Mining News Releases & Company Updates - Page 92

Discover news, analysis, and insights on junior mining companies and precious metals

Featured Articles

Honey Badger Silver Announces Closing of First Tranche of Non-Brokered Private Placement Raising Gross Proceeds of Approximately $2.013 Million

Honey Badger Silver raised $2.013M via private placements to fund exploration in Canada’s northern territories.

Dios Sells K2 to Azimut

Dios explores gold at its Heberto-Gold project; sells K2 property to Azimut for cash and shares, retaining a royalty. Focus on discovering a world-class gold deposit.

Trending Now

View All

Excellon Announces Appointment of Mike Hoffman to Board of Directors and Provides Corporate Update

Excellon Resources appoints mining veteran Mike Hoffman to its Board to enhance governance and support growth and production strategies.

Arya Resources Ltd. Engages CHF Capital Markets Inc.

Arya Resources partners with CHF Capital Markets for 12 months to boost investor relations, marketing, and capital markets advisory, with an option for share purchase.

Nevada Organic Phosphate Announces Stock Option Grant and Compensation Shares Issuance

Nevada Organic Phosphate granted stock options and issued shares as bonuses, including a related party transaction, to key personnel.

All Articles

Max Resource Announces TSX Venture Exchange Conditionally Approved Private Placement in Australian Subsidiary

MAX Resource Corp. announces conditional approval for a private placement of up to 30 million shares at AUD $0.10 each, aiming to raise up to AUD $3 million for its Florália DSO Hematite Project in Brazil and general working capital.

Transition Metals Receives OJEP Grant Funding to Resume Drilling at Its Saturday Night PGM Discovery in Early New Year

Transition Metals Corp. received approval for a matching grant of up to $200,000 to resume drilling at the Saturday Night project near Thunder Bay, Ontario. The project shows promising mineralization, and the company plans to mobilize a drill in the New Year.

Omai Gold Appoints David Stewart As Vice President Corporate Development & Investor Relations

Omai Gold Mines Corp. has appointed David Stewart as Vice President of Corporate Development & Investor Relations, effective immediately. Stewart brings 15 years of mining experience and aims to enhance the company's market profile and expand gold resources.

Appia Announces Closing of $425,000 Non-Brokered Flow-Through Private Placement

Appia Rare Earths & Uranium Corp. has closed a private placement for 3,541,667 flow-through units at $0.12 each, raising $425,000. The funds will support exploration in Saskatchewan and qualify for tax credits under the Canadian Tax Act.

Andean Precious Metals Renews Normal Course Issuer Bid Program

Andean Precious Metals Corp. plans to initiate a normal course issuer bid to buy back up to 7.49 million shares, representing 5% of its outstanding shares. This follows previous repurchases since 2022, with the new bid set to run from January 3, 2025, to January 2, 2026.

Aurania Directors Receive Stock Options in Lieu of Fees

Aurania Resources Ltd. announced that its directors opted to receive their quarterly fees for Q4 2024 as stock options instead of cash, totaling 54,000 options at C$0.425 each. The options are exercisable for three years and vested immediately.

RETRANSMISSION: Manganese X Energy Corp. Announces $2.1 Million Private Placement Including $2 Million Investment by Eric Sprott

Manganese X Energy Corp. plans a non-brokered private placement to raise up to $2.1 million through 60 million subscription receipts at $0.035 each. Investor Eric Sprott aims to purchase 57.1 million receipts, becoming a Control Person, pending shareholder and TSXV approvals. Proceeds will fund the Battery Hill project and general working capital.

Aero Energy Reflects on a Successful 2024 and Outlines Path Forward into 2025

Aero Energy Limited reports successful maiden drill programs in 2024 at its Murmac and Sun Dog Projects in Saskatchewan, confirming high-grade uranium potential with significant discoveries, including 8.4 m at 0.3% U₃O₈ at Murmac. Plans for further exploration in 2025 are outlined.

PowerStone Metals Announces Definitive Agreement for Amalgamation with Libra Lithium

PowerStone Metals Corp. has executed a definitive agreement to acquire Libra Lithium Corp. through a three-cornered amalgamation, constituting a "Fundamental Change." The deal includes a share consolidation and a name change to "Libra Energy Materials Inc."

