Cumberland's commitment to mineral exploration in North America and position the company as a potential key supplier of this strategic resource.

Besra Gold Refers To: Quantum Metal Sdn Bhd

Besra Gold Inc.'s largest CDI holder, Quantum Metal Recovery Inc, has informed Besra about a petition for the winding-up of Quantum Metal Sdn Bhd (QM Malaysia) by the Malaysian Government due to delayed tax payments. However, this petition exclusively involves QM Malaysia and does not affect Quantum Metal Recovery Inc or Besra. QM Malaysia has submitted a payment proposal to the government's Inland Revenue Department and expects the petition to be withdrawn once approved.

Advanced Gold Exploration Reports on Visible Gold Discovery at Doyle Property

Advanced Gold Exploration Inc. has announced the discovery of visible gold at their Doyle Property in the Batchawana Greenstone Belt. The discovery was made during surface prospecting and is believed to be the surface expression of a drill hole completed in 1994. Assays from samples in the area returned 13.2 g/t, and 9.82 g/t gold. The discovery is the result of diligent examination by their contractor, Superior Exploration. The gold appears to be related to intense quartz veining and silicification, and a Petrographic study is being undertaken to better define the distribution of gold in the area.

Unlock Premium

Get access to exclusive analysis and trading signals

- Access to all premium articles

- PDF change detection

- Advanced charting