Edison Lithium Receives Initial Deposit for Sale of Interest in Argentinian Lithium Properties

Edison Lithium Corp. announced the receipt of a $100,000 deposit from Mava Gasoil LLC as part of a $3.5 million deal to sell its Argentina subsidiary, Resource Ventures S.A. The transaction is pending final documentation and TSXV approval, expected to complete by February 2025.

Manganese X Energy Corp. Announces $2.1 Million Private Placement Including $2 Million Investment by Eric Sprott

Manganese X Energy Corp plans a non-brokered private placement offering of up to 60 million subscription receipts to raise $2.1 million, with Eric Sprott investing $2 million. Proceeds will fund the Battery Hill project and general working capital, pending shareholder and exchange approvals.

Lode Gold Closes $350,000 Financing

Lode Gold Resources Inc. has closed a $350,000 financing, issuing 1,944,444 units at $0.18 each, consisting of a share and a warrant. The company operates in Canada and the U.S., focusing on gold exploration in key mining regions.

Medaro Announces Shares for Debt Transaction

Medaro Mining Corp. has settled $297,682 in debt by issuing 3,166,826 shares at $0.094 each to creditors, improving its financial standing. The company, based in Vancouver, holds multiple lithium and uranium properties and is developing a lithium extraction process.

Newpath Announces Closing of Flow-Through Financing

Newpath Resources Inc. completed a non-brokered private placement, issuing 1,538,461 flow-through shares for $50,000 to fund exploration activities. CEO Alexander McAulay participated in the offering, which is considered a related-party transaction under Canadian securities laws.

Sanatana Announces Secured Promissory Note and Provides Notice of Exercise to Acquire a 60% Undivided Interest in the Oweegee Dome Porphyry Copper-Gold Project, Located in BC's Golden Triangle

Sanatana Resources Inc. has secured a $200,000 loan from an arm's length lender at 10% interest, due monthly, to finalize a 60% interest acquisition in the Oweegee Dome Project from ArcWest Exploration. The loan matures on December 31, 2025.

Radio Fuels Files Management Information Circular for Meeting of Shareholders to Approve Business Combination with Palisades

Radio Fuels Energy Corp. has filed materials for its January 30, 2025, shareholder meeting to approve a business combination with Palisades Goldcorp Ltd., where Palisades will acquire Radio Fuels. The merger aims to create a resource-focused investment company.

Caprock Announces Closing of Private Placement and Completes Issuance of First Tranche of Shares Pursuant to Destiny Gold Project Option Agreement

Caprock Mining Corp. has raised $292,125 from hard dollar units and $115,000 from flow-through units. The company issued 8 million shares to Big Ridge Gold under an option agreement for the Destiny gold project, with plans for a resource estimate update in Q1 2025.

Andean Precious Metals Provides Update on Master Services Agreement Dispute with Silver Elephant

Andean Precious Metals Corp. disputes allegations of default by Silver Elephant Mining Corp. regarding a Master Services Agreement, claiming wrongful termination and unmet obligations by Silver Elephant. Andean is seeking legal counsel and sourcing alternative suppliers.

Snow Lake Secures Funding to Drive Exploration, Strategic Acquisitions, and Investments in Clean Energy and Next Gen Minerals

Snow Lake Resources Ltd. announces it has raised over $20M to fund aggressive exploration and acquisitions in clean energy minerals. Key projects include uranium exploration at Engo Valley and Black Lake, along with updates on the Snow Lake Lithium™ Project.

Snow Lake Announces Closing of Public Offering for Gross Proceeds of US$15 Million

Snow Lake Resources Ltd. closed a public offering of 18.75 million shares at $0.80 each, raising approximately $15 million for working capital and corporate purposes. The offering was facilitated by ThinkEquity and complies with SEC regulations.

Vision Lithium Announces Closing of Flow-Through Private Placement

Vision Lithium Inc. announced a non-brokered private placement of 16.67 million flow-through shares at $0.03 each, raising $500,000 for Canadian exploration expenses. A Finder received a $30,000 commission and warrants. The offering awaits TSXV approval.

Beyond Lithium Completes Unit Private Placement for Gross Proceeds of $250,000

Beyond Lithium Inc. closed a non-brokered private placement of 5 million units, raising $250,000. Each unit includes a share and a half warrant. Proceeds will support corporate purposes. Finders received cash commissions and broker warrants. Securities are subject to a hold period and are not registered in the U.S.

ESGold Completes First Phase in Reaching Broader U.S. Investor Market with OTCQB Listing

ESGold Corp. announced its approval from FINRA for a priced quotation on the OTCQB, enhancing market access and liquidity. This uplisting and application for DTC eligibility aim to improve trading efficiency and broaden the investor base, reflecting the company's growth strategy.

Trojan Gold Inc. Closes a Non-Brokered Unit Offering

Trojan Gold Inc. has completed a non-brokered private placement, issuing 1,454,452 units at $0.05 each, raising $72,722.62 to settle debts. Each unit includes a common share and warrant, with a 24-month exercise option at $0.10. The company focuses on mineral exploration in Ontario.

American Creek Resources Announces Amendment to Plan of Arrangement with Cunningham Mining

American Creek Resources Ltd. has amended its arrangement agreement with Cunningham Mining Ltd., extending the acquisition deadline from December 30, 2024, to January 31, 2025, and removing a termination payment obligation. The company holds a 20% interest in the Treaty Creek Project.

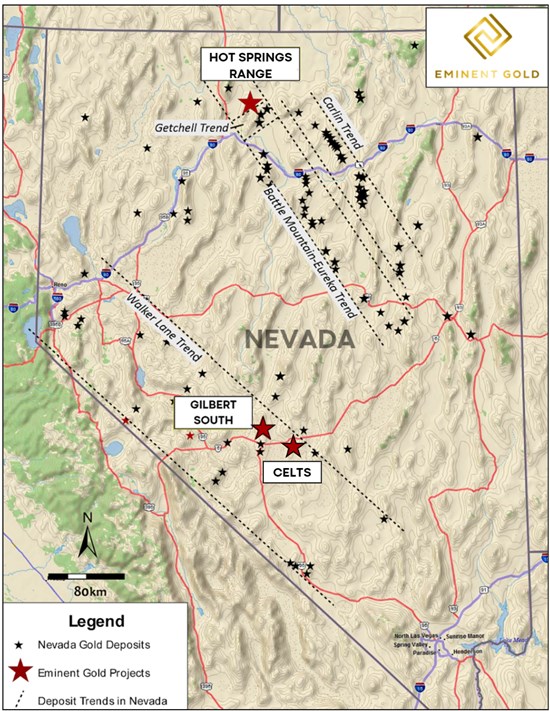

Eminent Gold Provides Drilling Update on Hot Springs Range Project

Eminent Gold Corp. reports progress on its drilling at the Hot Springs Range Project in Nevada, completing its first core hole at the Otis target. The drill program aims to explore the potential of HSRP as an analogue to the gold-rich Getchell Trend.

Elemental Altus Announces Appointment of New Director

Elemental Altus Royalties Corp. appoints Matthieu Bos as an independent non-executive director, replacing Jack Lunnon. His mining and capital markets experience is expected to enhance the Board's effectiveness. The Board remains at seven members, with six non-executives.

Sanu Gold Announces Closing of Strategic Partnership with Montage Gold & Strategic Investment by the Lundin Family

Montage Gold Corp. acquired a 19.9% stake in Sanu Gold for CAD $5.5 million, while the Lundin family gained a 10% stake. Montage's CEO now chairs Sanu's board, with plans to fund exploration activities in Guinea using the investment proceeds.

Silver Elephant Receives Notice of Cancelation of Pulacayo Mining Production Contract from Comibol

Silver Elephant Mining Corp. has received a cancellation notice for its Pulacayo Mining Production Contract from Bolivia's Comibol, citing alleged illegal mining. The company disputes this claim, maintains compliance, plans to appeal, and continues operations at its Apuradita concession.

Silver Elephant Terminates Management Services Agreement with Andean Precious Metals Corp.

Silver Elephant Mining Corp. has terminated its Mining Services Agreement and related Sale and Purchase Agreement with Andean Precious Metals due to non-payment of $1 million that was due on December 18, 2024. The company is now pursuing payment collection.

Unlock Premium

Get access to exclusive analysis and trading signals

- Access to all premium articles

- PDF change detection

- Advanced charting